Visa Unveils 'Intelligent Commerce' Platform, Allowing AI Agents to Use Your Card Safely

Visa has introduced a groundbreaking platform, Visa Intelligent Commerce, that empowers artificial intelligence agents to make purchases for users, essentially granting AI access to personal credit cards but with stringent safety measures in place. This innovative system was unveiled during Visa's Global Product Drop event in San Francisco last Wednesday, allowing AI assistants to go beyond mere product recommendations and handle the entire transaction process.

Jack Forestell, Visa's Chief Product and Strategy Officer, emphasized the transformative potential of this technology, saying, "Soon people will have AI agents browse, select, purchase, and manage on their behalf. These agents will need to be trusted with payments, not only by users, but by banks and sellers as well."

The platform is built on a robust network of partnerships with leading AI companies like Anthropic, IBM, Microsoft, Mistral AI, OpenAI, Perplexity, Samsung, and Stripe, among others. This collaboration aims to integrate payment functionalities directly into AI systems, enhancing how consumers discover and purchase products and services.

AI Shopping Assistants: From Discovery to Purchase

Visa's new platform fills a crucial gap in the AI commerce landscape. While AI has become adept at helping users find products, the challenge has always been in completing the transaction. Rubail Birwadker, SVP and Head of Growth, Products & Partnerships at Visa, explained to VentureBeat, "AI commerce is a new commerce experience where AI agents play an active role in helping users shop online. Today, agents help largely with product discovery, but with Visa Intelligent Commerce, they will start to transact on behalf of users."

The system utilizes tokenized digital credentials instead of traditional card details, ensuring secure access for authorized AI agents. Users can set specific parameters such as spending limits and merchant categories, maintaining control while the AI manages the transaction details. For instance, a user might instruct their AI to book a flight to Cancún for less than $500, order weekly groceries, or select the perfect gift for a family member. The AI would then scour multiple sites, compare options, and complete the purchase without the user needing to enter payment information repeatedly.

Birwadker highlighted the vast potential of AI agents in various commerce scenarios, stating, "There is tremendous potential for the role AI agents will play across a wide variety of commerce use cases, from everyday tasks such as ordering groceries, to more sophisticated search and decision-making like booking vacations."

Ensuring Security in the Age of AI Transactions

The announcement comes at a time when AI security and data privacy are major concerns for consumers. Visa has addressed these concerns by prioritizing security within the platform. Birwadker noted, "Visa takes an intelligence-driven approach to understanding new and novel fraud and cybercrime threats against emerging technology. Just like we identified, researched and built controls and best practices for using generative AI, Visa is also committed to identifying, researching and mitigating threat actor activity targeting agentic commerce."

Leveraging its extensive experience in fraud detection and prevention, Visa's AI and machine learning systems reportedly blocked around $40 billion in fraud last year. Key security features of the platform include AI-Ready Cards that use tokenized credentials, identity verification to ensure authorized access, and real-time transaction signals shared with Visa to enforce controls and manage disputes.

Birwadker elaborated on the security measures, saying, "Transactions made by an AI agent will be tokenized, meaning the card details are replaced. For personalization, Visa uses a data privacy-preserving framework. Data requests are managed through data tokens, which allows for consent management and control by the consumer, payment credential tokenization for the purpose of data sharing, and secure and encrypted transmission of data."

User Control Over AI Spending

A key aspect of Visa's approach is empowering users to maintain control over their AI agents' spending. Consumers can set spending limits, specify merchant categories, and even require real-time approval for certain transactions. Mark Nelsen, Visa's global head of consumer products, told PYMNTS that the system enables users to set parameters like a "$500 ceiling for a hotel or an airline ticket," allowing the AI to operate within these constraints.

Birwadker reiterated the importance of user control, stating, "For personalization, Visa uses a data privacy-preserving framework. Data requests are managed through data tokens, which allows for consent management and control by the consumer, payment credential tokenization for the purpose of data sharing, and secure and encrypted transmission of data."

This user-centric approach reflects Visa's understanding that consumer adoption depends on maintaining a sense of agency while delegating shopping tasks to AI. The system is designed to ensure convenience doesn't compromise control.

Visa's Global Reach in the AI Commerce Revolution

Visa's announcement positions the company at the forefront of a potential revolution in online shopping, akin to the shifts from physical to digital and from desktop to mobile commerce. Jack Forestell stated, "Just like the shift from physical shopping to online, and from online to mobile, Visa is setting a new standard for a new era of commerce. Now, with Visa Intelligent Commerce, AI agents can find, shop and buy for consumers based on their pre-selected preferences."

With a global presence in over 200 countries and territories, Visa's extensive network, existing tokenization framework, and merchant relationships provide the infrastructure needed to scale AI commerce globally. Birwadker expressed confidence in the technology's adoption, noting, "AI adoption is real and the numbers prove it. When you see metrics like OpenAI topping 400 million users and other GenAI platforms building their audiences, it's hard to imagine AI commerce not catching up. Visa Intelligent Commerce is a critical step and building block for the industry to start form and help create widespread adoption."

The company has opened up its APIs for developers to implement immediately, with pilot programs expected to launch soon.

Addressing Consumer Trust in AI Commerce

Despite Visa's enthusiasm and partnerships, some consumers and privacy advocates remain wary of granting AI agents access to their financial data. Visa is addressing these concerns by allowing users to start with small, low-risk transactions before expanding the AI's purchasing authority. The company assures consumers that they retain the same protections and fraud safeguards as with their Visa cards, even when transactions are AI-initiated.

Visa's extensive partnerships demonstrate its commitment to creating a comprehensive ecosystem. Birwadker explained, "We're working with each of the partners you mentioned to bring better commerce experiences to consumers. For example, with OpenAI we're enabling agentic commerce securely and safely at scale. And those aren't the only ones we're working with – we're currently with more than 20 payment service providers and AI infrastructure enablers on this program."

Reducing Cart Abandonment with AI Shopping Assistants

Visa's announcement comes amid increasing competition in AI commerce. What sets Visa apart is its focus on embedding payment capabilities directly into existing AI agents used by consumers for other tasks. This approach aims to reduce cart abandonment and streamline the shopping experience by allowing AI to handle transactions seamlessly across multiple sites and apps.

Birwadker emphasized the platform's goal, saying, "Unlike existing e-commerce, which places the task on consumers to search and transact, Visa Intelligent Commerce will enable seamless and scalable transactions through autonomous agents."

The Future of Shopping: AI at the Checkout

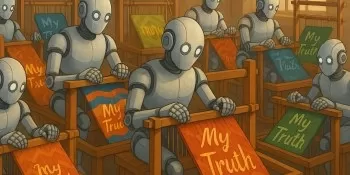

As Visa rolls out its Intelligent Commerce platform, the lines between human and artificial decision-making in commerce continue to blur. For decades, we've relied on humans—from retail clerks to travel agents—to meet our shopping needs. Now, we're on the brink of trusting algorithms not just with our product searches, but with our wallets too.

The success of Visa's initiative hinges not just on the technology, but on the psychological shift required from consumers. People who have always guarded their credit card details must now weigh the convenience of AI-powered shopping against their ingrained caution about financial data.

Shoppers have historically adapted to new ways of buying—from marketplace haggling to department stores, from mail-order catalogs to e-commerce—each transition demanding trust in new systems. Visa's AI commerce initiative represents perhaps the most significant trust leap yet: allowing an artificial agent to not only understand our desires but also spend our money to fulfill them. As consumers face this choice, they're not just evaluating a new technology; they're deciding whether to outsource the final human element in commerce—the decision to buy.

Related article

Is AI Personalization Enhancing Reality or Distorting It? The Hidden Risks Explored

Human civilization has witnessed cognitive revolutions before - handwriting externalized memory, calculators automated computation, GPS systems replaced wayfinding. Now we stand at the precipice of the most profound cognitive delegation yet: artifici

Is AI Personalization Enhancing Reality or Distorting It? The Hidden Risks Explored

Human civilization has witnessed cognitive revolutions before - handwriting externalized memory, calculators automated computation, GPS systems replaced wayfinding. Now we stand at the precipice of the most profound cognitive delegation yet: artifici

ByteDance Unveils Seed-Thinking-v1.5 AI Model to Boost Reasoning Capabilities

The race for advanced reasoning AI began with OpenAI’s o1 model in September 2024, gaining momentum with DeepSeek’s R1 launch in January 2025.Major AI developers are now competing to create faster, mo

ByteDance Unveils Seed-Thinking-v1.5 AI Model to Boost Reasoning Capabilities

The race for advanced reasoning AI began with OpenAI’s o1 model in September 2024, gaining momentum with DeepSeek’s R1 launch in January 2025.Major AI developers are now competing to create faster, mo

Salesforce Unveils AI Digital Teammates in Slack to Rival Microsoft Copilot

Salesforce launched a new workplace AI strategy, introducing specialized “digital teammates” integrated into Slack conversations, the company revealed on Monday.The new tool, Agentforce in Slack, enab

Comments (2)

0/200

Salesforce Unveils AI Digital Teammates in Slack to Rival Microsoft Copilot

Salesforce launched a new workplace AI strategy, introducing specialized “digital teammates” integrated into Slack conversations, the company revealed on Monday.The new tool, Agentforce in Slack, enab

Comments (2)

0/200

![RobertGonzalez]() RobertGonzalez

RobertGonzalez

August 26, 2025 at 1:33:16 AM EDT

August 26, 2025 at 1:33:16 AM EDT

This is wild! AI using my credit card? Visa’s new platform sounds cool but I’m wondering how foolproof those safety measures really are. 🤔 Anyone else hyped yet cautious about this?

0

0

![NicholasHernández]() NicholasHernández

NicholasHernández

August 25, 2025 at 9:01:18 PM EDT

August 25, 2025 at 9:01:18 PM EDT

This Visa AI platform sounds wild! Letting AI use my card feels like handing my wallet to a super-smart robot butler. I’m curious how safe it really is—those ‘stringent measures’ better be ironclad! 🤖💳

0

0

Visa has introduced a groundbreaking platform, Visa Intelligent Commerce, that empowers artificial intelligence agents to make purchases for users, essentially granting AI access to personal credit cards but with stringent safety measures in place. This innovative system was unveiled during Visa's Global Product Drop event in San Francisco last Wednesday, allowing AI assistants to go beyond mere product recommendations and handle the entire transaction process.

Jack Forestell, Visa's Chief Product and Strategy Officer, emphasized the transformative potential of this technology, saying, "Soon people will have AI agents browse, select, purchase, and manage on their behalf. These agents will need to be trusted with payments, not only by users, but by banks and sellers as well."

The platform is built on a robust network of partnerships with leading AI companies like Anthropic, IBM, Microsoft, Mistral AI, OpenAI, Perplexity, Samsung, and Stripe, among others. This collaboration aims to integrate payment functionalities directly into AI systems, enhancing how consumers discover and purchase products and services.

AI Shopping Assistants: From Discovery to Purchase

Visa's new platform fills a crucial gap in the AI commerce landscape. While AI has become adept at helping users find products, the challenge has always been in completing the transaction. Rubail Birwadker, SVP and Head of Growth, Products & Partnerships at Visa, explained to VentureBeat, "AI commerce is a new commerce experience where AI agents play an active role in helping users shop online. Today, agents help largely with product discovery, but with Visa Intelligent Commerce, they will start to transact on behalf of users."

The system utilizes tokenized digital credentials instead of traditional card details, ensuring secure access for authorized AI agents. Users can set specific parameters such as spending limits and merchant categories, maintaining control while the AI manages the transaction details. For instance, a user might instruct their AI to book a flight to Cancún for less than $500, order weekly groceries, or select the perfect gift for a family member. The AI would then scour multiple sites, compare options, and complete the purchase without the user needing to enter payment information repeatedly.

Birwadker highlighted the vast potential of AI agents in various commerce scenarios, stating, "There is tremendous potential for the role AI agents will play across a wide variety of commerce use cases, from everyday tasks such as ordering groceries, to more sophisticated search and decision-making like booking vacations."

Ensuring Security in the Age of AI Transactions

The announcement comes at a time when AI security and data privacy are major concerns for consumers. Visa has addressed these concerns by prioritizing security within the platform. Birwadker noted, "Visa takes an intelligence-driven approach to understanding new and novel fraud and cybercrime threats against emerging technology. Just like we identified, researched and built controls and best practices for using generative AI, Visa is also committed to identifying, researching and mitigating threat actor activity targeting agentic commerce."

Leveraging its extensive experience in fraud detection and prevention, Visa's AI and machine learning systems reportedly blocked around $40 billion in fraud last year. Key security features of the platform include AI-Ready Cards that use tokenized credentials, identity verification to ensure authorized access, and real-time transaction signals shared with Visa to enforce controls and manage disputes.

Birwadker elaborated on the security measures, saying, "Transactions made by an AI agent will be tokenized, meaning the card details are replaced. For personalization, Visa uses a data privacy-preserving framework. Data requests are managed through data tokens, which allows for consent management and control by the consumer, payment credential tokenization for the purpose of data sharing, and secure and encrypted transmission of data."

User Control Over AI Spending

A key aspect of Visa's approach is empowering users to maintain control over their AI agents' spending. Consumers can set spending limits, specify merchant categories, and even require real-time approval for certain transactions. Mark Nelsen, Visa's global head of consumer products, told PYMNTS that the system enables users to set parameters like a "$500 ceiling for a hotel or an airline ticket," allowing the AI to operate within these constraints.

Birwadker reiterated the importance of user control, stating, "For personalization, Visa uses a data privacy-preserving framework. Data requests are managed through data tokens, which allows for consent management and control by the consumer, payment credential tokenization for the purpose of data sharing, and secure and encrypted transmission of data."

This user-centric approach reflects Visa's understanding that consumer adoption depends on maintaining a sense of agency while delegating shopping tasks to AI. The system is designed to ensure convenience doesn't compromise control.

Visa's Global Reach in the AI Commerce Revolution

Visa's announcement positions the company at the forefront of a potential revolution in online shopping, akin to the shifts from physical to digital and from desktop to mobile commerce. Jack Forestell stated, "Just like the shift from physical shopping to online, and from online to mobile, Visa is setting a new standard for a new era of commerce. Now, with Visa Intelligent Commerce, AI agents can find, shop and buy for consumers based on their pre-selected preferences."

With a global presence in over 200 countries and territories, Visa's extensive network, existing tokenization framework, and merchant relationships provide the infrastructure needed to scale AI commerce globally. Birwadker expressed confidence in the technology's adoption, noting, "AI adoption is real and the numbers prove it. When you see metrics like OpenAI topping 400 million users and other GenAI platforms building their audiences, it's hard to imagine AI commerce not catching up. Visa Intelligent Commerce is a critical step and building block for the industry to start form and help create widespread adoption."

The company has opened up its APIs for developers to implement immediately, with pilot programs expected to launch soon.

Addressing Consumer Trust in AI Commerce

Despite Visa's enthusiasm and partnerships, some consumers and privacy advocates remain wary of granting AI agents access to their financial data. Visa is addressing these concerns by allowing users to start with small, low-risk transactions before expanding the AI's purchasing authority. The company assures consumers that they retain the same protections and fraud safeguards as with their Visa cards, even when transactions are AI-initiated.

Visa's extensive partnerships demonstrate its commitment to creating a comprehensive ecosystem. Birwadker explained, "We're working with each of the partners you mentioned to bring better commerce experiences to consumers. For example, with OpenAI we're enabling agentic commerce securely and safely at scale. And those aren't the only ones we're working with – we're currently with more than 20 payment service providers and AI infrastructure enablers on this program."

Reducing Cart Abandonment with AI Shopping Assistants

Visa's announcement comes amid increasing competition in AI commerce. What sets Visa apart is its focus on embedding payment capabilities directly into existing AI agents used by consumers for other tasks. This approach aims to reduce cart abandonment and streamline the shopping experience by allowing AI to handle transactions seamlessly across multiple sites and apps.

Birwadker emphasized the platform's goal, saying, "Unlike existing e-commerce, which places the task on consumers to search and transact, Visa Intelligent Commerce will enable seamless and scalable transactions through autonomous agents."

The Future of Shopping: AI at the Checkout

As Visa rolls out its Intelligent Commerce platform, the lines between human and artificial decision-making in commerce continue to blur. For decades, we've relied on humans—from retail clerks to travel agents—to meet our shopping needs. Now, we're on the brink of trusting algorithms not just with our product searches, but with our wallets too.

The success of Visa's initiative hinges not just on the technology, but on the psychological shift required from consumers. People who have always guarded their credit card details must now weigh the convenience of AI-powered shopping against their ingrained caution about financial data.

Shoppers have historically adapted to new ways of buying—from marketplace haggling to department stores, from mail-order catalogs to e-commerce—each transition demanding trust in new systems. Visa's AI commerce initiative represents perhaps the most significant trust leap yet: allowing an artificial agent to not only understand our desires but also spend our money to fulfill them. As consumers face this choice, they're not just evaluating a new technology; they're deciding whether to outsource the final human element in commerce—the decision to buy.

Is AI Personalization Enhancing Reality or Distorting It? The Hidden Risks Explored

Human civilization has witnessed cognitive revolutions before - handwriting externalized memory, calculators automated computation, GPS systems replaced wayfinding. Now we stand at the precipice of the most profound cognitive delegation yet: artifici

Is AI Personalization Enhancing Reality or Distorting It? The Hidden Risks Explored

Human civilization has witnessed cognitive revolutions before - handwriting externalized memory, calculators automated computation, GPS systems replaced wayfinding. Now we stand at the precipice of the most profound cognitive delegation yet: artifici

ByteDance Unveils Seed-Thinking-v1.5 AI Model to Boost Reasoning Capabilities

The race for advanced reasoning AI began with OpenAI’s o1 model in September 2024, gaining momentum with DeepSeek’s R1 launch in January 2025.Major AI developers are now competing to create faster, mo

ByteDance Unveils Seed-Thinking-v1.5 AI Model to Boost Reasoning Capabilities

The race for advanced reasoning AI began with OpenAI’s o1 model in September 2024, gaining momentum with DeepSeek’s R1 launch in January 2025.Major AI developers are now competing to create faster, mo

Salesforce Unveils AI Digital Teammates in Slack to Rival Microsoft Copilot

Salesforce launched a new workplace AI strategy, introducing specialized “digital teammates” integrated into Slack conversations, the company revealed on Monday.The new tool, Agentforce in Slack, enab

Salesforce Unveils AI Digital Teammates in Slack to Rival Microsoft Copilot

Salesforce launched a new workplace AI strategy, introducing specialized “digital teammates” integrated into Slack conversations, the company revealed on Monday.The new tool, Agentforce in Slack, enab

August 26, 2025 at 1:33:16 AM EDT

August 26, 2025 at 1:33:16 AM EDT

This is wild! AI using my credit card? Visa’s new platform sounds cool but I’m wondering how foolproof those safety measures really are. 🤔 Anyone else hyped yet cautious about this?

0

0

August 25, 2025 at 9:01:18 PM EDT

August 25, 2025 at 9:01:18 PM EDT

This Visa AI platform sounds wild! Letting AI use my card feels like handing my wallet to a super-smart robot butler. I’m curious how safe it really is—those ‘stringent measures’ better be ironclad! 🤖💳

0

0