11x, Backed by a16z and Benchmark, Accused of Falsely Claiming Customers

Last year, the AI-powered sales automation startup 11x was on a seemingly unstoppable growth path. However, according to nearly two dozen sources, including investors and current and former employees, the company has hit financial rough patches, largely due to its own actions.

Sources from the U.S. and U.K. have indicated to TechCrunch that things have gotten so precarious that 11x’s lead Series B investor, Andreessen Horowitz, might be contemplating legal action. Yet, a spokesperson from Andreessen Horowitz firmly denied any such plans, stating to TechCrunch that a16z is not pursuing any lawsuits.

11x provides an AI bot that automates outbound cold sales tasks, such as identifying prospects, crafting personalized messages, and setting up sales calls. It's part of the burgeoning field of AI sales development representatives, or AI SDRs.

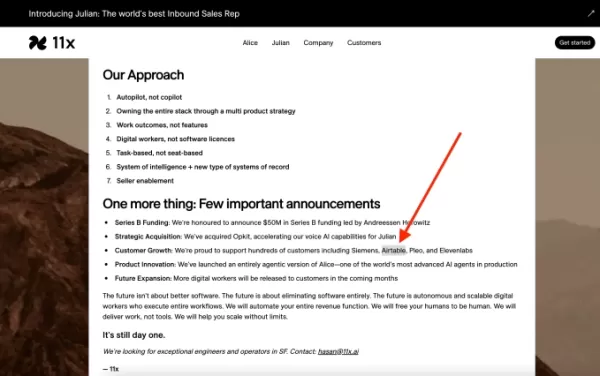

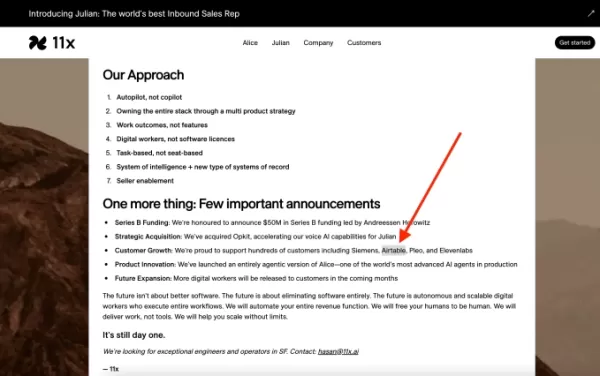

Founded in 2022 by Hasan Sukkar, 11x reported nearing $10 million in annualized recurring revenue (ARR) just two years post-launch. The company shifted its base from London to Silicon Valley in July last year and announced a $24 million Series A led by Benchmark in September. TechCrunch was the first to report on their $50 million Series B led by Andreessen Horowitz later that month.

According to three current and former 11x employees, a significant number of early customers opted out using "break clauses" in their contracts due to issues like malfunctioning email features or AI hallucinations.

The internal atmosphere was tense as well. Employees described a high-stress, demanding work environment that pushed even those accustomed to a hustle culture to their limits. Interestingly, from the group of early employees featured in a photo at the company's launch on TechCrunch, only CEO Hasan Sukkar remains.

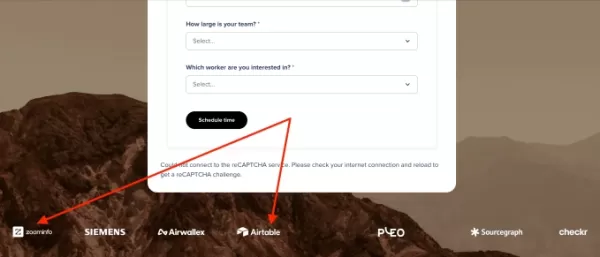

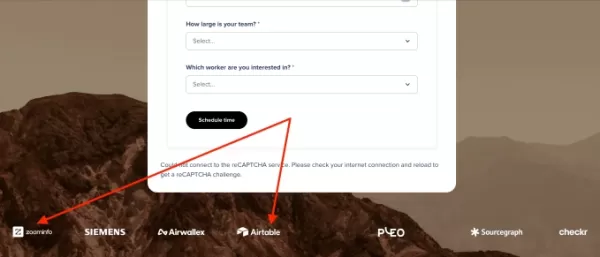

Logos on 11x’s website include companies that say they were not customers

Fake Customer Endorsements

Like many startups, 11x proudly displayed customer logos on its website as a sign of endorsement, typically with the customer's consent. However, TechCrunch discovered that multiple companies whose logos were featured on 11x’s site were not actual customers, and at least one is threatening legal action over this.

A spokesperson from ZoomInfo, which provides sales data and automation tools, told TechCrunch, "We did not give them permission to use our logo in any manner, and we are not a customer." The logo was removed only after a TechCrunch inquiry on March 6, but even afterwards, 11x's phone AI agent continued to claim ZoomInfo as a customer.

ZoomInfo had conducted a short, one-month trial of the AI SDR from mid-January to mid-February. The spokesperson noted that "during the pilot, 11x’s product performed significantly worse than our SDR employees, and we did not move forward afterward."

Despite this, "since November, 11x has been claiming us as a customer across various channels: in sales calls, on its website, and now even on its AI dialer. We’ve spent the past four months demanding that they stop displaying our logo and falsely counting us as a customer," the spokesperson added.

ZoomInfo’s lawyer has now threatened legal action, according to an email seen by TechCrunch from ZoomInfo’s lawyer to Sukkar, citing potential legal causes of action including deceptive trade practices, trademark infringement, misappropriation of goodwill, and false advertising.

Similarly, Airtable’s logo was displayed on the 11x website until a few weeks ago, and as of March 20, 11x’s website still listed Airtable as a "customer" on its "manifesto" page. Airtable confirmed to TechCrunch that it was not a customer and had not given 11x permission to use its logo.

Airtable had a "very short" trial of the product late last year, "and ultimately decided that it wasn’t a fit for our business," an Airtable spokesperson explained. "It was never used in production and never rolled out to our sales team."

Despite this, as of March 21, 11x was still claiming Airtable as a customer on its website. Another company, which preferred to remain unnamed, shared a similar experience with TechCrunch.

However, our research confirmed that some customer claims were legitimate. For instance, Pleo and Rho confirmed they are using 11x products.

11x insists it "promptly removed any undesired or inaccurate customer mentions on their site and within their products when requested" and in the "small number of cases" where it didn't, it was "due to human error."

11x’s website claimed Airtable was a customer on March 20, even though it wasn’t

A Creative Way to Calculate ARR

At least three employees cited questionable tactics at 11x as the reason for their departure. For instance, a prospective customer revealed that 11x insisted on a one-year contract for pilot programs, showing reluctance to offer trials or experimentation.

Instead, 11x offered a break clause, typically at three months, allowing customers to exit the contract easily. This essentially served as a trial period, according to former employees and potential customers.

However, when reporting annual recurring revenue (ARR), the company did not distinguish between trial periods and long-term customers, former and current employees noted. 11x calculated ARR based on the full year's contract.

11x states that it "uses contracted ARR (CARR)" when reporting to the board and that its investors were aware of this metric. The company says investors reviewed customer contracts, data files, and spoke to customers during due diligence.

Even after prospects used the break clause to end their trial—and their payments—the company continued to count ARR as if these companies were completing the full-year contract, sources said.

The 11x spokesperson clarified that the startup does offer "free trials" and the "majority of middle market customers" qualify for them, but some enterprise customers with "highly specialized" and customized needs "require a 12-month contract with an opt-out after 3 months."

The churn rate was high, with multiple employees stating that "we were losing 70-80% of customers that came through the door." This allowed 11x to "look like it’s doing better than it is," one employee remarked.

For example, the company might report $14 million in ARR when, in reality, the revenue from contracts that passed the three-month trial period was only about $3 million, an employee pointed out.

"They absolutely massaged the numbers internally when it came to growth and churn," another former employee noted.

11x acknowledges that its "highest churn" occurred for "initial cohorts in late 2023" but claims improvements in the product and refining sales to its "ideal customer" have improved retention, stating its "retention rate is currently 79%."

Venture capitalists say the issue isn't necessarily 11x using CARR to showcase its growth, but rather that investors expect startups to disclose potential opt-out revenue and customer churn. Benchmark confirms it has received transparent updates from 11x, including information on break clauses.

Product Underwhelms

Many companies canceled after their trial due to dissatisfaction with the product, according to at least one current and four former employees.

Some churn resulted from unrealistic expectations, with customers hoping 11x could replace an entire outbound sales team and save significant costs, a former employee explained.

This person noted that 11x salespeople often promised prospects a substantial increase in meetings, demos, and phone calls within months, despite employees knowing this was unrealistic.

"The actual results of the amount of automated emails versus meetings booked was disappointing," said one company that tried the product.

11x believes its product outperforms human SDRs but states "performance ultimately relies on the quality of user input." It also says it does not guarantee savings or revenues in its sales pitches.

Other customers complained about the 11x product hallucinating or failing to load properly, a former employee added. An anonymous reviewer on Medium criticized the product for being less effective and more costly than its competitors, though 11x claims this review was written by a competitor.

"The products barely work," a former engineer told TechCrunch. Customers often had to manually check and correct the work, which defeated the purpose of purchasing 11x’s product, another employee said.

There were also billing issues, with one customer being billed twice during their three-month trial period. "It almost seemed like they were kind of trying to get something past us," the customer remarked.

One venture capitalist considering investing in the Series A found the technology lacking during due diligence. Existing customers told the investor they were initially satisfied but that after a month, the startup’s AI failed to generate effective leads.

A current employee defended the company, suggesting that customers need time to adapt to 11x's system. They added that the company is working on ways to encourage more customers to stay longer.

Employee Churn

Employees also described a challenging work environment with significant turnover under founder-CEO Hasan Sukkar.

Employees were expected to work at least 60 hours a week and be constantly available, according to employees and messages seen by TechCrunch. Slack messages show Sukkar questioning employees' whereabouts at 8 p.m., after previously setting the workday start at 9 a.m.

"He doesn’t believe in people taking holidays," a current employee said. Another former employee mentioned expectations to work weekends and national holidays.

"You would have the founder on Slack, maybe three in the morning, sending messages saying ‘this needs to be resolved urgently,’" a former employee recalled, noting that the always-on mentality was so intense that some employees slept in the office.

When employees were unreachable or if issues arose, Sukkar was known to voice his frustrations publicly in the general Slack channel, at least two employees reported.

Employees who spoke out risked being threatened with dismissal, according to two employees.

"There’s a lot more under the hood," a current employee remarked, referring to Sukkar. "One day, there will be a documentary about this guy. I do believe that’s how scandalous he is."

11x attributes some turnover to its relocation from London to San Francisco last July, as employees who couldn't move chose to leave. The company says its headcount has doubled to 50 full-time employees during this period.

At least one former employee mentioned still awaiting back pay months after leaving the company. The concern over backpay has become part of the company culture, with a current employee noting that many wait until after payday to resign.

"We’ve just got paid today," a current employee said. "I’m expecting a couple of people to resign over the weekend or on Monday."

Related article

AI Reimagines Michael Jackson in the Metaverse with Stunning Digital Transformations

Artificial intelligence is fundamentally reshaping our understanding of creativity, entertainment, and cultural legacy. This exploration into AI-generated interpretations of Michael Jackson reveals how cutting-edge technology can breathe new life int

AI Reimagines Michael Jackson in the Metaverse with Stunning Digital Transformations

Artificial intelligence is fundamentally reshaping our understanding of creativity, entertainment, and cultural legacy. This exploration into AI-generated interpretations of Michael Jackson reveals how cutting-edge technology can breathe new life int

Does Training Mitigate AI-Induced Cognitive Offloading Effects?

A recent investigative piece on Unite.ai titled 'ChatGPT Might Be Draining Your Brain: Cognitive Debt in the AI Era' shed light on concerning research from MIT. Journalist Alex McFarland detailed compelling evidence of how excessive AI dependency can

Does Training Mitigate AI-Induced Cognitive Offloading Effects?

A recent investigative piece on Unite.ai titled 'ChatGPT Might Be Draining Your Brain: Cognitive Debt in the AI Era' shed light on concerning research from MIT. Journalist Alex McFarland detailed compelling evidence of how excessive AI dependency can

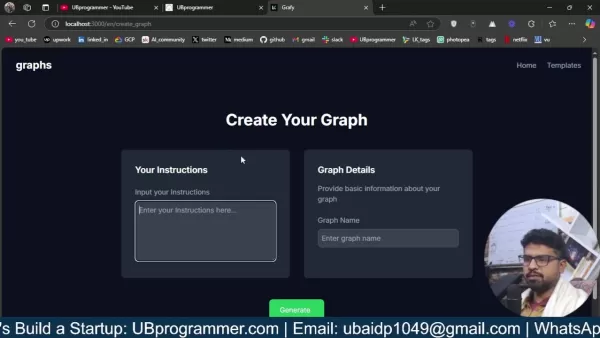

Easily Generate AI-Powered Graphs and Visualizations for Better Data Insights

Modern data analysis demands intuitive visualization of complex information. AI-powered graph generation solutions have emerged as indispensable assets, revolutionizing how professionals transform raw data into compelling visual stories. These intell

Comments (17)

0/200

Easily Generate AI-Powered Graphs and Visualizations for Better Data Insights

Modern data analysis demands intuitive visualization of complex information. AI-powered graph generation solutions have emerged as indispensable assets, revolutionizing how professionals transform raw data into compelling visual stories. These intell

Comments (17)

0/200

![DavidThomas]() DavidThomas

DavidThomas

August 24, 2025 at 3:01:24 PM EDT

August 24, 2025 at 3:01:24 PM EDT

Shady stuff at 11x? Claiming fake customers is a bold move, but tanking your rep like that? Yikes. Hope they sort it out, AI sales tech sounds dope otherwise! 😬

0

0

![JuanThomas]() JuanThomas

JuanThomas

August 6, 2025 at 7:00:59 AM EDT

August 6, 2025 at 7:00:59 AM EDT

This article about 11x is wild! 😲 I thought AI sales tools were supposed to be foolproof, but faking customers? That’s a bold move gone wrong. Curious how a16z and Benchmark will handle this mess.

0

0

![PaulMartínez]() PaulMartínez

PaulMartínez

April 25, 2025 at 11:43:54 AM EDT

April 25, 2025 at 11:43:54 AM EDT

11x schien anfangs vielversprechend, aber die finanziellen Schwierigkeiten und die Vorwürfe falscher Behauptungen sind enttäuschend. Ich habe sie unterstützt, aber jetzt bin ich mir nicht mehr sicher. Vielleicht kommen sie wieder auf die Beine, aber fürs Erste passe ich. 😕

0

0

![EdwardTaylor]() EdwardTaylor

EdwardTaylor

April 25, 2025 at 8:29:45 AM EDT

April 25, 2025 at 8:29:45 AM EDT

11xは最初は有望だったけど、財政難と虚偽の主張の疑惑は残念すぎる。応援していたのに、今はどうしようか迷ってる。回復してくれるといいけど、今はパスかな。😔

0

0

![MateoAdams]() MateoAdams

MateoAdams

April 25, 2025 at 5:34:10 AM EDT

April 25, 2025 at 5:34:10 AM EDT

11x는 처음에 기대가 컸는데, 재정 문제와 고객에 대한 거짓 주장 소식을 듣고 실망했어요. 기대가 컸던 만큼 실망도 크네요. 앞으로 어떻게 될지 지켜보겠지만, 기대는 크지 않아요. 😕

0

0

![TimothyDavis]() TimothyDavis

TimothyDavis

April 25, 2025 at 4:23:48 AM EDT

April 25, 2025 at 4:23:48 AM EDT

11x seemed promising at first but hearing about their financial troubles and false customer claims is a bummer. It's a reminder to always do your homework before jumping on the hype train! 🤦♂️ Maybe they can turn things around, but I'm skeptical.

0

0

Last year, the AI-powered sales automation startup 11x was on a seemingly unstoppable growth path. However, according to nearly two dozen sources, including investors and current and former employees, the company has hit financial rough patches, largely due to its own actions.

Sources from the U.S. and U.K. have indicated to TechCrunch that things have gotten so precarious that 11x’s lead Series B investor, Andreessen Horowitz, might be contemplating legal action. Yet, a spokesperson from Andreessen Horowitz firmly denied any such plans, stating to TechCrunch that a16z is not pursuing any lawsuits.

11x provides an AI bot that automates outbound cold sales tasks, such as identifying prospects, crafting personalized messages, and setting up sales calls. It's part of the burgeoning field of AI sales development representatives, or AI SDRs.

Founded in 2022 by Hasan Sukkar, 11x reported nearing $10 million in annualized recurring revenue (ARR) just two years post-launch. The company shifted its base from London to Silicon Valley in July last year and announced a $24 million Series A led by Benchmark in September. TechCrunch was the first to report on their $50 million Series B led by Andreessen Horowitz later that month.

According to three current and former 11x employees, a significant number of early customers opted out using "break clauses" in their contracts due to issues like malfunctioning email features or AI hallucinations.

The internal atmosphere was tense as well. Employees described a high-stress, demanding work environment that pushed even those accustomed to a hustle culture to their limits. Interestingly, from the group of early employees featured in a photo at the company's launch on TechCrunch, only CEO Hasan Sukkar remains.

Fake Customer Endorsements

Like many startups, 11x proudly displayed customer logos on its website as a sign of endorsement, typically with the customer's consent. However, TechCrunch discovered that multiple companies whose logos were featured on 11x’s site were not actual customers, and at least one is threatening legal action over this.

A spokesperson from ZoomInfo, which provides sales data and automation tools, told TechCrunch, "We did not give them permission to use our logo in any manner, and we are not a customer." The logo was removed only after a TechCrunch inquiry on March 6, but even afterwards, 11x's phone AI agent continued to claim ZoomInfo as a customer.

ZoomInfo had conducted a short, one-month trial of the AI SDR from mid-January to mid-February. The spokesperson noted that "during the pilot, 11x’s product performed significantly worse than our SDR employees, and we did not move forward afterward."

Despite this, "since November, 11x has been claiming us as a customer across various channels: in sales calls, on its website, and now even on its AI dialer. We’ve spent the past four months demanding that they stop displaying our logo and falsely counting us as a customer," the spokesperson added.

ZoomInfo’s lawyer has now threatened legal action, according to an email seen by TechCrunch from ZoomInfo’s lawyer to Sukkar, citing potential legal causes of action including deceptive trade practices, trademark infringement, misappropriation of goodwill, and false advertising.

Similarly, Airtable’s logo was displayed on the 11x website until a few weeks ago, and as of March 20, 11x’s website still listed Airtable as a "customer" on its "manifesto" page. Airtable confirmed to TechCrunch that it was not a customer and had not given 11x permission to use its logo.

Airtable had a "very short" trial of the product late last year, "and ultimately decided that it wasn’t a fit for our business," an Airtable spokesperson explained. "It was never used in production and never rolled out to our sales team."

Despite this, as of March 21, 11x was still claiming Airtable as a customer on its website. Another company, which preferred to remain unnamed, shared a similar experience with TechCrunch.

However, our research confirmed that some customer claims were legitimate. For instance, Pleo and Rho confirmed they are using 11x products.

11x insists it "promptly removed any undesired or inaccurate customer mentions on their site and within their products when requested" and in the "small number of cases" where it didn't, it was "due to human error."

A Creative Way to Calculate ARR

At least three employees cited questionable tactics at 11x as the reason for their departure. For instance, a prospective customer revealed that 11x insisted on a one-year contract for pilot programs, showing reluctance to offer trials or experimentation.

Instead, 11x offered a break clause, typically at three months, allowing customers to exit the contract easily. This essentially served as a trial period, according to former employees and potential customers.

However, when reporting annual recurring revenue (ARR), the company did not distinguish between trial periods and long-term customers, former and current employees noted. 11x calculated ARR based on the full year's contract.

11x states that it "uses contracted ARR (CARR)" when reporting to the board and that its investors were aware of this metric. The company says investors reviewed customer contracts, data files, and spoke to customers during due diligence.

Even after prospects used the break clause to end their trial—and their payments—the company continued to count ARR as if these companies were completing the full-year contract, sources said.

The 11x spokesperson clarified that the startup does offer "free trials" and the "majority of middle market customers" qualify for them, but some enterprise customers with "highly specialized" and customized needs "require a 12-month contract with an opt-out after 3 months."

The churn rate was high, with multiple employees stating that "we were losing 70-80% of customers that came through the door." This allowed 11x to "look like it’s doing better than it is," one employee remarked.

For example, the company might report $14 million in ARR when, in reality, the revenue from contracts that passed the three-month trial period was only about $3 million, an employee pointed out.

"They absolutely massaged the numbers internally when it came to growth and churn," another former employee noted.

11x acknowledges that its "highest churn" occurred for "initial cohorts in late 2023" but claims improvements in the product and refining sales to its "ideal customer" have improved retention, stating its "retention rate is currently 79%."

Venture capitalists say the issue isn't necessarily 11x using CARR to showcase its growth, but rather that investors expect startups to disclose potential opt-out revenue and customer churn. Benchmark confirms it has received transparent updates from 11x, including information on break clauses.

Product Underwhelms

Many companies canceled after their trial due to dissatisfaction with the product, according to at least one current and four former employees.

Some churn resulted from unrealistic expectations, with customers hoping 11x could replace an entire outbound sales team and save significant costs, a former employee explained.

This person noted that 11x salespeople often promised prospects a substantial increase in meetings, demos, and phone calls within months, despite employees knowing this was unrealistic.

"The actual results of the amount of automated emails versus meetings booked was disappointing," said one company that tried the product.

11x believes its product outperforms human SDRs but states "performance ultimately relies on the quality of user input." It also says it does not guarantee savings or revenues in its sales pitches.

Other customers complained about the 11x product hallucinating or failing to load properly, a former employee added. An anonymous reviewer on Medium criticized the product for being less effective and more costly than its competitors, though 11x claims this review was written by a competitor.

"The products barely work," a former engineer told TechCrunch. Customers often had to manually check and correct the work, which defeated the purpose of purchasing 11x’s product, another employee said.

There were also billing issues, with one customer being billed twice during their three-month trial period. "It almost seemed like they were kind of trying to get something past us," the customer remarked.

One venture capitalist considering investing in the Series A found the technology lacking during due diligence. Existing customers told the investor they were initially satisfied but that after a month, the startup’s AI failed to generate effective leads.

A current employee defended the company, suggesting that customers need time to adapt to 11x's system. They added that the company is working on ways to encourage more customers to stay longer.

Employee Churn

Employees also described a challenging work environment with significant turnover under founder-CEO Hasan Sukkar.

Employees were expected to work at least 60 hours a week and be constantly available, according to employees and messages seen by TechCrunch. Slack messages show Sukkar questioning employees' whereabouts at 8 p.m., after previously setting the workday start at 9 a.m.

"He doesn’t believe in people taking holidays," a current employee said. Another former employee mentioned expectations to work weekends and national holidays.

"You would have the founder on Slack, maybe three in the morning, sending messages saying ‘this needs to be resolved urgently,’" a former employee recalled, noting that the always-on mentality was so intense that some employees slept in the office.

When employees were unreachable or if issues arose, Sukkar was known to voice his frustrations publicly in the general Slack channel, at least two employees reported.

Employees who spoke out risked being threatened with dismissal, according to two employees.

"There’s a lot more under the hood," a current employee remarked, referring to Sukkar. "One day, there will be a documentary about this guy. I do believe that’s how scandalous he is."

11x attributes some turnover to its relocation from London to San Francisco last July, as employees who couldn't move chose to leave. The company says its headcount has doubled to 50 full-time employees during this period.

At least one former employee mentioned still awaiting back pay months after leaving the company. The concern over backpay has become part of the company culture, with a current employee noting that many wait until after payday to resign.

"We’ve just got paid today," a current employee said. "I’m expecting a couple of people to resign over the weekend or on Monday."

AI Reimagines Michael Jackson in the Metaverse with Stunning Digital Transformations

Artificial intelligence is fundamentally reshaping our understanding of creativity, entertainment, and cultural legacy. This exploration into AI-generated interpretations of Michael Jackson reveals how cutting-edge technology can breathe new life int

AI Reimagines Michael Jackson in the Metaverse with Stunning Digital Transformations

Artificial intelligence is fundamentally reshaping our understanding of creativity, entertainment, and cultural legacy. This exploration into AI-generated interpretations of Michael Jackson reveals how cutting-edge technology can breathe new life int

Does Training Mitigate AI-Induced Cognitive Offloading Effects?

A recent investigative piece on Unite.ai titled 'ChatGPT Might Be Draining Your Brain: Cognitive Debt in the AI Era' shed light on concerning research from MIT. Journalist Alex McFarland detailed compelling evidence of how excessive AI dependency can

Does Training Mitigate AI-Induced Cognitive Offloading Effects?

A recent investigative piece on Unite.ai titled 'ChatGPT Might Be Draining Your Brain: Cognitive Debt in the AI Era' shed light on concerning research from MIT. Journalist Alex McFarland detailed compelling evidence of how excessive AI dependency can

Easily Generate AI-Powered Graphs and Visualizations for Better Data Insights

Modern data analysis demands intuitive visualization of complex information. AI-powered graph generation solutions have emerged as indispensable assets, revolutionizing how professionals transform raw data into compelling visual stories. These intell

Easily Generate AI-Powered Graphs and Visualizations for Better Data Insights

Modern data analysis demands intuitive visualization of complex information. AI-powered graph generation solutions have emerged as indispensable assets, revolutionizing how professionals transform raw data into compelling visual stories. These intell

August 24, 2025 at 3:01:24 PM EDT

August 24, 2025 at 3:01:24 PM EDT

Shady stuff at 11x? Claiming fake customers is a bold move, but tanking your rep like that? Yikes. Hope they sort it out, AI sales tech sounds dope otherwise! 😬

0

0

August 6, 2025 at 7:00:59 AM EDT

August 6, 2025 at 7:00:59 AM EDT

This article about 11x is wild! 😲 I thought AI sales tools were supposed to be foolproof, but faking customers? That’s a bold move gone wrong. Curious how a16z and Benchmark will handle this mess.

0

0

April 25, 2025 at 11:43:54 AM EDT

April 25, 2025 at 11:43:54 AM EDT

11x schien anfangs vielversprechend, aber die finanziellen Schwierigkeiten und die Vorwürfe falscher Behauptungen sind enttäuschend. Ich habe sie unterstützt, aber jetzt bin ich mir nicht mehr sicher. Vielleicht kommen sie wieder auf die Beine, aber fürs Erste passe ich. 😕

0

0

April 25, 2025 at 8:29:45 AM EDT

April 25, 2025 at 8:29:45 AM EDT

11xは最初は有望だったけど、財政難と虚偽の主張の疑惑は残念すぎる。応援していたのに、今はどうしようか迷ってる。回復してくれるといいけど、今はパスかな。😔

0

0

April 25, 2025 at 5:34:10 AM EDT

April 25, 2025 at 5:34:10 AM EDT

11x는 처음에 기대가 컸는데, 재정 문제와 고객에 대한 거짓 주장 소식을 듣고 실망했어요. 기대가 컸던 만큼 실망도 크네요. 앞으로 어떻게 될지 지켜보겠지만, 기대는 크지 않아요. 😕

0

0

April 25, 2025 at 4:23:48 AM EDT

April 25, 2025 at 4:23:48 AM EDT

11x seemed promising at first but hearing about their financial troubles and false customer claims is a bummer. It's a reminder to always do your homework before jumping on the hype train! 🤦♂️ Maybe they can turn things around, but I'm skeptical.

0

0