Nvidia’s Earnings: Beyond Export Restrictions to New Hardware Demand

Nvidia will announce its fiscal 2026 first-quarter earnings, ending April 27, after market close on Wednesday.

While U.S. chip export controls have stirred concerns about Nvidia’s global chip sales and future outlook, some experts argue this isn’t the key focus of the company’s upcoming results.

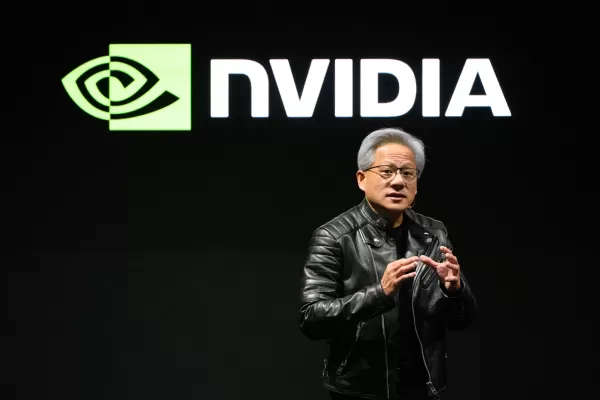

Kevin Cook, a senior equity strategist at Zacks Investment Research with a decade of Nvidia expertise, told TechCrunch that the launch of Nvidia’s GB200 NVL72 hardware—a single-rack exascale computer shipped since February—deserves more attention from investors.

Priced at roughly $3 million, each GB200 NVL72 unit includes 72 GPUs. Cook noted that despite high expectations, the uncertainty around DeepSeek in late January led analysts to slash delivery forecasts for these units.

Since this marks the first quarter of GB200 NVL72 shipments, Cook said there’s no clear gauge of performance yet.

“If Jensen [Huang] announces plans to deliver 10,000 units in Q2, the market will be thrilled,” Cook said. “That’s $30 billion for a $3 million product. I expect under 5,000 units.”

Cook emphasized that these results will reveal enterprise demand for cutting-edge AI technology. Will businesses upgrade AI hardware annually, like consumers with new iPhones? Cook remains uncertain, but noted this trend could significantly shape Nvidia’s future.

Join us at TechCrunch Sessions: AI

Reserve your place at our premier AI industry event featuring speakers from OpenAI, Anthropic, and Cohere. For a limited time, tickets cost $292 for a full day of expert talks, workshops, and impactful networking.

Exhibit at TechCrunch Sessions: AI

Showcase your innovation at TC Sessions: AI to over 1,200 decision-makers. Secure your spot by May 9 or while tables remain available.

Cook predicted Nvidia’s stock will face immediate reactions based on comments about U.S. export controls but believes these won’t affect long-term valuation as much as GB200 NVL72 demand.

He highlighted Nvidia’s ability to rebound from short-term market dips.

“We saw a flash crash, and the stock bounced back,” Cook said of Nvidia’s response to chip export restrictions. “Nvidia’s unique resilience and dominant market position allow it to shrug off challenges like restrictions on sales to China.”

Even with stricter export controls on China, Cook argued Nvidia has no shortage of buyers elsewhere, serving major hyperscalers and likely benefiting from Stargate’s new Middle East project.

For Cook, the spotlight remains on GB200 NVL72 shipments.

“As long as delivery expectations range from steady to strong, short-term revenue fluctuations will take a backseat,” Cook said. “Nvidia’s momentum will carry it through the year.”

Related article

Cognichip Unveils AI-Driven Chip Development to Accelerate Semiconductor Innovation

Chips are vital to the AI industry, yet their development lags behind the rapid pace of new AI models and products.Cognichip aims to revolutionize chip design with a foundational AI model to expedite

Cognichip Unveils AI-Driven Chip Development to Accelerate Semiconductor Innovation

Chips are vital to the AI industry, yet their development lags behind the rapid pace of new AI models and products.Cognichip aims to revolutionize chip design with a foundational AI model to expedite

New Study Reveals How Much Data LLMs Actually Memorize

How Much Do AI Models Actually Memorize? New Research Reveals Surprising InsightsWe all know that large language models (LLMs) like ChatGPT, Claude, and Gemini are trained on enormous datasets—trillions of words from books, websites, code, and even multimedia like images and audio. But what exactly

New Study Reveals How Much Data LLMs Actually Memorize

How Much Do AI Models Actually Memorize? New Research Reveals Surprising InsightsWe all know that large language models (LLMs) like ChatGPT, Claude, and Gemini are trained on enormous datasets—trillions of words from books, websites, code, and even multimedia like images and audio. But what exactly

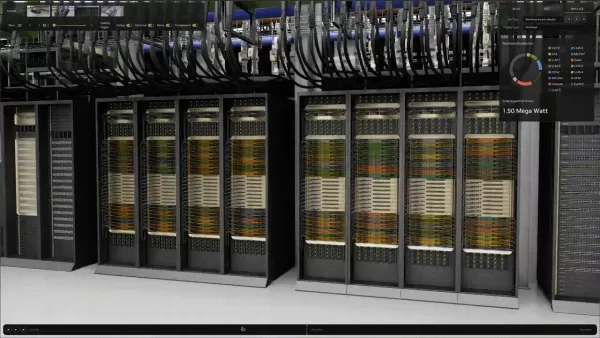

Nvidia provides Omniverse Blueprint for AI factory digital twins

NVIDIA Unveils Major Expansion of Omniverse Blueprint for AI Factory Digital TwinsIn a major announcement at Computex 2025 in Taipei, NVIDIA has significantly broadened the scope of its Omniverse Blueprint for AI Factory Digital Twins, now available as a preview. This update comes as the world witne

Comments (0)

0/200

Nvidia provides Omniverse Blueprint for AI factory digital twins

NVIDIA Unveils Major Expansion of Omniverse Blueprint for AI Factory Digital TwinsIn a major announcement at Computex 2025 in Taipei, NVIDIA has significantly broadened the scope of its Omniverse Blueprint for AI Factory Digital Twins, now available as a preview. This update comes as the world witne

Comments (0)

0/200

Nvidia will announce its fiscal 2026 first-quarter earnings, ending April 27, after market close on Wednesday.

While U.S. chip export controls have stirred concerns about Nvidia’s global chip sales and future outlook, some experts argue this isn’t the key focus of the company’s upcoming results.

Kevin Cook, a senior equity strategist at Zacks Investment Research with a decade of Nvidia expertise, told TechCrunch that the launch of Nvidia’s GB200 NVL72 hardware—a single-rack exascale computer shipped since February—deserves more attention from investors.

Priced at roughly $3 million, each GB200 NVL72 unit includes 72 GPUs. Cook noted that despite high expectations, the uncertainty around DeepSeek in late January led analysts to slash delivery forecasts for these units.

Since this marks the first quarter of GB200 NVL72 shipments, Cook said there’s no clear gauge of performance yet.

“If Jensen [Huang] announces plans to deliver 10,000 units in Q2, the market will be thrilled,” Cook said. “That’s $30 billion for a $3 million product. I expect under 5,000 units.”

Cook emphasized that these results will reveal enterprise demand for cutting-edge AI technology. Will businesses upgrade AI hardware annually, like consumers with new iPhones? Cook remains uncertain, but noted this trend could significantly shape Nvidia’s future.

Join us at TechCrunch Sessions: AI

Reserve your place at our premier AI industry event featuring speakers from OpenAI, Anthropic, and Cohere. For a limited time, tickets cost $292 for a full day of expert talks, workshops, and impactful networking.

Exhibit at TechCrunch Sessions: AI

Showcase your innovation at TC Sessions: AI to over 1,200 decision-makers. Secure your spot by May 9 or while tables remain available.

Cook predicted Nvidia’s stock will face immediate reactions based on comments about U.S. export controls but believes these won’t affect long-term valuation as much as GB200 NVL72 demand.

He highlighted Nvidia’s ability to rebound from short-term market dips.

“We saw a flash crash, and the stock bounced back,” Cook said of Nvidia’s response to chip export restrictions. “Nvidia’s unique resilience and dominant market position allow it to shrug off challenges like restrictions on sales to China.”

Even with stricter export controls on China, Cook argued Nvidia has no shortage of buyers elsewhere, serving major hyperscalers and likely benefiting from Stargate’s new Middle East project.

For Cook, the spotlight remains on GB200 NVL72 shipments.

“As long as delivery expectations range from steady to strong, short-term revenue fluctuations will take a backseat,” Cook said. “Nvidia’s momentum will carry it through the year.”

Cognichip Unveils AI-Driven Chip Development to Accelerate Semiconductor Innovation

Chips are vital to the AI industry, yet their development lags behind the rapid pace of new AI models and products.Cognichip aims to revolutionize chip design with a foundational AI model to expedite

Cognichip Unveils AI-Driven Chip Development to Accelerate Semiconductor Innovation

Chips are vital to the AI industry, yet their development lags behind the rapid pace of new AI models and products.Cognichip aims to revolutionize chip design with a foundational AI model to expedite

New Study Reveals How Much Data LLMs Actually Memorize

How Much Do AI Models Actually Memorize? New Research Reveals Surprising InsightsWe all know that large language models (LLMs) like ChatGPT, Claude, and Gemini are trained on enormous datasets—trillions of words from books, websites, code, and even multimedia like images and audio. But what exactly

New Study Reveals How Much Data LLMs Actually Memorize

How Much Do AI Models Actually Memorize? New Research Reveals Surprising InsightsWe all know that large language models (LLMs) like ChatGPT, Claude, and Gemini are trained on enormous datasets—trillions of words from books, websites, code, and even multimedia like images and audio. But what exactly

Nvidia provides Omniverse Blueprint for AI factory digital twins

NVIDIA Unveils Major Expansion of Omniverse Blueprint for AI Factory Digital TwinsIn a major announcement at Computex 2025 in Taipei, NVIDIA has significantly broadened the scope of its Omniverse Blueprint for AI Factory Digital Twins, now available as a preview. This update comes as the world witne

Nvidia provides Omniverse Blueprint for AI factory digital twins

NVIDIA Unveils Major Expansion of Omniverse Blueprint for AI Factory Digital TwinsIn a major announcement at Computex 2025 in Taipei, NVIDIA has significantly broadened the scope of its Omniverse Blueprint for AI Factory Digital Twins, now available as a preview. This update comes as the world witne