Navigating the AI Investment Bubble: Key Insights and Strategic Approaches

The artificial intelligence sector has been buzzing with activity, with companies like NVIDIA briefly eclipsing Microsoft as the world's most valuable company. However, recent developments, such as Micron's disappointing outlook and the subsequent drop in its shares, have sparked concerns about an AI bubble. Investors are now scrutinizing whether the high expectations for AI are sustainable and if the current market valuations are justified. This article explores the intricacies of the AI investment landscape, providing insights and strategies for navigating this potentially volatile market.

Key Points

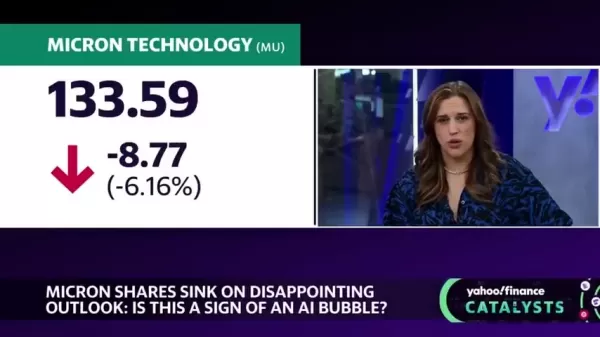

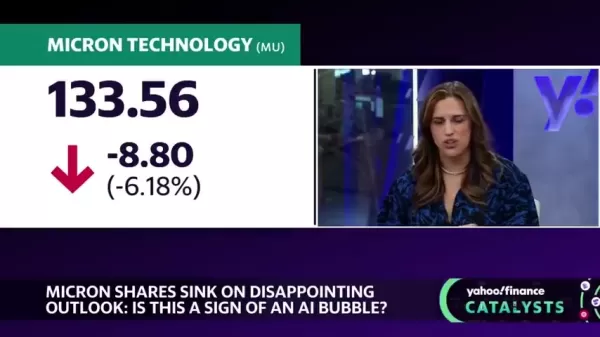

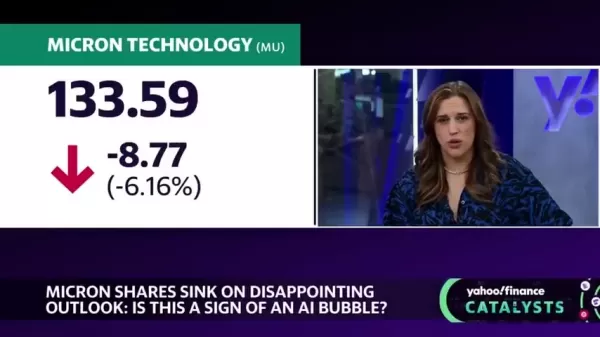

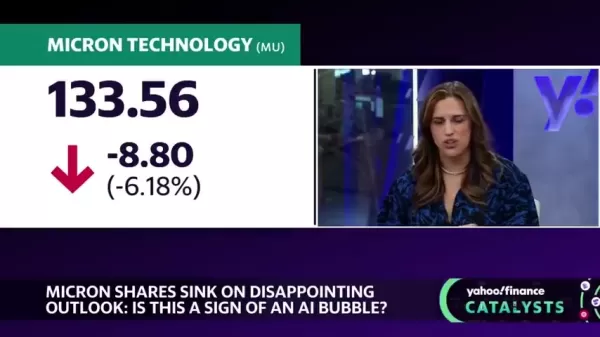

- Micron's shares fell due to disappointing forecasts, fueling concerns about an AI investment bubble.

- NVIDIA's stock experienced volatility, briefly topping Microsoft before declining.

- The concentration of investment in a few AI giants is causing investor apprehension.

- Expert analysis suggests that AI is real, but its full potential may take longer to materialize.

- Overbuilding capacity and a focus on project-based work may indicate a slight bubble in the AI sector.

- Growth dollar retention rates are critical indicators for AI investments.

- Profitable, non-IPO-bound software companies are potentially safer investment options.

- Software companies are not growing as rapidly as previously thought.

- Gross dollar retention rates are an essential measure of customer retention for investment decisions.

The State of AI Investment: A Closer Look

Micron's Dip and the AI Bubble Question

Micron Technology, a key player in the semiconductor industry, saw its shares plummet after a disappointing outlook.  This event has triggered discussions about whether the high expectations surrounding the AI sector are realistic, and if there's a potential AI bubble brewing. Investors had high hopes for Micron due to its role in enabling AI technologies, but the company's forecast fell short of those expectations. This raises the critical question: Are we seeing signs of an AI bubble, where valuations exceed what the underlying business fundamentals can support? Understanding these dynamics is crucial for assessing the true prospects of AI investments.

This event has triggered discussions about whether the high expectations surrounding the AI sector are realistic, and if there's a potential AI bubble brewing. Investors had high hopes for Micron due to its role in enabling AI technologies, but the company's forecast fell short of those expectations. This raises the critical question: Are we seeing signs of an AI bubble, where valuations exceed what the underlying business fundamentals can support? Understanding these dynamics is crucial for assessing the true prospects of AI investments.

NVIDIA's Rollercoaster and Market Concentration

NVIDIA, a leading force in AI hardware, has also had a rollercoaster week, briefly surpassing Microsoft as the world's most valuable company before experiencing a decline.  This highlights the concentration of investment in a few key players within the AI sector. Such concentration can be a cause for concern, as it makes the market vulnerable to the performance of these giants. The phrase "NVIDIA is the new Cisco" is often thrown around, but what does it really mean? Is it a sign of overvaluation, or simply an acknowledgment of NVIDIA's current dominance in the AI landscape? Over the last five days, NVIDIA's stock has dropped nearly 5 percent, prompting questions about both NVIDIA's and Micron's place in the investment landscape.

This highlights the concentration of investment in a few key players within the AI sector. Such concentration can be a cause for concern, as it makes the market vulnerable to the performance of these giants. The phrase "NVIDIA is the new Cisco" is often thrown around, but what does it really mean? Is it a sign of overvaluation, or simply an acknowledgment of NVIDIA's current dominance in the AI landscape? Over the last five days, NVIDIA's stock has dropped nearly 5 percent, prompting questions about both NVIDIA's and Micron's place in the investment landscape.

Expert Insights: Is AI Overvalued?

Mitchell Green's Perspective on AI's Future

Mitchell Green, Founding Partner of Lead Edge Capital, offers valuable insights into the AI investment landscape. He stresses the importance of distinguishing between a company being overvalued and its high valuation being sustainable in the long term. Green believes that AI is very real and its impact will unfold over a longer period than many expect. Although Lead Edge Capital has not yet invested in AI, they remain open to doing so. Green suggests that investment in NVIDIA should be based on the belief that hyperscalers and governments in Singapore and the Middle East will continue to increase their spending on AI. He likens the evolution of AI to the transformation of website building from the late 1990s to today, suggesting that AI costs will decrease over time.

Growth Rates and the Telecom Bust Analogy

Green draws parallels to the telecom bust of the late 1990s and early 2000s, suggesting that the AI sector could face similar overcapacity issues. He notes that while some AI companies show impressive growth rates, gross dollar retention rates can be unstable. He believes there's a slight bubble due to the focus on project-based work that may not sustain a small customer base. Green uses an analogy with the website boom of the late '90s, where building a website could cost up to $50 million, compared to today, where it can be done for $25 on platforms like GoDaddy. This highlights three overlooked aspects of AI: the advancements brought by smartphones like the iPhone, unprecedented growth rates, and the shakiness of these growth rates.

Winning Strategies: Focus on the Incumbents

Green suggests that established companies, or 'incumbents,' will ultimately benefit most from AI. He mentions companies like ByteDance, Pinduoduo, and Uber, but emphasizes that the true winners will be those integrating AI into their existing businesses. He believes it's easier to invest in established giants like Google or Microsoft. Given the struggles in the software sector, Green suggests it might be an opportune time to invest in new companies.

Investing in AI: Navigating the Nuances

How Can You Invest?

While Green offers reasons to be cautious, there are still opportunities for investment in AI. Here are some strategies for navigating the AI investment space:

- Diversification: Spread your investments across different AI sub-sectors and company sizes.

- Due Diligence: Thoroughly research any AI company before investing. Understand its business model, technology, and competitive landscape.

- Long-Term Perspective: AI is a long-term investment. Be prepared to hold your investments through periods of volatility.

- Focus on Gross Retention: Look for gross retention rates of 90% or above. Companies need to upsell, retain customers, and provide value to improve these rates.

Pricing

Pricing Structure and Profitability

The pricing structures discussed by Mitchell Green are tied to specific companies. Understanding the market and the pricing available to customers is key. What makes someone a loyal user or customer? Providing value is essential to improve this.

Evaluating AI Investments: Advantages and Disadvantages

Pros

- Potential for High Returns: The AI sector has the potential for significant growth and value creation.

- Transformative Technology: AI has the power to revolutionize various industries and aspects of life.

- First-Mover Advantage: Early investment in AI companies can provide a competitive edge.

- Use of Software: Companies can leverage software like Salesforce and Oracle.

- Profitability of Smaller Companies: Smaller companies may be able to become profitable.

Cons

- Risk of Overvaluation: Many AI companies may be currently overvalued, leading to potential losses.

- Market Concentration: Investment is heavily concentrated in a few key players.

- Technological Uncertainty: The rapid pace of technological change makes it difficult to predict long-term winners.

- High Costs: Investing in AI can be costly.

- Long-Term Realization: It may take a long time for AI investments to reach their goals.

Core Features

Software Features

With software investment hovering around 40%, it's crucial to stay updated on the various market offerings. Consider focusing on the key features you might use and how they could benefit others in the ecosystem.

Use Cases

Areas to Focus On

If you're struggling to achieve results with various software and technologies, consider which areas could lead to effective investments. As Green points out, private equity is important in this sector, with over 60% of companies being profitable, and these numbers can improve.

FAQ

Is the AI boom a bubble?

There are concerns that the AI sector is overvalued, but the potential for AI is considered real and transformative. It will simply take more time for its market to materialize. As technology advances, challenges arise in maintaining gross retention and profitability for companies.

Are growth rates important?

While AI presents opportunities for expanding existing and future profits and businesses, certain factors should be monitored. Always look for growth in terms of gross retention to understand where to invest and how to provide true value. Companies must have solid foundations, business plans, and value.

What does the future of AI look like?

The AI space is poised to revolutionize our lives, and it will take time to see how it unfolds. Green highlights similarities with the telecom bubble, suggesting that similar scenarios may occur with the AI bubble. It just needs the right amount of time for all of this to unfold.

Related Questions

What is the status of Micron Shares?

Micron shares have fallen due to lower-than-expected forecasts, contributing to growing worries about an AI investment bubble. Despite the setback, the company remains essential to the semiconductor industry and plays a role in enabling AI technology. Investors had high expectations for Micron based on its role in AI, but the company's forecast failed to meet those hopes, raising questions about whether we're seeing signs of an AI bubble where valuations exceed what the business fundamentals can support.

Who is Mitchell Green?

Mitchell Green, Founding Partner of Lead Edge Capital, offers valuable insights into the AI investment landscape. He emphasizes the importance of distinguishing between whether a company is overvalued and whether its high valuation is sustainable in the long term. He believes that AI is very real and its impact will unfold over a longer period than many expect. Although Lead Edge Capital has not yet invested in AI, they remain open to doing so.

Related article

AI-Powered Cover Letters: Expert Guide for Journal Submissions

In today's competitive academic publishing environment, crafting an effective cover letter can make the crucial difference in your manuscript's acceptance. Discover how AI-powered tools like ChatGPT can streamline this essential task, helping you cre

AI-Powered Cover Letters: Expert Guide for Journal Submissions

In today's competitive academic publishing environment, crafting an effective cover letter can make the crucial difference in your manuscript's acceptance. Discover how AI-powered tools like ChatGPT can streamline this essential task, helping you cre

US to Sanction Foreign Officials Over Social Media Regulations

US Takes Stand Against Global Digital Content Regulations

The State Department issued a sharp diplomatic rebuke this week targeting European digital governance policies, signaling escalating tensions over control of online platforms. Secretary Marco

US to Sanction Foreign Officials Over Social Media Regulations

US Takes Stand Against Global Digital Content Regulations

The State Department issued a sharp diplomatic rebuke this week targeting European digital governance policies, signaling escalating tensions over control of online platforms. Secretary Marco

Ultimate Guide to AI-Powered YouTube Video Summarizers

In our information-rich digital landscape, AI-powered YouTube video summarizers have become indispensable for efficient content consumption. This in-depth guide explores how to build a sophisticated summarization tool using cutting-edge NLP technolog

Comments (6)

0/200

Ultimate Guide to AI-Powered YouTube Video Summarizers

In our information-rich digital landscape, AI-powered YouTube video summarizers have become indispensable for efficient content consumption. This in-depth guide explores how to build a sophisticated summarization tool using cutting-edge NLP technolog

Comments (6)

0/200

![LiamCarter]() LiamCarter

LiamCarter

July 30, 2025 at 9:41:19 PM EDT

July 30, 2025 at 9:41:19 PM EDT

Wow, the AI bubble talk is intense! NVIDIA overtaking Microsoft was wild, but Micron’s drop has me wondering if the hype’s cooling off. Still, I’m curious how startups will navigate this—betting big on AI feels risky but exciting! 🚀

0

0

![HarryLewis]() HarryLewis

HarryLewis

May 3, 2025 at 7:59:46 PM EDT

May 3, 2025 at 7:59:46 PM EDT

AI投資バブルに関するこのガイドはとても参考になります。複雑な情報を分かりやすく説明しています。特に市場の変動についての洞察が役立ちました。グラフやチャートがあるとさらに良いかもしれません。

0

0

![ChristopherAllen]() ChristopherAllen

ChristopherAllen

May 3, 2025 at 2:33:30 AM EDT

May 3, 2025 at 2:33:30 AM EDT

Esta guía es súper útil si quieres entender el panorama de inversión en IA. Simplifica conceptos complejos en partes fáciles de entender. Encontré las perspectivas sobre la volatilidad del mercado particularmente útiles. Podría usar más visualizaciones, como gráficos o tablas.

0

0

![FrankMartínez]() FrankMartínez

FrankMartínez

May 2, 2025 at 3:14:23 PM EDT

May 2, 2025 at 3:14:23 PM EDT

This guide is super helpful if you're trying to understand the AI investment landscape. It breaks down complex ideas into easy-to-digest bits. I found the insights on market volatility particularly useful. Could use more visuals though, maybe charts or graphs?

0

0

![HarryLewis]() HarryLewis

HarryLewis

May 2, 2025 at 11:29:42 AM EDT

May 2, 2025 at 11:29:42 AM EDT

AI 투자 버블에 대한 이 가이드는 정말 유용해요. 복잡한 개념을 쉽게 이해할 수 있게 해줍니다. 시장 변동성에 대한 통찰이 특히 유용했어요. 그래프나 차트가 있으면 더 좋았을 것 같아요.

0

0

![AndrewWilson]() AndrewWilson

AndrewWilson

May 2, 2025 at 5:07:02 AM EDT

May 2, 2025 at 5:07:02 AM EDT

Essa guia é super útil se você quiser entender o cenário de investimento em IA. Ela simplifica ideias complexas em pedaços fáceis de digerir. Encontrei as insigths sobre volatilidade do mercado particularmente úteis. Poderia usar mais visuais, talvez gráficos ou tabelas?

0

0

The artificial intelligence sector has been buzzing with activity, with companies like NVIDIA briefly eclipsing Microsoft as the world's most valuable company. However, recent developments, such as Micron's disappointing outlook and the subsequent drop in its shares, have sparked concerns about an AI bubble. Investors are now scrutinizing whether the high expectations for AI are sustainable and if the current market valuations are justified. This article explores the intricacies of the AI investment landscape, providing insights and strategies for navigating this potentially volatile market.

Key Points

- Micron's shares fell due to disappointing forecasts, fueling concerns about an AI investment bubble.

- NVIDIA's stock experienced volatility, briefly topping Microsoft before declining.

- The concentration of investment in a few AI giants is causing investor apprehension.

- Expert analysis suggests that AI is real, but its full potential may take longer to materialize.

- Overbuilding capacity and a focus on project-based work may indicate a slight bubble in the AI sector.

- Growth dollar retention rates are critical indicators for AI investments.

- Profitable, non-IPO-bound software companies are potentially safer investment options.

- Software companies are not growing as rapidly as previously thought.

- Gross dollar retention rates are an essential measure of customer retention for investment decisions.

The State of AI Investment: A Closer Look

Micron's Dip and the AI Bubble Question

Micron Technology, a key player in the semiconductor industry, saw its shares plummet after a disappointing outlook.  This event has triggered discussions about whether the high expectations surrounding the AI sector are realistic, and if there's a potential AI bubble brewing. Investors had high hopes for Micron due to its role in enabling AI technologies, but the company's forecast fell short of those expectations. This raises the critical question: Are we seeing signs of an AI bubble, where valuations exceed what the underlying business fundamentals can support? Understanding these dynamics is crucial for assessing the true prospects of AI investments.

This event has triggered discussions about whether the high expectations surrounding the AI sector are realistic, and if there's a potential AI bubble brewing. Investors had high hopes for Micron due to its role in enabling AI technologies, but the company's forecast fell short of those expectations. This raises the critical question: Are we seeing signs of an AI bubble, where valuations exceed what the underlying business fundamentals can support? Understanding these dynamics is crucial for assessing the true prospects of AI investments.

NVIDIA's Rollercoaster and Market Concentration

NVIDIA, a leading force in AI hardware, has also had a rollercoaster week, briefly surpassing Microsoft as the world's most valuable company before experiencing a decline.  This highlights the concentration of investment in a few key players within the AI sector. Such concentration can be a cause for concern, as it makes the market vulnerable to the performance of these giants. The phrase "NVIDIA is the new Cisco" is often thrown around, but what does it really mean? Is it a sign of overvaluation, or simply an acknowledgment of NVIDIA's current dominance in the AI landscape? Over the last five days, NVIDIA's stock has dropped nearly 5 percent, prompting questions about both NVIDIA's and Micron's place in the investment landscape.

This highlights the concentration of investment in a few key players within the AI sector. Such concentration can be a cause for concern, as it makes the market vulnerable to the performance of these giants. The phrase "NVIDIA is the new Cisco" is often thrown around, but what does it really mean? Is it a sign of overvaluation, or simply an acknowledgment of NVIDIA's current dominance in the AI landscape? Over the last five days, NVIDIA's stock has dropped nearly 5 percent, prompting questions about both NVIDIA's and Micron's place in the investment landscape.

Expert Insights: Is AI Overvalued?

Mitchell Green's Perspective on AI's Future

Mitchell Green, Founding Partner of Lead Edge Capital, offers valuable insights into the AI investment landscape. He stresses the importance of distinguishing between a company being overvalued and its high valuation being sustainable in the long term. Green believes that AI is very real and its impact will unfold over a longer period than many expect. Although Lead Edge Capital has not yet invested in AI, they remain open to doing so. Green suggests that investment in NVIDIA should be based on the belief that hyperscalers and governments in Singapore and the Middle East will continue to increase their spending on AI. He likens the evolution of AI to the transformation of website building from the late 1990s to today, suggesting that AI costs will decrease over time.

Growth Rates and the Telecom Bust Analogy

Green draws parallels to the telecom bust of the late 1990s and early 2000s, suggesting that the AI sector could face similar overcapacity issues. He notes that while some AI companies show impressive growth rates, gross dollar retention rates can be unstable. He believes there's a slight bubble due to the focus on project-based work that may not sustain a small customer base. Green uses an analogy with the website boom of the late '90s, where building a website could cost up to $50 million, compared to today, where it can be done for $25 on platforms like GoDaddy. This highlights three overlooked aspects of AI: the advancements brought by smartphones like the iPhone, unprecedented growth rates, and the shakiness of these growth rates.

Winning Strategies: Focus on the Incumbents

Green suggests that established companies, or 'incumbents,' will ultimately benefit most from AI. He mentions companies like ByteDance, Pinduoduo, and Uber, but emphasizes that the true winners will be those integrating AI into their existing businesses. He believes it's easier to invest in established giants like Google or Microsoft. Given the struggles in the software sector, Green suggests it might be an opportune time to invest in new companies.

Investing in AI: Navigating the Nuances

How Can You Invest?

While Green offers reasons to be cautious, there are still opportunities for investment in AI. Here are some strategies for navigating the AI investment space:

- Diversification: Spread your investments across different AI sub-sectors and company sizes.

- Due Diligence: Thoroughly research any AI company before investing. Understand its business model, technology, and competitive landscape.

- Long-Term Perspective: AI is a long-term investment. Be prepared to hold your investments through periods of volatility.

- Focus on Gross Retention: Look for gross retention rates of 90% or above. Companies need to upsell, retain customers, and provide value to improve these rates.

Pricing

Pricing Structure and Profitability

The pricing structures discussed by Mitchell Green are tied to specific companies. Understanding the market and the pricing available to customers is key. What makes someone a loyal user or customer? Providing value is essential to improve this.

Evaluating AI Investments: Advantages and Disadvantages

Pros

- Potential for High Returns: The AI sector has the potential for significant growth and value creation.

- Transformative Technology: AI has the power to revolutionize various industries and aspects of life.

- First-Mover Advantage: Early investment in AI companies can provide a competitive edge.

- Use of Software: Companies can leverage software like Salesforce and Oracle.

- Profitability of Smaller Companies: Smaller companies may be able to become profitable.

Cons

- Risk of Overvaluation: Many AI companies may be currently overvalued, leading to potential losses.

- Market Concentration: Investment is heavily concentrated in a few key players.

- Technological Uncertainty: The rapid pace of technological change makes it difficult to predict long-term winners.

- High Costs: Investing in AI can be costly.

- Long-Term Realization: It may take a long time for AI investments to reach their goals.

Core Features

Software Features

With software investment hovering around 40%, it's crucial to stay updated on the various market offerings. Consider focusing on the key features you might use and how they could benefit others in the ecosystem.

Use Cases

Areas to Focus On

If you're struggling to achieve results with various software and technologies, consider which areas could lead to effective investments. As Green points out, private equity is important in this sector, with over 60% of companies being profitable, and these numbers can improve.

FAQ

Is the AI boom a bubble?

There are concerns that the AI sector is overvalued, but the potential for AI is considered real and transformative. It will simply take more time for its market to materialize. As technology advances, challenges arise in maintaining gross retention and profitability for companies.

Are growth rates important?

While AI presents opportunities for expanding existing and future profits and businesses, certain factors should be monitored. Always look for growth in terms of gross retention to understand where to invest and how to provide true value. Companies must have solid foundations, business plans, and value.

What does the future of AI look like?

The AI space is poised to revolutionize our lives, and it will take time to see how it unfolds. Green highlights similarities with the telecom bubble, suggesting that similar scenarios may occur with the AI bubble. It just needs the right amount of time for all of this to unfold.

Related Questions

What is the status of Micron Shares?

Micron shares have fallen due to lower-than-expected forecasts, contributing to growing worries about an AI investment bubble. Despite the setback, the company remains essential to the semiconductor industry and plays a role in enabling AI technology. Investors had high expectations for Micron based on its role in AI, but the company's forecast failed to meet those hopes, raising questions about whether we're seeing signs of an AI bubble where valuations exceed what the business fundamentals can support.

Who is Mitchell Green?

Mitchell Green, Founding Partner of Lead Edge Capital, offers valuable insights into the AI investment landscape. He emphasizes the importance of distinguishing between whether a company is overvalued and whether its high valuation is sustainable in the long term. He believes that AI is very real and its impact will unfold over a longer period than many expect. Although Lead Edge Capital has not yet invested in AI, they remain open to doing so.

AI-Powered Cover Letters: Expert Guide for Journal Submissions

In today's competitive academic publishing environment, crafting an effective cover letter can make the crucial difference in your manuscript's acceptance. Discover how AI-powered tools like ChatGPT can streamline this essential task, helping you cre

AI-Powered Cover Letters: Expert Guide for Journal Submissions

In today's competitive academic publishing environment, crafting an effective cover letter can make the crucial difference in your manuscript's acceptance. Discover how AI-powered tools like ChatGPT can streamline this essential task, helping you cre

US to Sanction Foreign Officials Over Social Media Regulations

US Takes Stand Against Global Digital Content Regulations

The State Department issued a sharp diplomatic rebuke this week targeting European digital governance policies, signaling escalating tensions over control of online platforms. Secretary Marco

US to Sanction Foreign Officials Over Social Media Regulations

US Takes Stand Against Global Digital Content Regulations

The State Department issued a sharp diplomatic rebuke this week targeting European digital governance policies, signaling escalating tensions over control of online platforms. Secretary Marco

Ultimate Guide to AI-Powered YouTube Video Summarizers

In our information-rich digital landscape, AI-powered YouTube video summarizers have become indispensable for efficient content consumption. This in-depth guide explores how to build a sophisticated summarization tool using cutting-edge NLP technolog

Ultimate Guide to AI-Powered YouTube Video Summarizers

In our information-rich digital landscape, AI-powered YouTube video summarizers have become indispensable for efficient content consumption. This in-depth guide explores how to build a sophisticated summarization tool using cutting-edge NLP technolog

July 30, 2025 at 9:41:19 PM EDT

July 30, 2025 at 9:41:19 PM EDT

Wow, the AI bubble talk is intense! NVIDIA overtaking Microsoft was wild, but Micron’s drop has me wondering if the hype’s cooling off. Still, I’m curious how startups will navigate this—betting big on AI feels risky but exciting! 🚀

0

0

May 3, 2025 at 7:59:46 PM EDT

May 3, 2025 at 7:59:46 PM EDT

AI投資バブルに関するこのガイドはとても参考になります。複雑な情報を分かりやすく説明しています。特に市場の変動についての洞察が役立ちました。グラフやチャートがあるとさらに良いかもしれません。

0

0

May 3, 2025 at 2:33:30 AM EDT

May 3, 2025 at 2:33:30 AM EDT

Esta guía es súper útil si quieres entender el panorama de inversión en IA. Simplifica conceptos complejos en partes fáciles de entender. Encontré las perspectivas sobre la volatilidad del mercado particularmente útiles. Podría usar más visualizaciones, como gráficos o tablas.

0

0

May 2, 2025 at 3:14:23 PM EDT

May 2, 2025 at 3:14:23 PM EDT

This guide is super helpful if you're trying to understand the AI investment landscape. It breaks down complex ideas into easy-to-digest bits. I found the insights on market volatility particularly useful. Could use more visuals though, maybe charts or graphs?

0

0

May 2, 2025 at 11:29:42 AM EDT

May 2, 2025 at 11:29:42 AM EDT

AI 투자 버블에 대한 이 가이드는 정말 유용해요. 복잡한 개념을 쉽게 이해할 수 있게 해줍니다. 시장 변동성에 대한 통찰이 특히 유용했어요. 그래프나 차트가 있으면 더 좋았을 것 같아요.

0

0

May 2, 2025 at 5:07:02 AM EDT

May 2, 2025 at 5:07:02 AM EDT

Essa guia é super útil se você quiser entender o cenário de investimento em IA. Ela simplifica ideias complexas em pedaços fáceis de digerir. Encontrei as insigths sobre volatilidade do mercado particularmente úteis. Poderia usar mais visuais, talvez gráficos ou tabelas?

0

0