CoreWeave Founders Cash Out $488 Million Before Potential $4 Billion IPO

CoreWeave's IPO Filing Reveals Surprising Details and High Stakes

CoreWeave's S-1 document for its anticipated initial public offering (IPO) is packed with intriguing revelations. Supported by Nvidia, the company operates a specialized AI cloud service across 32 data centers, boasting over 250,000 Nvidia GPUs by the end of 2024. They've also integrated Nvidia's latest Blackwell product, enhancing their capabilities in AI reasoning.

While the specifics on the number of shares and pricing remain under wraps, IPO experts at Renaissance Capital predict CoreWeave aims to raise at least $3.5 billion, targeting a $32 billion valuation, potentially soaring to over $4 billion. This marks a significant jump from its last valuation of $23 billion in November 2024, following a $650 million secondary share sale, according to Reuters.

Co-Founders' Significant Share Sales

A notable revelation from the filing is that CoreWeave's three co-founders have already sold off a substantial portion of their Class A shares. Between tender offers in 2023 and 2024, they've cashed out nearly $488 million. Specifically, CEO and chairman Michael Intrator sold shares worth about $160 million, chief strategy officer Brian Venturo sold about $177 million, and chief development officer Brannin McBee sold around $151 million. Despite holding less than 3% of the Class A shares now, they maintain control through their majority ownership of Class B shares, which have 10 votes each, controlling about 80% of the votes.

From Finance to Tech: An Unusual Journey

Interestingly, the co-founders come from a finance background, specifically from oil industry hedge funds. Michael Intrator previously ran a natural gas hedge fund alongside Brian Venturo, while Brannin McBee was a trader at another such fund. To strengthen their technical expertise, they brought in Chen Goldberg from Google Cloud as senior vice president of engineering, who led Google's Kubernetes and serverless team.

Strategic Alliances and Revenue Growth

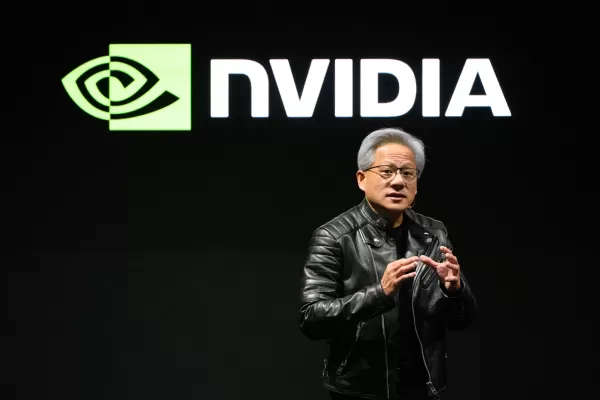

Nvidia, holding over 6% in CoreWeave and utilizing its services, forms a formidable partnership. CoreWeave's access to Nvidia GPUs has propelled its revenue to an impressive $1.9 billion in 2024, a near eightfold increase from $228.9 million in 2023. However, a significant portion of this revenue, 62%, comes from a single customer, Microsoft, which CoreWeave labels both as a customer and a competitor, alongside IBM. Other notable clients include Cohere, Meta, and Mistral.

Financial Challenges and Strategies

Despite its revenue surge, CoreWeave remains unprofitable, reporting a loss of $863 million in 2024 and carrying a hefty $7.9 billion debt. The founders, leveraging their finance background, view this debt as a strategic asset, describing their financial approach as "sophisticated" and pioneering "GPU infrastructure-backed lending." They use their valuable GPU collection as collateral. However, the cost of servicing this debt was $941 million in 2024, contributing to the company's losses. CoreWeave plans to potentially use IPO proceeds to reduce this debt burden.

The excitement around CoreWeave's IPO reflects the current market's enthusiasm for AI-driven companies with significant revenue growth. The company declined further comment on its IPO plans, leaving investors and industry watchers eager to see how this unfolds.

Related article

Two Charged in Scheme to Illegally Export AI Chips to China

The U.S. Department of Justice (DOJ) announced Tuesday that two Chinese nationals were apprehended for allegedly orchestrating the illegal export of high-performance AI chips, valued at tens of millio

Two Charged in Scheme to Illegally Export AI Chips to China

The U.S. Department of Justice (DOJ) announced Tuesday that two Chinese nationals were apprehended for allegedly orchestrating the illegal export of high-performance AI chips, valued at tens of millio

Oracle's $40B Nvidia Chip Investment Boosts Texas AI Data Center

Oracle is set to invest approximately $40 billion in Nvidia chips to power a major new data center in Texas, developed by OpenAI, as reported by the Financial Times. This deal, one of the largest chip

Oracle's $40B Nvidia Chip Investment Boosts Texas AI Data Center

Oracle is set to invest approximately $40 billion in Nvidia chips to power a major new data center in Texas, developed by OpenAI, as reported by the Financial Times. This deal, one of the largest chip

Nvidia’s Earnings: Beyond Export Restrictions to New Hardware Demand

Nvidia will announce its fiscal 2026 first-quarter earnings, ending April 27, after market close on Wednesday.While U.S. chip export controls have stirred concerns about Nvidia’s global chip sales and

Comments (0)

0/200

Nvidia’s Earnings: Beyond Export Restrictions to New Hardware Demand

Nvidia will announce its fiscal 2026 first-quarter earnings, ending April 27, after market close on Wednesday.While U.S. chip export controls have stirred concerns about Nvidia’s global chip sales and

Comments (0)

0/200

CoreWeave's IPO Filing Reveals Surprising Details and High Stakes

CoreWeave's S-1 document for its anticipated initial public offering (IPO) is packed with intriguing revelations. Supported by Nvidia, the company operates a specialized AI cloud service across 32 data centers, boasting over 250,000 Nvidia GPUs by the end of 2024. They've also integrated Nvidia's latest Blackwell product, enhancing their capabilities in AI reasoning.

While the specifics on the number of shares and pricing remain under wraps, IPO experts at Renaissance Capital predict CoreWeave aims to raise at least $3.5 billion, targeting a $32 billion valuation, potentially soaring to over $4 billion. This marks a significant jump from its last valuation of $23 billion in November 2024, following a $650 million secondary share sale, according to Reuters.

Co-Founders' Significant Share Sales

A notable revelation from the filing is that CoreWeave's three co-founders have already sold off a substantial portion of their Class A shares. Between tender offers in 2023 and 2024, they've cashed out nearly $488 million. Specifically, CEO and chairman Michael Intrator sold shares worth about $160 million, chief strategy officer Brian Venturo sold about $177 million, and chief development officer Brannin McBee sold around $151 million. Despite holding less than 3% of the Class A shares now, they maintain control through their majority ownership of Class B shares, which have 10 votes each, controlling about 80% of the votes.

From Finance to Tech: An Unusual Journey

Interestingly, the co-founders come from a finance background, specifically from oil industry hedge funds. Michael Intrator previously ran a natural gas hedge fund alongside Brian Venturo, while Brannin McBee was a trader at another such fund. To strengthen their technical expertise, they brought in Chen Goldberg from Google Cloud as senior vice president of engineering, who led Google's Kubernetes and serverless team.

Strategic Alliances and Revenue Growth

Nvidia, holding over 6% in CoreWeave and utilizing its services, forms a formidable partnership. CoreWeave's access to Nvidia GPUs has propelled its revenue to an impressive $1.9 billion in 2024, a near eightfold increase from $228.9 million in 2023. However, a significant portion of this revenue, 62%, comes from a single customer, Microsoft, which CoreWeave labels both as a customer and a competitor, alongside IBM. Other notable clients include Cohere, Meta, and Mistral.

Financial Challenges and Strategies

Despite its revenue surge, CoreWeave remains unprofitable, reporting a loss of $863 million in 2024 and carrying a hefty $7.9 billion debt. The founders, leveraging their finance background, view this debt as a strategic asset, describing their financial approach as "sophisticated" and pioneering "GPU infrastructure-backed lending." They use their valuable GPU collection as collateral. However, the cost of servicing this debt was $941 million in 2024, contributing to the company's losses. CoreWeave plans to potentially use IPO proceeds to reduce this debt burden.

The excitement around CoreWeave's IPO reflects the current market's enthusiasm for AI-driven companies with significant revenue growth. The company declined further comment on its IPO plans, leaving investors and industry watchers eager to see how this unfolds.

Two Charged in Scheme to Illegally Export AI Chips to China

The U.S. Department of Justice (DOJ) announced Tuesday that two Chinese nationals were apprehended for allegedly orchestrating the illegal export of high-performance AI chips, valued at tens of millio

Two Charged in Scheme to Illegally Export AI Chips to China

The U.S. Department of Justice (DOJ) announced Tuesday that two Chinese nationals were apprehended for allegedly orchestrating the illegal export of high-performance AI chips, valued at tens of millio

Nvidia’s Earnings: Beyond Export Restrictions to New Hardware Demand

Nvidia will announce its fiscal 2026 first-quarter earnings, ending April 27, after market close on Wednesday.While U.S. chip export controls have stirred concerns about Nvidia’s global chip sales and

Nvidia’s Earnings: Beyond Export Restrictions to New Hardware Demand

Nvidia will announce its fiscal 2026 first-quarter earnings, ending April 27, after market close on Wednesday.While U.S. chip export controls have stirred concerns about Nvidia’s global chip sales and