Bankbull TradePro AI Enhances Trading Accuracy with Backtesting Feature

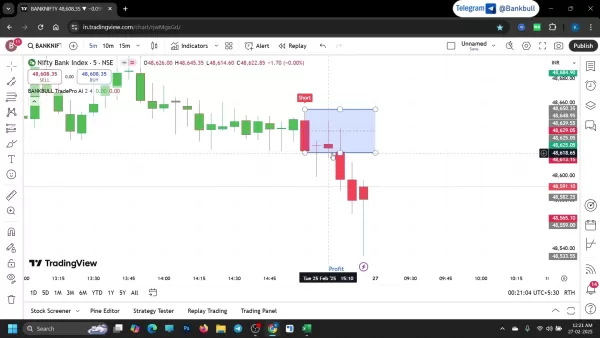

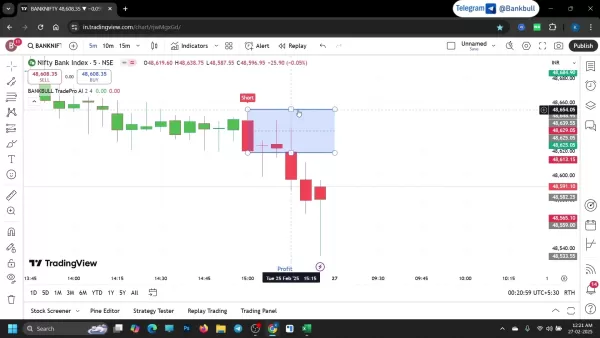

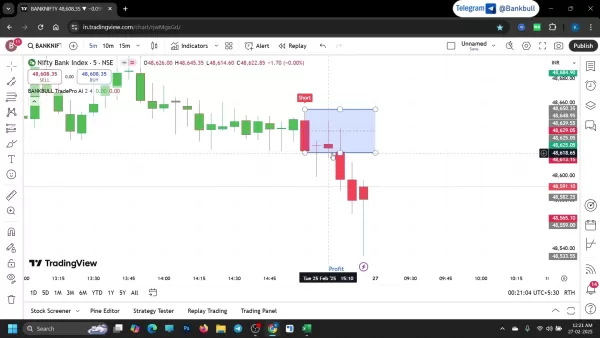

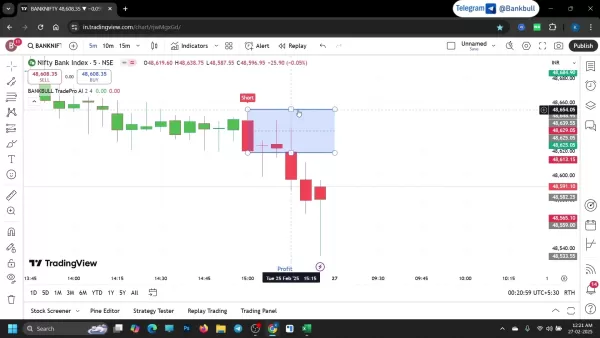

In today's fast-paced stock trading environment, precision execution makes all the difference. This in-depth analysis examines Bankbull TradePro AI's real-world performance through rigorous backtesting - revealing how this specialized indicator enhances trade accuracy for BankNifty markets. We dissect its systematic methodology, profitability metrics, and practical applications in volatile trading conditions.

Key Advantages

Precision-engineered trading signals tailored for BankNifty market dynamics

Comprehensive backtesting validation ensures reliable performance metrics

Rule-based algorithmic approach eliminates emotional trading decisions

Optimized for both short-term gains and long-position profitability

Strategic entry filters help traders avoid consolidation period traps

Understanding Bankbull TradePro AI

Specialized Market Intelligence

Bankbull TradePro AI represents cutting-edge trading technology specifically calibrated for BankNifty market movements. This quantitative indicator combines sophisticated algorithms with market-tested rules to generate high-probability trading signals. Unlike generic trading tools, it addresses the unique volatility and liquidity characteristics of banking sector indexes.

The system operates through meticulous criteria - analyzing market structure, momentum, and price action patterns. By establishing strict entry/exit protocols and dynamic risk parameters, it provides traders with actionable intelligence while maintaining disciplined position management.

The Science of Backtesting Validation

Rigorous backtesting provides the empirical foundation evaluating Bankbull TradePro AI's edge. Through systematic replay of historical market conditions, traders gain quantitative proof of the indicator's effectiveness before risking capital.

Backtesting reveals critical performance dimensions including:

- Win-loss ratios across market cycles

- Drawdown characteristics during volatility spikes

- Profit consistency metrics

- Adaptability to changing market regimes

This data-driven approach transforms trading from speculation to calculated probability management.

Core Algorithmic Rules

Bankbull TradePro AI's effectiveness stems from uncompromising adherence to its foundational rules:

- Confirmatory Entry Protocol: Requires subsequent price confirmation beyond signal candle ranges

- Defined Range Parameters: Uses quantifiable volatility thresholds to filter trades

- Time-Based Execution Window: Limits entries to three subsequent bars after initial signal

- Sideways Market Safeguards: Sophisticated volatility filters prevent false breakout trades

These constraints ensure traders only participate in high-conviction setups with favorable risk profiles.

Performance Metrics Analysis

Point Capture Efficiency

A comprehensive performance review examines net points captured versus points surrendered during testing periods. This reveals the indicator's ability to maximize gains while minimizing losses.

Metric Value Total Points Gained 11,266 Total Points Lost 579 Point Capture Accuracy 95%

Trade Success Consistency

Beyond point differentials, win-rate percentages demonstrate reliability across individual trade executions. A healthy ratio of winning trades to losing trades indicates robust predictive capability.

Metric Value Winning Trades 41 Losing Trades 9 Trade Accuracy Rate 78%

Practical Implementation Guide

Step-by-Step Trade Execution

Maximizing Bankbull TradePro AI's potential requires disciplined adherence to its methodology:

- Indicator Setup: Properly configure settings for BankNifty contract specifications

- Signal Identification: Monitor for validated trade triggers with proper confirmations

- Risk Parameter Setting: Establish appropriate stop levels based on volatility

- Trade Management: Execute trailing stop protocols to protect gains

This systematic approach transforms raw signals into optimized trading outcomes.

Balanced Performance Assessment

Advantages

- Quantitative edge demonstrated through extensive backtesting

- Specialized for BankNifty liquidity and volatility profiles

- Removes emotional decision-making from trading process

- Clear protocols prevent overtrading during uncertain conditions

- Provides objective trade administration guidelines

Considerations

- Requires strict rule compliance for advertised performance

- Market outlier events may trigger stop losses

- Requires basic technical analysis understanding

- Performance tied to proper parameter settings

- Initial learning curve for optimal utilization

Essential Questions Answered

How does Bankbull TradePro AI maintain accuracy?

The indicator combines multi-factor confirmation requirements with dynamic volatility filters, ensuring signals only trigger when statistical edges meet minimum thresholds.

What defines the entry confirmation protocol?

Trades require price to clearly break signal candle ranges within three subsequent bars - filtering false moves while capturing valid breakouts.

How should traders handle consolidation periods?

The system automatically reduces activity during ambiguous market conditions, preventing overtrading when directional edges are unclear.

Related Considerations

Optimizing Trade Execution Timing

Bankbull TradePro AI's defined three-candle entry window balances responsiveness with confirmation validity. This temporal filter prevents chasing moves while ensuring timely participation in developing trends.

Historical Validation Importance

Backtesting provides more than performance snapshots - it reveals the indicator's resilience across bull markets, corrections, and varying volatility environments. This multi-cycle validation builds confidence in real-world application.

Related article

"Desi Vocal: AI-Powered Voice Generator Creates Engaging Audio Content for Free"

In today's content-driven digital ecosystem, compelling audio can make all the difference. Desi Vocal revolutionizes voice-over creation with its free, AI-powered text-to-speech technology, enabling anyone to produce studio-quality narration without

"Desi Vocal: AI-Powered Voice Generator Creates Engaging Audio Content for Free"

In today's content-driven digital ecosystem, compelling audio can make all the difference. Desi Vocal revolutionizes voice-over creation with its free, AI-powered text-to-speech technology, enabling anyone to produce studio-quality narration without

Google Relaunches AI-Powered 'Ask Photos' with Improved Speed Features

Following a temporary halt in testing, Google is relaunching its AI-driven "Ask Photos" search functionality in Google Photos with significant enhancements. Powered by Google's Gemini AI technology, this innovative feature helps users locate specific

Google Relaunches AI-Powered 'Ask Photos' with Improved Speed Features

Following a temporary halt in testing, Google is relaunching its AI-driven "Ask Photos" search functionality in Google Photos with significant enhancements. Powered by Google's Gemini AI technology, this innovative feature helps users locate specific

Master Infographic Design in Adobe Illustrator: Step-by-Step Guide

This authoritative guide explores professional techniques for crafting compelling infographics in Adobe Illustrator. As visual storytelling tools that transform complex data into accessible information, infographics serve critical roles in education,

Comments (0)

0/200

Master Infographic Design in Adobe Illustrator: Step-by-Step Guide

This authoritative guide explores professional techniques for crafting compelling infographics in Adobe Illustrator. As visual storytelling tools that transform complex data into accessible information, infographics serve critical roles in education,

Comments (0)

0/200

In today's fast-paced stock trading environment, precision execution makes all the difference. This in-depth analysis examines Bankbull TradePro AI's real-world performance through rigorous backtesting - revealing how this specialized indicator enhances trade accuracy for BankNifty markets. We dissect its systematic methodology, profitability metrics, and practical applications in volatile trading conditions.

Key Advantages

Precision-engineered trading signals tailored for BankNifty market dynamics

Comprehensive backtesting validation ensures reliable performance metrics

Rule-based algorithmic approach eliminates emotional trading decisions

Optimized for both short-term gains and long-position profitability

Strategic entry filters help traders avoid consolidation period traps

Understanding Bankbull TradePro AI

Specialized Market Intelligence

Bankbull TradePro AI represents cutting-edge trading technology specifically calibrated for BankNifty market movements. This quantitative indicator combines sophisticated algorithms with market-tested rules to generate high-probability trading signals. Unlike generic trading tools, it addresses the unique volatility and liquidity characteristics of banking sector indexes.

The system operates through meticulous criteria - analyzing market structure, momentum, and price action patterns. By establishing strict entry/exit protocols and dynamic risk parameters, it provides traders with actionable intelligence while maintaining disciplined position management.

The Science of Backtesting Validation

Rigorous backtesting provides the empirical foundation evaluating Bankbull TradePro AI's edge. Through systematic replay of historical market conditions, traders gain quantitative proof of the indicator's effectiveness before risking capital.

Backtesting reveals critical performance dimensions including:

- Win-loss ratios across market cycles

- Drawdown characteristics during volatility spikes

- Profit consistency metrics

- Adaptability to changing market regimes

This data-driven approach transforms trading from speculation to calculated probability management.

Core Algorithmic Rules

Bankbull TradePro AI's effectiveness stems from uncompromising adherence to its foundational rules:

- Confirmatory Entry Protocol: Requires subsequent price confirmation beyond signal candle ranges

- Defined Range Parameters: Uses quantifiable volatility thresholds to filter trades

- Time-Based Execution Window: Limits entries to three subsequent bars after initial signal

- Sideways Market Safeguards: Sophisticated volatility filters prevent false breakout trades

These constraints ensure traders only participate in high-conviction setups with favorable risk profiles.

Performance Metrics Analysis

Point Capture Efficiency

A comprehensive performance review examines net points captured versus points surrendered during testing periods. This reveals the indicator's ability to maximize gains while minimizing losses.

| Metric | Value |

|---|---|

| Total Points Gained | 11,266 |

| Total Points Lost | 579 |

| Point Capture Accuracy | 95% |

Trade Success Consistency

Beyond point differentials, win-rate percentages demonstrate reliability across individual trade executions. A healthy ratio of winning trades to losing trades indicates robust predictive capability.

| Metric | Value |

|---|---|

| Winning Trades | 41 |

| Losing Trades | 9 |

| Trade Accuracy Rate | 78% |

Practical Implementation Guide

Step-by-Step Trade Execution

Maximizing Bankbull TradePro AI's potential requires disciplined adherence to its methodology:

- Indicator Setup: Properly configure settings for BankNifty contract specifications

- Signal Identification: Monitor for validated trade triggers with proper confirmations

- Risk Parameter Setting: Establish appropriate stop levels based on volatility

- Trade Management: Execute trailing stop protocols to protect gains

This systematic approach transforms raw signals into optimized trading outcomes.

Balanced Performance Assessment

Advantages

- Quantitative edge demonstrated through extensive backtesting

- Specialized for BankNifty liquidity and volatility profiles

- Removes emotional decision-making from trading process

- Clear protocols prevent overtrading during uncertain conditions

- Provides objective trade administration guidelines

Considerations

- Requires strict rule compliance for advertised performance

- Market outlier events may trigger stop losses

- Requires basic technical analysis understanding

- Performance tied to proper parameter settings

- Initial learning curve for optimal utilization

Essential Questions Answered

How does Bankbull TradePro AI maintain accuracy?

The indicator combines multi-factor confirmation requirements with dynamic volatility filters, ensuring signals only trigger when statistical edges meet minimum thresholds.

What defines the entry confirmation protocol?

Trades require price to clearly break signal candle ranges within three subsequent bars - filtering false moves while capturing valid breakouts.

How should traders handle consolidation periods?

The system automatically reduces activity during ambiguous market conditions, preventing overtrading when directional edges are unclear.

Related Considerations

Optimizing Trade Execution Timing

Bankbull TradePro AI's defined three-candle entry window balances responsiveness with confirmation validity. This temporal filter prevents chasing moves while ensuring timely participation in developing trends.

Historical Validation Importance

Backtesting provides more than performance snapshots - it reveals the indicator's resilience across bull markets, corrections, and varying volatility environments. This multi-cycle validation builds confidence in real-world application.

"Desi Vocal: AI-Powered Voice Generator Creates Engaging Audio Content for Free"

In today's content-driven digital ecosystem, compelling audio can make all the difference. Desi Vocal revolutionizes voice-over creation with its free, AI-powered text-to-speech technology, enabling anyone to produce studio-quality narration without

"Desi Vocal: AI-Powered Voice Generator Creates Engaging Audio Content for Free"

In today's content-driven digital ecosystem, compelling audio can make all the difference. Desi Vocal revolutionizes voice-over creation with its free, AI-powered text-to-speech technology, enabling anyone to produce studio-quality narration without

Google Relaunches AI-Powered 'Ask Photos' with Improved Speed Features

Following a temporary halt in testing, Google is relaunching its AI-driven "Ask Photos" search functionality in Google Photos with significant enhancements. Powered by Google's Gemini AI technology, this innovative feature helps users locate specific

Google Relaunches AI-Powered 'Ask Photos' with Improved Speed Features

Following a temporary halt in testing, Google is relaunching its AI-driven "Ask Photos" search functionality in Google Photos with significant enhancements. Powered by Google's Gemini AI technology, this innovative feature helps users locate specific

Master Infographic Design in Adobe Illustrator: Step-by-Step Guide

This authoritative guide explores professional techniques for crafting compelling infographics in Adobe Illustrator. As visual storytelling tools that transform complex data into accessible information, infographics serve critical roles in education,

Master Infographic Design in Adobe Illustrator: Step-by-Step Guide

This authoritative guide explores professional techniques for crafting compelling infographics in Adobe Illustrator. As visual storytelling tools that transform complex data into accessible information, infographics serve critical roles in education,