AI Revolutionizes Economic Trends: Integrating Finance and Technology

Welcome to the fascinating world where finance meets technology! We're exploring how Artificial Intelligence (AI) is reshaping financial trading, merging traditional financial expertise with cutting-edge tech. This article dives into a crucial technology trend, focusing on data, AI systems, and their transformative effects on the financial sector.

Key Points

- AI is acting as a bridge between the tech and finance worlds.

- Anthropic's Economic Index tracks AI's impact on labor markets and the economy.

- Large Language Models (LLMs) are revolutionizing problem-solving in finance.

- Critical thinking, writing, programming, and troubleshooting are vital skills for algorithmic trading.

- Data analysis and strategic planning are becoming crucial in AI-driven financial roles.

The Convergence of AI and Finance

AI's Growing Role in Financial Trading

The financial industry is undergoing a rapid transformation, and AI technologies are at the heart of this change. From algorithmic trading to risk management and customer service, AI is not just a buzzword; it's a game-changer that's reshaping how financial institutions and individual traders operate.

The integration of AI in finance comes with its own set of challenges. As these systems grow more complex, understanding their implications becomes essential for financial professionals. The blend of technology and financial acumen is no longer optional but a necessity for success in this dynamic field.

Key technologies driving this convergence include:

- Machine Learning (ML): Enables systems to learn from data, improve predictions, and automate tasks.

- Natural Language Processing (NLP): Facilitates communication between computers and humans, enabling AI to process and understand financial news and reports.

- Big Data Analytics: Helps in sifting through vast datasets to identify patterns and trends that inform trading strategies and risk management.

By embracing these technologies, the financial sector can unlock unprecedented opportunities for growth and efficiency. However, the key lies in understanding and adapting to these changes, ensuring that technology complements, rather than replaces, human expertise.

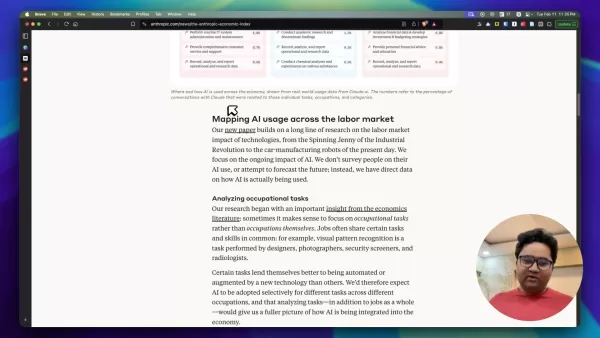

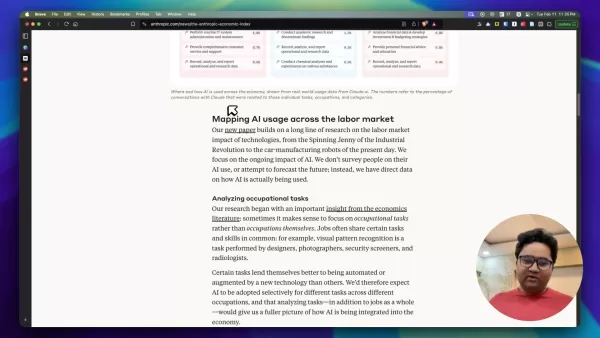

Anthropic's Economic Index: Measuring AI's Impact

One of the most significant developments in understanding AI's impact on the economy is the launch of Anthropic's Economic Index.

This index serves as a crucial tool for measuring how AI systems are affecting labor markets and the economy overall. It analyzes AI's effects on various aspects of work, providing insights into the roles that are being augmented, automated, or transformed by AI.

According to Anthropic, AI systems will have a major impact on the ways people work. Understanding this impact is critical for policymakers, business leaders, and individual workers. The Economic Index aims to provide a clearer picture of AI's integration into real-world tasks and its economic consequences.

Key Features of the Index:

- First-of-its-kind Data: Analysis based on millions of anonymized conversations, providing unparalleled insights into AI’s operational use.

- Understanding AI’s Effects: Provides data-driven analysis of AI’s impact on labor markets and the broader economy.

- Informing Policy: Helps policymakers create strategies to address the coming transformation in the labor market.

Through this initiative, Anthropic is not only contributing to the understanding of AI but also helping to shape policies and strategies that will enable a smooth transition into an AI-driven economy. The index serves as a beacon, guiding stakeholders through the complexities of this technological evolution.

The Reddit Discussion: How Will AI Affect Quant Roles?

Evolving Perspectives on AI in Quantitative Finance

Two years ago, a discussion on Reddit's r/quant subreddit highlighted prevailing sentiments about AI's role in quantitative finance.

The conversation revolved around how AI would affect quant roles, particularly in research and trading. The general consensus was that AI was not suitable for many problems in finance because AI models are designed to solve problems with well-defined answers. This viewpoint emphasized the limitations of AI in tackling the complexities and noise inherent in financial markets.

One of the key arguments presented was that AI does less well on problems where the solution is dominated by noise, reflecting skepticism about AI's ability to outperform traditional quantitative methods. However, this perspective is now evolving. Large Language Models (LLMs) and other advancements in AI are starting to challenge these traditional viewpoints. AI is no longer limited to solving well-defined problems; it's capable of handling more nuanced and complex scenarios, making it increasingly relevant in quantitative finance.

Changing Opinions on AI’s Usefulness:

- Initial Skepticism: Two years ago, AI was considered unsuitable for many core problems in finance.

- Emerging Optimism: With advancements in AI, especially LLMs, opinions are shifting towards recognizing AI’s potential.

- Data-Driven Insights: AI’s ability to analyze vast amounts of data and extract meaningful insights is becoming more valued.

The Reddit discussion reveals a critical shift in perspective, from skepticism to cautious optimism. As AI technologies continue to advance, they will likely play a more significant role in quantitative finance, enhancing existing strategies and opening up new possibilities.

Challenging Traditional Views with LLMs

The advent of Large Language Models (LLMs) has fundamentally changed the game for AI in finance.

LLMs, like Anthropic's Claude, are now capable of addressing problems that previously seemed beyond the reach of AI. These models excel in understanding natural language, processing vast amounts of unstructured data, and generating insights that were once the sole domain of human analysts.

The key difference with LLMs is their ability to handle less well-defined problems. Traditional AI models require clearly defined inputs and outputs, but LLMs can make sense of ambiguous and noisy data, making them invaluable in real-world financial scenarios. For example, LLMs can analyze news articles, social media feeds, and earnings reports to gauge market sentiment and predict stock movements. The technology has now advanced to the point where well-defined answers are no longer necessary to solve problems.

Specific applications of LLMs in finance include:

- Sentiment Analysis: Analyzing news and social media to gauge market sentiment.

- Risk Assessment: Identifying potential risks by processing vast amounts of financial data and news reports.

- Algorithmic Trading: Developing more sophisticated trading strategies based on LLM-generated insights.

By leveraging LLMs, financial institutions can enhance their decision-making processes, improve risk management, and develop more effective trading strategies. The capabilities of LLMs represent a significant leap forward for AI in finance, paving the way for new innovations and efficiencies.

Actionable Skills for the AI-Driven Financial World

Essential Skills for Algorithmic Trading

To succeed in the evolving financial landscape, traders need to develop a specific set of skills that go beyond traditional financial knowledge.

The integration of AI and machine learning into trading requires a blend of analytical, technical, and strategic thinking.

Critical skills highlighted by the analysis include:

- Critical Thinking: The ability to evaluate data, identify patterns, and make informed decisions is paramount.

- Writing: Effective communication of strategies and insights is crucial for collaboration and decision-making.

- Programming: Proficiency in coding is necessary for developing and implementing algorithmic trading strategies.

- Troubleshooting: The capacity to quickly identify and resolve issues in algorithms and trading systems is essential.

These skills are not just for technologists; they are becoming essential for anyone looking to thrive in the modern financial sector. By acquiring these capabilities, traders can effectively leverage AI technologies to enhance their performance and adapt to the changes in the market.

Understanding Algorithmic Trading Statistics

AI Usage and Opportunities in Financial Roles

The analysis provides valuable insights into the current state of AI adoption in various financial roles. While the numbers might seem small, they represent significant opportunities for those willing to embrace AI and machine learning.

Key statistics include:

- Computer and Mathematical Roles: 37.2% usage indicates a strong foundation for AI integration.

- Arts & Media and Education: Around 10% shows potential for creative applications and educational enhancements.

- Business & Finance: 5.9% highlights the untapped opportunities for AI in financial analysis and strategy.

Within the Business & Finance sector, specific tasks like analyzing financial data and developing investment strategies show utilization rates of under 1%. This underscores the potential for AI to revolutionize these processes. These numbers suggest that integrating AI into these functions can lead to significant competitive advantages.

As AI continues to evolve, these statistics will likely change, reflecting the growing adoption and impact of AI across the financial sector. Traders and financial professionals who focus on developing AI proficiency now are likely to be the most successful ones moving forward.

Pros and Cons of AI Integration in Finance

Pros

- Enhanced efficiency through automation.

- Improved accuracy in data analysis and predictions.

- Ability to process and analyze vast amounts of data.

- New possibilities and strategies for problem-solving.

Cons

- Risk of job displacement.

- Initial costs for implementing AI technologies.

- Potential for algorithmic bias and errors.

- Dependence on data quality and model accuracy.

Mapping AI Usage Across Industries

How AI is Reshaping the Job Market

Looking at the map of AI usage across the labor market, it's clear that a revolution is unfolding across multiple industries. AI isn't just altering finance; it's reaching into computer programming, mathematics, arts and media, and even lifestyle-related jobs.

It's crucial for professionals to keep an eye on long-term industry trends. As more industries continue to utilize AI, the job market as a whole will become more automated, relying less on human capital.

By learning how to harness AI now, professionals can create a future where they're not competing against machine learning models, but rather working alongside them.

Frequently Asked Questions (FAQ)

What is Anthropic's Economic Index?

Anthropic's Economic Index is a tool for measuring how AI systems are affecting labor markets and the economy overall. It provides insights into the roles that are being augmented, automated, or transformed by AI, offering a data-driven analysis of AI’s impact on labor markets and the broader economy. This information helps policymakers create strategies to address the coming transformation in the labor market. Anthropic aims to provide an understanding of AI’s integration into real-world tasks and its economic consequences.

How are LLMs changing the landscape of problem-solving in finance?

Large Language Models (LLMs) are now capable of addressing problems that previously seemed beyond the reach of AI. These models excel in understanding natural language, processing vast amounts of unstructured data, and generating insights that were once the sole domain of human analysts. LLMs also handle less well-defined problems. Financial institutions can enhance their decision-making processes, improve risk management, and develop more effective trading strategies using the capabilities LLMs offer. These models represent a significant leap forward for AI in finance, paving the way for new innovations and efficiencies.

What essential skills are required for the AI-driven financial world?

The integration of AI and machine learning into trading requires a blend of analytical, technical, and strategic thinking. Essential skills include critical thinking, writing, programming, and troubleshooting. These skills are becoming essential for anyone looking to thrive in the modern financial sector. It's also critical to have the ability to evaluate data, identify patterns, make informed decisions, communicate strategies effectively, and develop and implement algorithmic trading strategies.

Related Questions

How can professionals prepare for an AI-driven future in finance?

To prepare for an AI-driven future in finance, professionals should focus on acquiring a mix of technical and analytical skills. Key areas to focus on include machine learning, data analysis, and programming languages like Python. Additionally, developing strong problem-solving and critical-thinking abilities is essential for effectively leveraging AI tools.

Steps to prepare for the future:

- Invest in Education: Enroll in courses and workshops focused on AI and machine learning.

- Practical Experience: Work on projects that apply AI to financial problems.

- Stay Updated: Keep abreast of the latest developments in AI through research and industry publications.

- Network: Connect with professionals in the AI and finance sectors to exchange knowledge and insights.

By focusing on these steps, professionals can ensure they are well-equipped to navigate the changing landscape and capitalize on the opportunities presented by AI.

Related article

Efficiently Scrape LinkedIn Profiles at Scale Using AI-Powered Tools

In our professional landscape dominated by data, automating LinkedIn profile extraction delivers significant competitive advantages for sales prospecting, targeted marketing, and talent acquisition. Relevance AI revolutionizes this process with intel

Efficiently Scrape LinkedIn Profiles at Scale Using AI-Powered Tools

In our professional landscape dominated by data, automating LinkedIn profile extraction delivers significant competitive advantages for sales prospecting, targeted marketing, and talent acquisition. Relevance AI revolutionizes this process with intel

Anthropic Resolves Legal Case Over AI-Generated Book Piracy

Anthropic has reached a resolution in a significant copyright dispute with US authors, agreeing to a proposed class action settlement that avoids a potentially costly trial. The agreement, filed in court documents this Tuesday, stems from allegations

Anthropic Resolves Legal Case Over AI-Generated Book Piracy

Anthropic has reached a resolution in a significant copyright dispute with US authors, agreeing to a proposed class action settlement that avoids a potentially costly trial. The agreement, filed in court documents this Tuesday, stems from allegations

Meta Shares Revenue with Hosts of Llama AI Models, Filing Discloses

While Meta CEO Mark Zuckerberg emphasized in July 2023 that "selling access" isn't their business model for Llama AI models, newly disclosed court filings reveal Meta engages in revenue-sharing partnerships with cloud providers hosting these open-sou

Comments (13)

0/200

Meta Shares Revenue with Hosts of Llama AI Models, Filing Discloses

While Meta CEO Mark Zuckerberg emphasized in July 2023 that "selling access" isn't their business model for Llama AI models, newly disclosed court filings reveal Meta engages in revenue-sharing partnerships with cloud providers hosting these open-sou

Comments (13)

0/200

![TimothyBaker]() TimothyBaker

TimothyBaker

September 11, 2025 at 8:30:37 PM EDT

September 11, 2025 at 8:30:37 PM EDT

这篇文章把AI和金融结合的分析太到位了!我以前完全没想到机器学习模型能这么精准预测市场走势,看来传统投资者的饭碗真的危险了 🤯 下次能不能多谈谈具体算法在量化交易中的应用?

0

0

![MatthewSanchez]() MatthewSanchez

MatthewSanchez

August 25, 2025 at 7:01:20 PM EDT

August 25, 2025 at 7:01:20 PM EDT

AI in finance sounds like a game-changer! Curious how it’ll shake up trading strategies. 🤔 Hope it doesn’t outsmart us all!

0

0

![HaroldMiller]() HaroldMiller

HaroldMiller

August 24, 2025 at 1:01:14 AM EDT

August 24, 2025 at 1:01:14 AM EDT

Mind-blowing how AI's shaking up finance! It's like giving Wall Street a super-smart robot brain. Can't wait to see where this tech takes trading next! 🚀

0

0

![CharlesWhite]() CharlesWhite

CharlesWhite

April 26, 2025 at 6:43:25 PM EDT

April 26, 2025 at 6:43:25 PM EDT

¡La IA en finanzas es una locura! Es como unir Wall Street con Silicon Valley. La tecnología es genial, pero a veces parece que estamos perdiendo el toque humano en el comercio. ¡Aun así, estoy emocionado de ver a dónde va esto! 🚀

0

0

![WalterHarris]() WalterHarris

WalterHarris

April 26, 2025 at 3:42:42 PM EDT

April 26, 2025 at 3:42:42 PM EDT

KI in der Finanzwelt ist verrückt! Es ist, als ob Wall Street und Silicon Valley verschmelzen. Die Technologie ist cool, aber manchmal fühlt es sich an, als ob wir den menschlichen Touch im Handel verlieren. Trotzdem freue ich mich darauf zu sehen, wohin das führt! 🚀

0

0

![TimothyMitchell]() TimothyMitchell

TimothyMitchell

April 26, 2025 at 2:48:48 PM EDT

April 26, 2025 at 2:48:48 PM EDT

金融におけるAIは驚くべきものですね!ウォールストリートとシリコンバレーを融合させるようなものです。技術は素晴らしいですが、取引における人間性が失われているように感じることもあります。それでも、この進展が楽しみです!🚀

0

0

Welcome to the fascinating world where finance meets technology! We're exploring how Artificial Intelligence (AI) is reshaping financial trading, merging traditional financial expertise with cutting-edge tech. This article dives into a crucial technology trend, focusing on data, AI systems, and their transformative effects on the financial sector.

Key Points

- AI is acting as a bridge between the tech and finance worlds.

- Anthropic's Economic Index tracks AI's impact on labor markets and the economy.

- Large Language Models (LLMs) are revolutionizing problem-solving in finance.

- Critical thinking, writing, programming, and troubleshooting are vital skills for algorithmic trading.

- Data analysis and strategic planning are becoming crucial in AI-driven financial roles.

The Convergence of AI and Finance

AI's Growing Role in Financial Trading

The financial industry is undergoing a rapid transformation, and AI technologies are at the heart of this change. From algorithmic trading to risk management and customer service, AI is not just a buzzword; it's a game-changer that's reshaping how financial institutions and individual traders operate.

The integration of AI in finance comes with its own set of challenges. As these systems grow more complex, understanding their implications becomes essential for financial professionals. The blend of technology and financial acumen is no longer optional but a necessity for success in this dynamic field.

Key technologies driving this convergence include:

- Machine Learning (ML): Enables systems to learn from data, improve predictions, and automate tasks.

- Natural Language Processing (NLP): Facilitates communication between computers and humans, enabling AI to process and understand financial news and reports.

- Big Data Analytics: Helps in sifting through vast datasets to identify patterns and trends that inform trading strategies and risk management.

By embracing these technologies, the financial sector can unlock unprecedented opportunities for growth and efficiency. However, the key lies in understanding and adapting to these changes, ensuring that technology complements, rather than replaces, human expertise.

Anthropic's Economic Index: Measuring AI's Impact

One of the most significant developments in understanding AI's impact on the economy is the launch of Anthropic's Economic Index.

This index serves as a crucial tool for measuring how AI systems are affecting labor markets and the economy overall. It analyzes AI's effects on various aspects of work, providing insights into the roles that are being augmented, automated, or transformed by AI.

According to Anthropic, AI systems will have a major impact on the ways people work. Understanding this impact is critical for policymakers, business leaders, and individual workers. The Economic Index aims to provide a clearer picture of AI's integration into real-world tasks and its economic consequences.

Key Features of the Index:

- First-of-its-kind Data: Analysis based on millions of anonymized conversations, providing unparalleled insights into AI’s operational use.

- Understanding AI’s Effects: Provides data-driven analysis of AI’s impact on labor markets and the broader economy.

- Informing Policy: Helps policymakers create strategies to address the coming transformation in the labor market.

Through this initiative, Anthropic is not only contributing to the understanding of AI but also helping to shape policies and strategies that will enable a smooth transition into an AI-driven economy. The index serves as a beacon, guiding stakeholders through the complexities of this technological evolution.

The Reddit Discussion: How Will AI Affect Quant Roles?

Evolving Perspectives on AI in Quantitative Finance

Two years ago, a discussion on Reddit's r/quant subreddit highlighted prevailing sentiments about AI's role in quantitative finance.

The conversation revolved around how AI would affect quant roles, particularly in research and trading. The general consensus was that AI was not suitable for many problems in finance because AI models are designed to solve problems with well-defined answers. This viewpoint emphasized the limitations of AI in tackling the complexities and noise inherent in financial markets.

One of the key arguments presented was that AI does less well on problems where the solution is dominated by noise, reflecting skepticism about AI's ability to outperform traditional quantitative methods. However, this perspective is now evolving. Large Language Models (LLMs) and other advancements in AI are starting to challenge these traditional viewpoints. AI is no longer limited to solving well-defined problems; it's capable of handling more nuanced and complex scenarios, making it increasingly relevant in quantitative finance.

Changing Opinions on AI’s Usefulness:

- Initial Skepticism: Two years ago, AI was considered unsuitable for many core problems in finance.

- Emerging Optimism: With advancements in AI, especially LLMs, opinions are shifting towards recognizing AI’s potential.

- Data-Driven Insights: AI’s ability to analyze vast amounts of data and extract meaningful insights is becoming more valued.

The Reddit discussion reveals a critical shift in perspective, from skepticism to cautious optimism. As AI technologies continue to advance, they will likely play a more significant role in quantitative finance, enhancing existing strategies and opening up new possibilities.

Challenging Traditional Views with LLMs

The advent of Large Language Models (LLMs) has fundamentally changed the game for AI in finance.

LLMs, like Anthropic's Claude, are now capable of addressing problems that previously seemed beyond the reach of AI. These models excel in understanding natural language, processing vast amounts of unstructured data, and generating insights that were once the sole domain of human analysts.

The key difference with LLMs is their ability to handle less well-defined problems. Traditional AI models require clearly defined inputs and outputs, but LLMs can make sense of ambiguous and noisy data, making them invaluable in real-world financial scenarios. For example, LLMs can analyze news articles, social media feeds, and earnings reports to gauge market sentiment and predict stock movements. The technology has now advanced to the point where well-defined answers are no longer necessary to solve problems.

Specific applications of LLMs in finance include:

- Sentiment Analysis: Analyzing news and social media to gauge market sentiment.

- Risk Assessment: Identifying potential risks by processing vast amounts of financial data and news reports.

- Algorithmic Trading: Developing more sophisticated trading strategies based on LLM-generated insights.

By leveraging LLMs, financial institutions can enhance their decision-making processes, improve risk management, and develop more effective trading strategies. The capabilities of LLMs represent a significant leap forward for AI in finance, paving the way for new innovations and efficiencies.

Actionable Skills for the AI-Driven Financial World

Essential Skills for Algorithmic Trading

To succeed in the evolving financial landscape, traders need to develop a specific set of skills that go beyond traditional financial knowledge.

The integration of AI and machine learning into trading requires a blend of analytical, technical, and strategic thinking.

Critical skills highlighted by the analysis include:

- Critical Thinking: The ability to evaluate data, identify patterns, and make informed decisions is paramount.

- Writing: Effective communication of strategies and insights is crucial for collaboration and decision-making.

- Programming: Proficiency in coding is necessary for developing and implementing algorithmic trading strategies.

- Troubleshooting: The capacity to quickly identify and resolve issues in algorithms and trading systems is essential.

These skills are not just for technologists; they are becoming essential for anyone looking to thrive in the modern financial sector. By acquiring these capabilities, traders can effectively leverage AI technologies to enhance their performance and adapt to the changes in the market.

Understanding Algorithmic Trading Statistics

AI Usage and Opportunities in Financial Roles

The analysis provides valuable insights into the current state of AI adoption in various financial roles. While the numbers might seem small, they represent significant opportunities for those willing to embrace AI and machine learning.

Key statistics include:

- Computer and Mathematical Roles: 37.2% usage indicates a strong foundation for AI integration.

- Arts & Media and Education: Around 10% shows potential for creative applications and educational enhancements.

- Business & Finance: 5.9% highlights the untapped opportunities for AI in financial analysis and strategy.

Within the Business & Finance sector, specific tasks like analyzing financial data and developing investment strategies show utilization rates of under 1%. This underscores the potential for AI to revolutionize these processes. These numbers suggest that integrating AI into these functions can lead to significant competitive advantages.

As AI continues to evolve, these statistics will likely change, reflecting the growing adoption and impact of AI across the financial sector. Traders and financial professionals who focus on developing AI proficiency now are likely to be the most successful ones moving forward.

Pros and Cons of AI Integration in Finance

Pros

- Enhanced efficiency through automation.

- Improved accuracy in data analysis and predictions.

- Ability to process and analyze vast amounts of data.

- New possibilities and strategies for problem-solving.

Cons

- Risk of job displacement.

- Initial costs for implementing AI technologies.

- Potential for algorithmic bias and errors.

- Dependence on data quality and model accuracy.

Mapping AI Usage Across Industries

How AI is Reshaping the Job Market

Looking at the map of AI usage across the labor market, it's clear that a revolution is unfolding across multiple industries. AI isn't just altering finance; it's reaching into computer programming, mathematics, arts and media, and even lifestyle-related jobs.

It's crucial for professionals to keep an eye on long-term industry trends. As more industries continue to utilize AI, the job market as a whole will become more automated, relying less on human capital.

By learning how to harness AI now, professionals can create a future where they're not competing against machine learning models, but rather working alongside them.

Frequently Asked Questions (FAQ)

What is Anthropic's Economic Index?

Anthropic's Economic Index is a tool for measuring how AI systems are affecting labor markets and the economy overall. It provides insights into the roles that are being augmented, automated, or transformed by AI, offering a data-driven analysis of AI’s impact on labor markets and the broader economy. This information helps policymakers create strategies to address the coming transformation in the labor market. Anthropic aims to provide an understanding of AI’s integration into real-world tasks and its economic consequences.

How are LLMs changing the landscape of problem-solving in finance?

Large Language Models (LLMs) are now capable of addressing problems that previously seemed beyond the reach of AI. These models excel in understanding natural language, processing vast amounts of unstructured data, and generating insights that were once the sole domain of human analysts. LLMs also handle less well-defined problems. Financial institutions can enhance their decision-making processes, improve risk management, and develop more effective trading strategies using the capabilities LLMs offer. These models represent a significant leap forward for AI in finance, paving the way for new innovations and efficiencies.

What essential skills are required for the AI-driven financial world?

The integration of AI and machine learning into trading requires a blend of analytical, technical, and strategic thinking. Essential skills include critical thinking, writing, programming, and troubleshooting. These skills are becoming essential for anyone looking to thrive in the modern financial sector. It's also critical to have the ability to evaluate data, identify patterns, make informed decisions, communicate strategies effectively, and develop and implement algorithmic trading strategies.

Related Questions

How can professionals prepare for an AI-driven future in finance?

To prepare for an AI-driven future in finance, professionals should focus on acquiring a mix of technical and analytical skills. Key areas to focus on include machine learning, data analysis, and programming languages like Python. Additionally, developing strong problem-solving and critical-thinking abilities is essential for effectively leveraging AI tools.

Steps to prepare for the future:

- Invest in Education: Enroll in courses and workshops focused on AI and machine learning.

- Practical Experience: Work on projects that apply AI to financial problems.

- Stay Updated: Keep abreast of the latest developments in AI through research and industry publications.

- Network: Connect with professionals in the AI and finance sectors to exchange knowledge and insights.

By focusing on these steps, professionals can ensure they are well-equipped to navigate the changing landscape and capitalize on the opportunities presented by AI.

Efficiently Scrape LinkedIn Profiles at Scale Using AI-Powered Tools

In our professional landscape dominated by data, automating LinkedIn profile extraction delivers significant competitive advantages for sales prospecting, targeted marketing, and talent acquisition. Relevance AI revolutionizes this process with intel

Efficiently Scrape LinkedIn Profiles at Scale Using AI-Powered Tools

In our professional landscape dominated by data, automating LinkedIn profile extraction delivers significant competitive advantages for sales prospecting, targeted marketing, and talent acquisition. Relevance AI revolutionizes this process with intel

Anthropic Resolves Legal Case Over AI-Generated Book Piracy

Anthropic has reached a resolution in a significant copyright dispute with US authors, agreeing to a proposed class action settlement that avoids a potentially costly trial. The agreement, filed in court documents this Tuesday, stems from allegations

Anthropic Resolves Legal Case Over AI-Generated Book Piracy

Anthropic has reached a resolution in a significant copyright dispute with US authors, agreeing to a proposed class action settlement that avoids a potentially costly trial. The agreement, filed in court documents this Tuesday, stems from allegations

September 11, 2025 at 8:30:37 PM EDT

September 11, 2025 at 8:30:37 PM EDT

这篇文章把AI和金融结合的分析太到位了!我以前完全没想到机器学习模型能这么精准预测市场走势,看来传统投资者的饭碗真的危险了 🤯 下次能不能多谈谈具体算法在量化交易中的应用?

0

0

August 25, 2025 at 7:01:20 PM EDT

August 25, 2025 at 7:01:20 PM EDT

AI in finance sounds like a game-changer! Curious how it’ll shake up trading strategies. 🤔 Hope it doesn’t outsmart us all!

0

0

August 24, 2025 at 1:01:14 AM EDT

August 24, 2025 at 1:01:14 AM EDT

Mind-blowing how AI's shaking up finance! It's like giving Wall Street a super-smart robot brain. Can't wait to see where this tech takes trading next! 🚀

0

0

April 26, 2025 at 6:43:25 PM EDT

April 26, 2025 at 6:43:25 PM EDT

¡La IA en finanzas es una locura! Es como unir Wall Street con Silicon Valley. La tecnología es genial, pero a veces parece que estamos perdiendo el toque humano en el comercio. ¡Aun así, estoy emocionado de ver a dónde va esto! 🚀

0

0

April 26, 2025 at 3:42:42 PM EDT

April 26, 2025 at 3:42:42 PM EDT

KI in der Finanzwelt ist verrückt! Es ist, als ob Wall Street und Silicon Valley verschmelzen. Die Technologie ist cool, aber manchmal fühlt es sich an, als ob wir den menschlichen Touch im Handel verlieren. Trotzdem freue ich mich darauf zu sehen, wohin das führt! 🚀

0

0

April 26, 2025 at 2:48:48 PM EDT

April 26, 2025 at 2:48:48 PM EDT

金融におけるAIは驚くべきものですね!ウォールストリートとシリコンバレーを融合させるようなものです。技術は素晴らしいですが、取引における人間性が失われているように感じることもあります。それでも、この進展が楽しみです!🚀

0

0