Top 10 AI Stock Trading Bots for April 2025 Revealed

Artificial intelligence (AI) is revolutionizing the stock trading world by harnessing computing power to mimic human logic and expertise at an advanced level. AI and machine learning (ML) technologies automate processes and adhere to strict rules, significantly reducing human errors and freeing up traders from time-consuming tasks.

These technologies are capable of analyzing massive datasets that are readily available, applying them against real-time data to make accurate forecasts and execute trades. The impact of AI on stock trading is profound, especially with the introduction of trading bots. These bots make decisions at lightning speed with fewer errors, which often translates into higher profitability.

The market offers a variety of AI stock trading bots, each with unique features and capabilities. Here’s a look at the top 10 AI stock trading bots:

1. Trade Ideas

Leading the pack is Trade Ideas, a robust stock trading software crafted by a skilled team of US-based developers. It connects directly to the Exchanges, utilizing advanced AI algorithms to analyze every market tick in real-time.

Trade Ideas caters to all levels of experience, from beginners who can use simulated training to experts who can customize strategies. The AI Holly bot provides Entry and Exit Signals based on statistical models and risk management for intraday trading.

Key features include a Market Dashboard for real-time insights, Treemaps for visualizing market trends, and Stock Races to track fast-moving stocks. Picture-in-Picture (PiP) Charts allow monitoring multiple timeframes without screen clutter. The Money Machine automatically selects the top 3 momentum stocks in real-time, ensuring traders focus on the best opportunities.

- AI Algorithms

- Simulated Training

- Entry & Exit Signals

- Market Dashboard with Treemaps & Stock Races

- Picture-in-Picture Charts

- The Money Machine

Use Discount Code: UNITE25 for a 25% discount on all trading fees.

Visit Trade Ideas →

2. TrendSpider

TrendSpider is a powerful platform that brings machine learning to traders of all experience levels. With its AI Strategy Lab, users can create, customize, and deploy AI-driven trading strategies without any programming. These custom AI models are used across the platform for backtesting, charting, scanning, and real-time alerts, helping traders make smarter, faster decisions.

TrendSpider’s Trading Bots automate strategies, triggering actions based on specific conditions. These bots can handle everything from placing trades to sending updates in private channels, executing strategies across any timeframe.

The platform supports various markets, including stocks, ETFs, Futures, crypto, and Forex, offering users the flexibility to train and apply models across a wide range of assets. Since its launch in 2018, TrendSpider has become a trusted tool for over 15,000 traders worldwide.

- AI Strategy Lab for custom AI strategies without coding

- Trading Bots for strategy automation across any timeframe

- Support for stocks, ETFs, Futures, crypto, and Forex

- Integrated tools for backtesting, charting, scanning, and alerts

- Trusted by over 15,000 traders for real-time insights and efficient trading

Visit TrendSpider →

3. Intellectia

Intellectia, launched in early 2023, is a fintech platform designed to transform stock investment through AI. It aims to democratize access to advanced financial insights, offering tools for both novice and experienced investors. Intellectia provides real-time stock tracking, in-depth technical analysis, and customizable stock selection driven by AI. Users can leverage over 100 technical indicators and receive AI-summarized financial news.

The platform integrates event markers like insider trade signals and analyst ratings directly onto price charts, offering contextual insights. It supports over 6,000 public companies, aggregating vast amounts of financial data, including news, research, earnings transcripts, and social media insights.

Intellectia's mission is to revolutionize the investment experience by delivering analyst-quality answers, intelligent chat features, and AI-driven quick insights, making financial intelligence accessible to all investors.

- AI-powered stock analysis with over 100 technical indicators

- Real-time tracking and event markers, including insider trade signals and analyst ratings

- Comprehensive financial data aggregation from over 6,000 public companies

- Instant access to summarized financial news and research insights

- User-friendly platform democratizing advanced financial tools for all investors

Use Discount Code: UNITEAI to get 36% off your first yearly subscription.

Visit Intellectia →

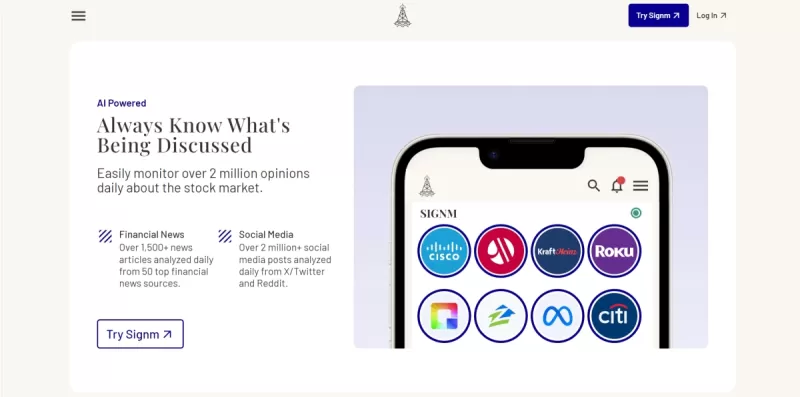

4. Signm

Signm offers rapid analysis of market trends, leveraging AI-powered tools to give investors an edge through financial news and social analysis. It monitors over 2 million opinions daily about the stock market, keeping users informed about prevailing discussions.

The platform analyzes over 1,500 news articles daily from 50 leading financial news sources, incorporating diverse perspectives from outlets like CNN, Forbes, and The Motley Fool. It also examines over 2 million social media posts each day from platforms like Twitter and Reddit, providing actionable insights by capturing the pulse of the market.

Signm identifies sentiment shifts, revealing public opinion about companies, and helps users spot early trends in market conversations. Utilizing decades of expertise in AI, machine learning, and quantitative finance, it facilitates informed decision-making, akin to Wall Street strategies.

By using AI, Signm uncovers hidden investment opportunities, predicts market movements, and assists users in making better decisions for a competitive edge. It measures sentiment from bearish to bullish, analyzing and scoring articles and social media posts for relevance.

- Analyzes over 1,500 news articles daily from top financial sources

- Examines over 2 million daily social media posts from platforms like Twitter and Reddit

- Identifies sentiment shifts and public opinions on companies

- Detects early trends in market conversations

- Uses AI, machine learning, and quantitative finance for informed decision-making

- Uncovers hidden investment opportunities and predicts market movements

- Sentiment scores calculated using machine learning algorithms trained on financial content

- AI-aggregated data reviewed by human experts for accuracy

- Includes screener and watchlist for tracking investments

- Offers comprehensive analysis and research on over 1,000+ companies

Visit Signm →

5. Signal Stack

SignalStack offers a fast, easy, and simple way to convert any alert from any trading platform into an executed order in any brokerage account, automatically. It levels the playing field by allowing users to automate orders similar to how hedge funds do it.

This enterprise-grade platform is designed to be highly available and reliable, processing incoming signals from any outside system and converting them into live orders within a brokerage account. This technology was previously unavailable to retail traders.

- Place Market and Limit orders automatically by adjusting the payload sent to SignalStack

- Keeps detailed logs of all interactions with outside brokers and sends automated alerts upon any exception

- No coding required

- Convert signals into orders in milliseconds to minimize slippage

Visit Signal Stack →

6. Stock Hero

Stock Hero is a multifaceted platform that offers a simulated paper exchange for risk-free strategy testing. Once satisfied with the results, users can easily deploy their bot into the real world.

With no coding necessary, users can create, test, and deploy bots in minutes. The platform offers various options, including:

- Connect API keys to trade across multiple exchanges

- Available with a web interface or iOS/Android App

- Backtesting available in 6 different time frames: 1 Day, 1 Week, 1 Month, 3 Months, 6 Months, 1 Year

- Uses candlestick data pulled from brokerages to evaluate trade signals with each candlestick's open value

The cloud-based platform increases speed and reduces potential lag with time-sensitive trades. StockHero's Bots Marketplace makes it easy for new users to immediately take advantage of well-performing stock trading bots created by experienced traders.

Visit Stock Hero →

7. Tickeron

Tickeron is an advanced platform offering a wide range of AI trading options. Its AI Robots enable users to view bought and sold trades with potential profit and stop loss in real-time.

The AI Robots scan stocks and ETFs every minute and present them in a customizable field. Users can adjust the selection, and the AI Robot scans the tickers to find trading opportunities based on Real Time Patterns. AI Robots also operate automated trading rooms where the AI makes trades based on several neural networks.

Tickeron offers features like AI Trend Forecasting, relying on historical price data to predict market trends with a confidence level. Users can customize confidence levels, allowing risk-averse individuals to use more proven techniques.

- AI Trend Forecasting

- AI Active Portfolios

- Custom Pattern Search Criteria

- AI Robots

- Customizable Confidence Levels

Visit Tickeron →

8. Scanz

Scanz is the “all in one” market scanning platform designed for day traders and swing traders. It enables users to scan the entire stock market in seconds, sending a constant stream of trade opportunities in real-time.

Users can scan a combination of over 100 price, volume, technical, and fundamental variables, or choose a pre-built scan designed by the Scanz trading team. The software identifies and targets active stocks making moves from 5:00 am to 8:00 pm EST.

Built for news traders, News Scanner delivers the fastest, most advanced news feed with ultra-powerful filtering and sorting functionality. Powered by over 100 news sources, press release wires, financial blogs, and complete SEC filings, it ensures users never miss a market-moving event.

Stock notifications include:

- Stocks making new highs or lows

- Breaking out of price or volume ranges

- One of a kind block trade signals

- Liquidity or technical filters

An informative window offers all necessary information, including charts, level 2, time & sales, fundamentals, news, and more. It easily integrates with multiple brokers, including Interactive Brokers or TD Ameritrade.

Visit Scanz →

9. Imperative Execution

Imperative Execution gathers information on financial exchanges, particularly U.S. Equities. It is the parent company of Intelligent Cross US equities ATS, the first venue to use AI to optimize trading performance.

The platform optimizes price discovery and minimizes market impact to enhance market efficiency. The IntelligenceCross tool matches orders at discrete times and within microseconds of arrival, maximizing price discovery.

Imperative Execution also features the ASPEN (Adverse Selection Protection Engine) system, acting as a bid/offer book. The IQX data feed provides an in-depth view of all executions on Aspen.

- IntelligenceCross

- ASPEN system

- Automated order management

- Near-continuous order matching

Visit Imperative Execution →

10. Kavout

Closing our list is Kavout, an innovative AI investing platform. At its core is “Kai,” an AI machine that analyzes millions of data points, filings, stock quotes, news, blogs, and social media channels to provide an accurate view.

The software runs the data through various financial and engineering models, including classification and regression, compiling results in a predictive ranking for stocks and other assets.

Kavout’s additional features include a paper trading portfolio for testing investment strategies and a market analysis tool that filters out the best stocks and provides a calendar to track stock performance.

- “Kai” machine-learning process

- Analyzes millions of data points

- Paper trading portfolio

- Market analysis tool

Visit Kavout →

Summary

In conclusion, artificial intelligence (AI) is significantly transforming the stock trading landscape by enhancing the efficiency and accuracy of trading processes. AI-driven technologies and machine learning (ML) algorithms can analyze vast amounts of data, making precise predictions and executing trades with minimal errors. This automation reduces the need for human intervention, thereby minimizing the potential for mistakes and freeing up valuable time for traders.

One of the most profound impacts of AI in stock trading is the introduction of trading bots. These bots can process information and make trading decisions much faster than humans, often resulting in increased profitability. They can identify trends, predict market movements, and execute trades in real-time, ensuring traders can capitalize on opportunities as they arise.

With a variety of AI stock trading bots available, each offering unique features and capabilities, traders can find tools tailored to their specific needs. These bots not only improve the accuracy and speed of trades but also offer advanced functionalities like trend forecasting, sentiment analysis, and automated order execution, making them invaluable assets in modern trading strategies.

As AI continues to evolve, its integration into stock trading is set to further enhance the efficiency, accuracy, and profitability of trading activities, paving the way for more sophisticated and effective trading solutions.

Related article

"Dot AI Companion App Announces Closure, Discontinues Personalized Service"

Dot, an AI companion application designed to function as a personal friend and confidant, will cease operations, according to a Friday announcement from its developers. New Computer, the startup behind Dot, stated on its website that the service will

"Dot AI Companion App Announces Closure, Discontinues Personalized Service"

Dot, an AI companion application designed to function as a personal friend and confidant, will cease operations, according to a Friday announcement from its developers. New Computer, the startup behind Dot, stated on its website that the service will

Anthropic Resolves Legal Case Over AI-Generated Book Piracy

Anthropic has reached a resolution in a significant copyright dispute with US authors, agreeing to a proposed class action settlement that avoids a potentially costly trial. The agreement, filed in court documents this Tuesday, stems from allegations

Anthropic Resolves Legal Case Over AI-Generated Book Piracy

Anthropic has reached a resolution in a significant copyright dispute with US authors, agreeing to a proposed class action settlement that avoids a potentially costly trial. The agreement, filed in court documents this Tuesday, stems from allegations

Figma Releases AI-Powered App Builder Tool to All Users

Figma Make, the innovative prompt-to-app development platform unveiled earlier this year, has officially exited beta and rolled out to all users. This groundbreaking tool joins the ranks of AI-powered coding assistants like Google's Gemini Code Assis

Comments (22)

0/200

Figma Releases AI-Powered App Builder Tool to All Users

Figma Make, the innovative prompt-to-app development platform unveiled earlier this year, has officially exited beta and rolled out to all users. This groundbreaking tool joins the ranks of AI-powered coding assistants like Google's Gemini Code Assis

Comments (22)

0/200

![HarrySmith]() HarrySmith

HarrySmith

August 21, 2025 at 11:01:17 PM EDT

August 21, 2025 at 11:01:17 PM EDT

AI trading bots sound like a game-changer, but I’m skeptical—can they really outsmart human traders or just overhype? 🤔

0

0

![MarkJohnson]() MarkJohnson

MarkJohnson

August 1, 2025 at 4:25:35 AM EDT

August 1, 2025 at 4:25:35 AM EDT

AI trading bots sound cool, but I’m curious—how do they handle sudden market crashes? Feels like trusting a robot with my money could be a wild ride! 🤖📉

0

0

![LawrenceLopez]() LawrenceLopez

LawrenceLopez

April 24, 2025 at 7:31:54 PM EDT

April 24, 2025 at 7:31:54 PM EDT

Esses bots de negociação de ações com IA são fantásticos! Comecei a usar um deles e meu portfólio disparou. A única desvantagem é que às vezes há falhas, mas nada é perfeito, né? Vale a pena conferir se você gosta de trading! 🚀

0

0

![TerryHernández]() TerryHernández

TerryHernández

April 24, 2025 at 4:34:34 AM EDT

April 24, 2025 at 4:34:34 AM EDT

Diese KI-Aktienhandels-Bots sind der Wahnsinn! Ich habe einen ausprobiert und meine Portfolio-Performance ist in die Höhe geschossen. Das einzige Manko sind gelegentliche Fehler, aber nichts ist perfekt, oder? Auf jeden Fall einen Versuch wert, wenn man sich für Trading interessiert! 🚀

0

0

![HarryLewis]() HarryLewis

HarryLewis

April 24, 2025 at 12:30:57 AM EDT

April 24, 2025 at 12:30:57 AM EDT

このAI株式取引ボットは本当に便利です!使い始めてから、ポートフォリオのパフォーマンスが大幅に向上しました。ただ、時々エラーが発生するのが少し残念です。それでも、これを使わない手はないですね!👍

0

0

![BruceWilson]() BruceWilson

BruceWilson

April 22, 2025 at 3:16:10 AM EDT

April 22, 2025 at 3:16:10 AM EDT

These AI stock trading bots are a game-changer! I've been using one of them and my portfolio's performance has skyrocketed. The only downside is the occasional glitch, but hey, nothing's perfect, right? Definitely worth checking out if you're into trading! 🚀

0

0

Artificial intelligence (AI) is revolutionizing the stock trading world by harnessing computing power to mimic human logic and expertise at an advanced level. AI and machine learning (ML) technologies automate processes and adhere to strict rules, significantly reducing human errors and freeing up traders from time-consuming tasks.

These technologies are capable of analyzing massive datasets that are readily available, applying them against real-time data to make accurate forecasts and execute trades. The impact of AI on stock trading is profound, especially with the introduction of trading bots. These bots make decisions at lightning speed with fewer errors, which often translates into higher profitability.

The market offers a variety of AI stock trading bots, each with unique features and capabilities. Here’s a look at the top 10 AI stock trading bots:

1. Trade Ideas

Leading the pack is Trade Ideas, a robust stock trading software crafted by a skilled team of US-based developers. It connects directly to the Exchanges, utilizing advanced AI algorithms to analyze every market tick in real-time.

Trade Ideas caters to all levels of experience, from beginners who can use simulated training to experts who can customize strategies. The AI Holly bot provides Entry and Exit Signals based on statistical models and risk management for intraday trading.

Key features include a Market Dashboard for real-time insights, Treemaps for visualizing market trends, and Stock Races to track fast-moving stocks. Picture-in-Picture (PiP) Charts allow monitoring multiple timeframes without screen clutter. The Money Machine automatically selects the top 3 momentum stocks in real-time, ensuring traders focus on the best opportunities.

- AI Algorithms

- Simulated Training

- Entry & Exit Signals

- Market Dashboard with Treemaps & Stock Races

- Picture-in-Picture Charts

- The Money Machine

Use Discount Code: UNITE25 for a 25% discount on all trading fees.

Visit Trade Ideas →

2. TrendSpider

TrendSpider is a powerful platform that brings machine learning to traders of all experience levels. With its AI Strategy Lab, users can create, customize, and deploy AI-driven trading strategies without any programming. These custom AI models are used across the platform for backtesting, charting, scanning, and real-time alerts, helping traders make smarter, faster decisions.

TrendSpider’s Trading Bots automate strategies, triggering actions based on specific conditions. These bots can handle everything from placing trades to sending updates in private channels, executing strategies across any timeframe.

The platform supports various markets, including stocks, ETFs, Futures, crypto, and Forex, offering users the flexibility to train and apply models across a wide range of assets. Since its launch in 2018, TrendSpider has become a trusted tool for over 15,000 traders worldwide.

- AI Strategy Lab for custom AI strategies without coding

- Trading Bots for strategy automation across any timeframe

- Support for stocks, ETFs, Futures, crypto, and Forex

- Integrated tools for backtesting, charting, scanning, and alerts

- Trusted by over 15,000 traders for real-time insights and efficient trading

Visit TrendSpider →

3. Intellectia

Intellectia, launched in early 2023, is a fintech platform designed to transform stock investment through AI. It aims to democratize access to advanced financial insights, offering tools for both novice and experienced investors. Intellectia provides real-time stock tracking, in-depth technical analysis, and customizable stock selection driven by AI. Users can leverage over 100 technical indicators and receive AI-summarized financial news.

The platform integrates event markers like insider trade signals and analyst ratings directly onto price charts, offering contextual insights. It supports over 6,000 public companies, aggregating vast amounts of financial data, including news, research, earnings transcripts, and social media insights.

Intellectia's mission is to revolutionize the investment experience by delivering analyst-quality answers, intelligent chat features, and AI-driven quick insights, making financial intelligence accessible to all investors.

- AI-powered stock analysis with over 100 technical indicators

- Real-time tracking and event markers, including insider trade signals and analyst ratings

- Comprehensive financial data aggregation from over 6,000 public companies

- Instant access to summarized financial news and research insights

- User-friendly platform democratizing advanced financial tools for all investors

Use Discount Code: UNITEAI to get 36% off your first yearly subscription.

Visit Intellectia →

4. Signm

Signm offers rapid analysis of market trends, leveraging AI-powered tools to give investors an edge through financial news and social analysis. It monitors over 2 million opinions daily about the stock market, keeping users informed about prevailing discussions.

The platform analyzes over 1,500 news articles daily from 50 leading financial news sources, incorporating diverse perspectives from outlets like CNN, Forbes, and The Motley Fool. It also examines over 2 million social media posts each day from platforms like Twitter and Reddit, providing actionable insights by capturing the pulse of the market.

Signm identifies sentiment shifts, revealing public opinion about companies, and helps users spot early trends in market conversations. Utilizing decades of expertise in AI, machine learning, and quantitative finance, it facilitates informed decision-making, akin to Wall Street strategies.

By using AI, Signm uncovers hidden investment opportunities, predicts market movements, and assists users in making better decisions for a competitive edge. It measures sentiment from bearish to bullish, analyzing and scoring articles and social media posts for relevance.

- Analyzes over 1,500 news articles daily from top financial sources

- Examines over 2 million daily social media posts from platforms like Twitter and Reddit

- Identifies sentiment shifts and public opinions on companies

- Detects early trends in market conversations

- Uses AI, machine learning, and quantitative finance for informed decision-making

- Uncovers hidden investment opportunities and predicts market movements

- Sentiment scores calculated using machine learning algorithms trained on financial content

- AI-aggregated data reviewed by human experts for accuracy

- Includes screener and watchlist for tracking investments

- Offers comprehensive analysis and research on over 1,000+ companies

Visit Signm →

5. Signal Stack

SignalStack offers a fast, easy, and simple way to convert any alert from any trading platform into an executed order in any brokerage account, automatically. It levels the playing field by allowing users to automate orders similar to how hedge funds do it.

This enterprise-grade platform is designed to be highly available and reliable, processing incoming signals from any outside system and converting them into live orders within a brokerage account. This technology was previously unavailable to retail traders.

- Place Market and Limit orders automatically by adjusting the payload sent to SignalStack

- Keeps detailed logs of all interactions with outside brokers and sends automated alerts upon any exception

- No coding required

- Convert signals into orders in milliseconds to minimize slippage

Visit Signal Stack →

6. Stock Hero

Stock Hero is a multifaceted platform that offers a simulated paper exchange for risk-free strategy testing. Once satisfied with the results, users can easily deploy their bot into the real world.

With no coding necessary, users can create, test, and deploy bots in minutes. The platform offers various options, including:

- Connect API keys to trade across multiple exchanges

- Available with a web interface or iOS/Android App

- Backtesting available in 6 different time frames: 1 Day, 1 Week, 1 Month, 3 Months, 6 Months, 1 Year

- Uses candlestick data pulled from brokerages to evaluate trade signals with each candlestick's open value

The cloud-based platform increases speed and reduces potential lag with time-sensitive trades. StockHero's Bots Marketplace makes it easy for new users to immediately take advantage of well-performing stock trading bots created by experienced traders.

Visit Stock Hero →

7. Tickeron

Tickeron is an advanced platform offering a wide range of AI trading options. Its AI Robots enable users to view bought and sold trades with potential profit and stop loss in real-time.

The AI Robots scan stocks and ETFs every minute and present them in a customizable field. Users can adjust the selection, and the AI Robot scans the tickers to find trading opportunities based on Real Time Patterns. AI Robots also operate automated trading rooms where the AI makes trades based on several neural networks.

Tickeron offers features like AI Trend Forecasting, relying on historical price data to predict market trends with a confidence level. Users can customize confidence levels, allowing risk-averse individuals to use more proven techniques.

- AI Trend Forecasting

- AI Active Portfolios

- Custom Pattern Search Criteria

- AI Robots

- Customizable Confidence Levels

Visit Tickeron →

8. Scanz

Scanz is the “all in one” market scanning platform designed for day traders and swing traders. It enables users to scan the entire stock market in seconds, sending a constant stream of trade opportunities in real-time.

Users can scan a combination of over 100 price, volume, technical, and fundamental variables, or choose a pre-built scan designed by the Scanz trading team. The software identifies and targets active stocks making moves from 5:00 am to 8:00 pm EST.

Built for news traders, News Scanner delivers the fastest, most advanced news feed with ultra-powerful filtering and sorting functionality. Powered by over 100 news sources, press release wires, financial blogs, and complete SEC filings, it ensures users never miss a market-moving event.

Stock notifications include:

- Stocks making new highs or lows

- Breaking out of price or volume ranges

- One of a kind block trade signals

- Liquidity or technical filters

An informative window offers all necessary information, including charts, level 2, time & sales, fundamentals, news, and more. It easily integrates with multiple brokers, including Interactive Brokers or TD Ameritrade.

Visit Scanz →

9. Imperative Execution

Imperative Execution gathers information on financial exchanges, particularly U.S. Equities. It is the parent company of Intelligent Cross US equities ATS, the first venue to use AI to optimize trading performance.

The platform optimizes price discovery and minimizes market impact to enhance market efficiency. The IntelligenceCross tool matches orders at discrete times and within microseconds of arrival, maximizing price discovery.

Imperative Execution also features the ASPEN (Adverse Selection Protection Engine) system, acting as a bid/offer book. The IQX data feed provides an in-depth view of all executions on Aspen.

- IntelligenceCross

- ASPEN system

- Automated order management

- Near-continuous order matching

Visit Imperative Execution →

10. Kavout

Closing our list is Kavout, an innovative AI investing platform. At its core is “Kai,” an AI machine that analyzes millions of data points, filings, stock quotes, news, blogs, and social media channels to provide an accurate view.

The software runs the data through various financial and engineering models, including classification and regression, compiling results in a predictive ranking for stocks and other assets.

Kavout’s additional features include a paper trading portfolio for testing investment strategies and a market analysis tool that filters out the best stocks and provides a calendar to track stock performance.

- “Kai” machine-learning process

- Analyzes millions of data points

- Paper trading portfolio

- Market analysis tool

Visit Kavout →

Summary

In conclusion, artificial intelligence (AI) is significantly transforming the stock trading landscape by enhancing the efficiency and accuracy of trading processes. AI-driven technologies and machine learning (ML) algorithms can analyze vast amounts of data, making precise predictions and executing trades with minimal errors. This automation reduces the need for human intervention, thereby minimizing the potential for mistakes and freeing up valuable time for traders.

One of the most profound impacts of AI in stock trading is the introduction of trading bots. These bots can process information and make trading decisions much faster than humans, often resulting in increased profitability. They can identify trends, predict market movements, and execute trades in real-time, ensuring traders can capitalize on opportunities as they arise.

With a variety of AI stock trading bots available, each offering unique features and capabilities, traders can find tools tailored to their specific needs. These bots not only improve the accuracy and speed of trades but also offer advanced functionalities like trend forecasting, sentiment analysis, and automated order execution, making them invaluable assets in modern trading strategies.

As AI continues to evolve, its integration into stock trading is set to further enhance the efficiency, accuracy, and profitability of trading activities, paving the way for more sophisticated and effective trading solutions.

Anthropic Resolves Legal Case Over AI-Generated Book Piracy

Anthropic has reached a resolution in a significant copyright dispute with US authors, agreeing to a proposed class action settlement that avoids a potentially costly trial. The agreement, filed in court documents this Tuesday, stems from allegations

Anthropic Resolves Legal Case Over AI-Generated Book Piracy

Anthropic has reached a resolution in a significant copyright dispute with US authors, agreeing to a proposed class action settlement that avoids a potentially costly trial. The agreement, filed in court documents this Tuesday, stems from allegations

Figma Releases AI-Powered App Builder Tool to All Users

Figma Make, the innovative prompt-to-app development platform unveiled earlier this year, has officially exited beta and rolled out to all users. This groundbreaking tool joins the ranks of AI-powered coding assistants like Google's Gemini Code Assis

Figma Releases AI-Powered App Builder Tool to All Users

Figma Make, the innovative prompt-to-app development platform unveiled earlier this year, has officially exited beta and rolled out to all users. This groundbreaking tool joins the ranks of AI-powered coding assistants like Google's Gemini Code Assis

August 21, 2025 at 11:01:17 PM EDT

August 21, 2025 at 11:01:17 PM EDT

AI trading bots sound like a game-changer, but I’m skeptical—can they really outsmart human traders or just overhype? 🤔

0

0

August 1, 2025 at 4:25:35 AM EDT

August 1, 2025 at 4:25:35 AM EDT

AI trading bots sound cool, but I’m curious—how do they handle sudden market crashes? Feels like trusting a robot with my money could be a wild ride! 🤖📉

0

0

April 24, 2025 at 7:31:54 PM EDT

April 24, 2025 at 7:31:54 PM EDT

Esses bots de negociação de ações com IA são fantásticos! Comecei a usar um deles e meu portfólio disparou. A única desvantagem é que às vezes há falhas, mas nada é perfeito, né? Vale a pena conferir se você gosta de trading! 🚀

0

0

April 24, 2025 at 4:34:34 AM EDT

April 24, 2025 at 4:34:34 AM EDT

Diese KI-Aktienhandels-Bots sind der Wahnsinn! Ich habe einen ausprobiert und meine Portfolio-Performance ist in die Höhe geschossen. Das einzige Manko sind gelegentliche Fehler, aber nichts ist perfekt, oder? Auf jeden Fall einen Versuch wert, wenn man sich für Trading interessiert! 🚀

0

0

April 24, 2025 at 12:30:57 AM EDT

April 24, 2025 at 12:30:57 AM EDT

このAI株式取引ボットは本当に便利です!使い始めてから、ポートフォリオのパフォーマンスが大幅に向上しました。ただ、時々エラーが発生するのが少し残念です。それでも、これを使わない手はないですね!👍

0

0

April 22, 2025 at 3:16:10 AM EDT

April 22, 2025 at 3:16:10 AM EDT

These AI stock trading bots are a game-changer! I've been using one of them and my portfolio's performance has skyrocketed. The only downside is the occasional glitch, but hey, nothing's perfect, right? Definitely worth checking out if you're into trading! 🚀

0

0