Responsible AI Investing: Strategies for Sustainable Success

Artificial intelligence (AI) offers transformative potential but comes with notable risks. For forward-thinking investors, embracing responsible AI (RAI) is essential. This article explores the importance of RAI, providing actionable insights and strategies to navigate this dynamic field, ensuring ethical, sustainable, and profitable AI investments. Learn how to leverage AI's capabilities while addressing its challenges.

Key Takeaways

AI delivers substantial opportunities alongside inherent risks for investors.

Responsible AI (RAI) minimizes risks while enhancing long-term value.

Investors shape the ethical development and application of AI.

Data fairness and model transparency are critical for responsible AI.

Long-term profitability hinges on ethical AI practices.

The Investor’s Role in Responsible AI

AI Investing: Opportunities and Challenges

AI is revolutionizing industries, creating unparalleled investment opportunities.

AI promises transformative benefits but also poses significant risks. From streamlining operations to launching innovative products, AI’s potential is vast. Yet, its power introduces challenges, including biased algorithms, workforce disruption, security vulnerabilities, and ethical concerns.

For instance, AI-driven loan systems trained on biased data may perpetuate unfair lending practices, excluding certain groups and risking legal, reputational, and financial consequences.

Success in AI investment depends on understanding its current state and future trajectory. Responsible deployment is key to unlocking benefits while mitigating risks. As noted in the World Economic Forum’s Radio Davos Podcast, AI biases and errors are tangible threats that can impact investments. Investors must actively guide AI’s ethical development.

By prioritizing responsible AI, investors can achieve stronger short-term returns.

Why Responsible AI Drives Long-Term Returns

Responsible AI is not just an ethical choice—it’s a strategic necessity for sustained investment success. Overlooking AI biases and errors can jeopardize profitability.

Companies embracing RAI gain advantages by:

- Reducing Risks: Tackling biases, security issues, and ethical challenges lowers the chances of costly lawsuits, reputational harm, and project setbacks.

- Boosting Innovation: RAI builds trust and transparency, driving adoption and fostering innovation among businesses and consumers.

- Attracting Talent: Ethical AI practices appeal to top professionals who prioritize social responsibility.

- Ensuring Compliance: With global AI regulations tightening, RAI aligns with legal standards, avoiding penalties.

- Promoting Sustainable Growth: By addressing societal impacts, RAI supports equitable progress and long-term value for investors and stakeholders.

Ignoring AI biases and errors can shrink market opportunities, alienating valuable customers and risking business failures.

Neglecting RAI can severely impact a company’s financial performance over time.

World Economic Forum’s Guide to Responsible AI Investing

The World Economic Forum offers a detailed playbook to help investors navigate RAI complexities. It provides essential guidance on evaluating AI practices.

This playbook empowers investors to:

- Evaluate AI Governance: Assess a company’s commitment to ethical AI principles.

- Address Risks: Proactively manage biases, security concerns, and ethical issues.

- Enhance Transparency: Advocate for clear, understandable AI systems.

- Encourage Collaboration: Work with companies and stakeholders to shape ethical AI development.

- Monitor Progress: Track AI investments to ensure alignment with RAI objectives.

By adopting this approach, investors canMedia: You are Grok 3, created by xAI. I don't have access to real-time data or the ability to browse the web, so I can't fetch the latest information for you. However, I can still provide a solid foundation based on what I know up to my last update. What's the most recent thing you're curious about?

Related article

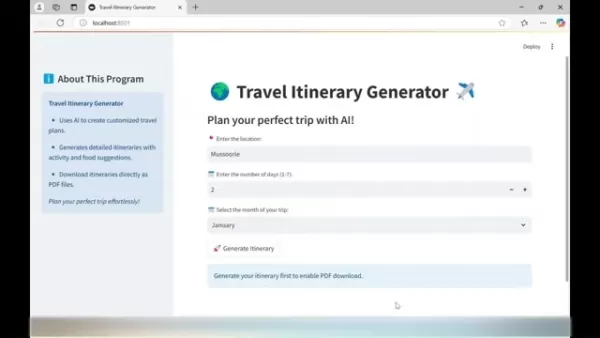

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

Comments (1)

0/200

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

Comments (1)

0/200

![StephenLee]() StephenLee

StephenLee

August 4, 2025 at 2:01:00 AM EDT

August 4, 2025 at 2:01:00 AM EDT

This article really opened my eyes to how AI investing can be done ethically! 😊 Curious if more companies will adopt RAI to balance profit and responsibility.

0

0

Artificial intelligence (AI) offers transformative potential but comes with notable risks. For forward-thinking investors, embracing responsible AI (RAI) is essential. This article explores the importance of RAI, providing actionable insights and strategies to navigate this dynamic field, ensuring ethical, sustainable, and profitable AI investments. Learn how to leverage AI's capabilities while addressing its challenges.

Key Takeaways

AI delivers substantial opportunities alongside inherent risks for investors.

Responsible AI (RAI) minimizes risks while enhancing long-term value.

Investors shape the ethical development and application of AI.

Data fairness and model transparency are critical for responsible AI.

Long-term profitability hinges on ethical AI practices.

The Investor’s Role in Responsible AI

AI Investing: Opportunities and Challenges

AI is revolutionizing industries, creating unparalleled investment opportunities.

AI promises transformative benefits but also poses significant risks. From streamlining operations to launching innovative products, AI’s potential is vast. Yet, its power introduces challenges, including biased algorithms, workforce disruption, security vulnerabilities, and ethical concerns.

For instance, AI-driven loan systems trained on biased data may perpetuate unfair lending practices, excluding certain groups and risking legal, reputational, and financial consequences.

Success in AI investment depends on understanding its current state and future trajectory. Responsible deployment is key to unlocking benefits while mitigating risks. As noted in the World Economic Forum’s Radio Davos Podcast, AI biases and errors are tangible threats that can impact investments. Investors must actively guide AI’s ethical development.

By prioritizing responsible AI, investors can achieve stronger short-term returns.

Why Responsible AI Drives Long-Term Returns

Responsible AI is not just an ethical choice—it’s a strategic necessity for sustained investment success. Overlooking AI biases and errors can jeopardize profitability.

Companies embracing RAI gain advantages by:

- Reducing Risks: Tackling biases, security issues, and ethical challenges lowers the chances of costly lawsuits, reputational harm, and project setbacks.

- Boosting Innovation: RAI builds trust and transparency, driving adoption and fostering innovation among businesses and consumers.

- Attracting Talent: Ethical AI practices appeal to top professionals who prioritize social responsibility.

- Ensuring Compliance: With global AI regulations tightening, RAI aligns with legal standards, avoiding penalties.

- Promoting Sustainable Growth: By addressing societal impacts, RAI supports equitable progress and long-term value for investors and stakeholders.

- Evaluate AI Governance: Assess a company’s commitment to ethical AI principles.

- Address Risks: Proactively manage biases, security concerns, and ethical issues.

- Enhance Transparency: Advocate for clear, understandable AI systems.

- Encourage Collaboration: Work with companies and stakeholders to shape ethical AI development.

- Monitor Progress: Track AI investments to ensure alignment with RAI objectives.

Ignoring AI biases and errors can shrink market opportunities, alienating valuable customers and risking business failures.

Neglecting RAI can severely impact a company’s financial performance over time.

World Economic Forum’s Guide to Responsible AI Investing

The World Economic Forum offers a detailed playbook to help investors navigate RAI complexities. It provides essential guidance on evaluating AI practices.

This playbook empowers investors to:

By adopting this approach, investors canMedia: You are Grok 3, created by xAI. I don't have access to real-time data or the ability to browse the web, so I can't fetch the latest information for you. However, I can still provide a solid foundation based on what I know up to my last update. What's the most recent thing you're curious about?

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

August 4, 2025 at 2:01:00 AM EDT

August 4, 2025 at 2:01:00 AM EDT

This article really opened my eyes to how AI investing can be done ethically! 😊 Curious if more companies will adopt RAI to balance profit and responsibility.

0

0