Master AI-Powered NEPSE Trading: Ultimate Guide to NepseAlpha Strategies

AI-Powered Trading in NEPSE: A Complete Guide to NepseAlpha

The Nepalese stock market (NEPSE) is dynamic, fast-paced, and full of opportunities—but navigating it successfully requires more than just gut instinct. Artificial intelligence (AI) is transforming trading, offering data-driven insights that help investors make smarter, more strategic decisions.

If you're looking to enhance your trading strategies, minimize risks, and maximize returns, NepseAlpha—an AI-driven trading platform—could be your ultimate tool. Whether you're a beginner or a seasoned trader, this guide will show you how to leverage AI for better trading outcomes in NEPSE.

Why AI is a Game-Changer for NEPSE Trading

The Power of AI in Stock Markets

AI has revolutionized stock trading by:

✅ Processing vast amounts of data (market trends, news, economic indicators) in real-time.

✅ Identifying patterns that human traders might miss.

✅ Reducing emotional bias, leading to more disciplined trading.

✅ Adapting to market changes faster than traditional methods.

For NEPSE traders, AI tools like NepseAlpha provide automated buy/sell signals, risk management strategies, and deep market analysis—giving you an edge in a competitive market.

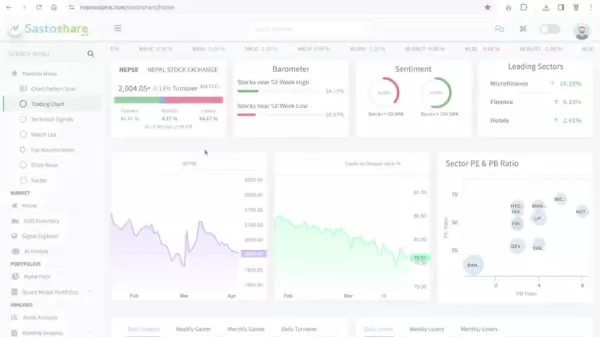

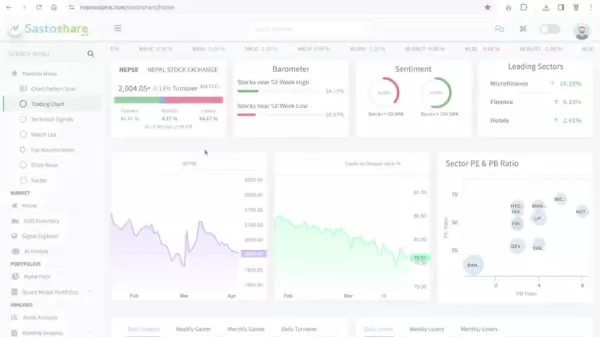

What is NepseAlpha?

NepseAlpha is an AI-powered trading platform designed specifically for the Nepalese stock market. It offers:

- AI-generated trading signals (buy/sell recommendations)

- Risk management tools (stop-loss, position sizing)

- Market sentiment analysis (sector performance, trends)

- Customizable strategies based on your trading style

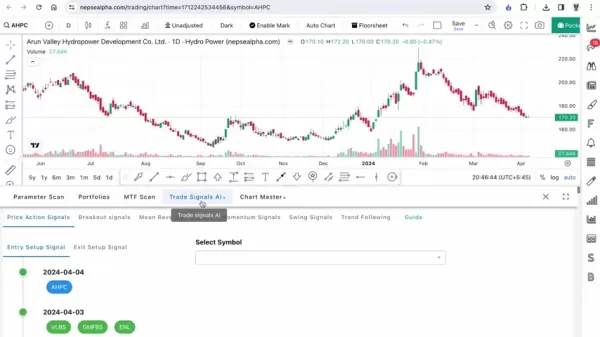

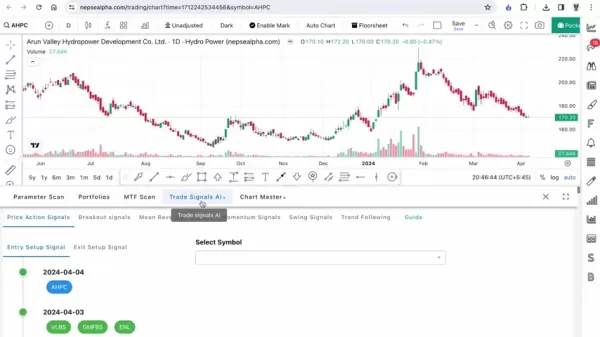

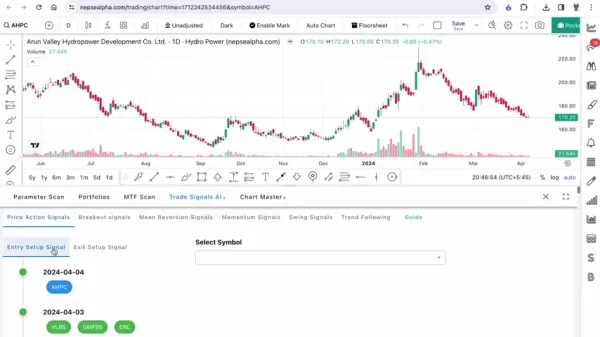

How NepseAlpha’s AI Signals Work

Types of Trading Signals

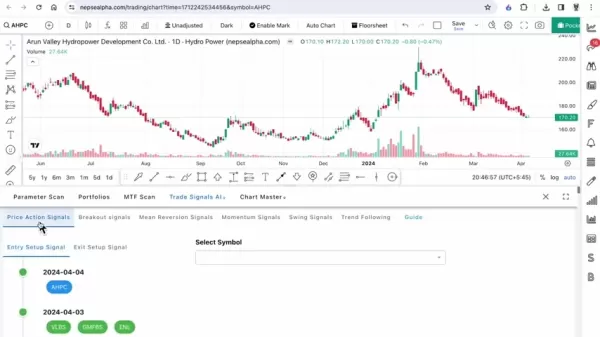

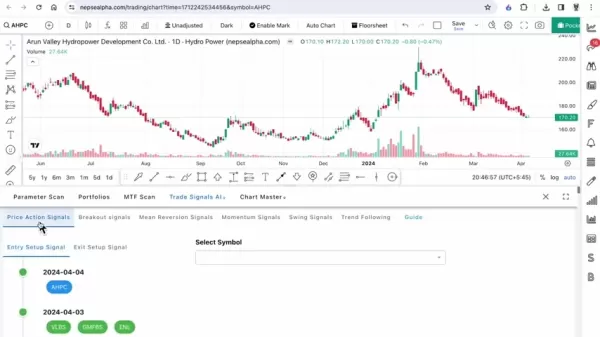

NepseAlpha generates signals using multiple trading strategies:

🔹 Price Action Signals – Based on historical price movements.

🔹 Breakout Signals – Identifies stocks breaking key resistance/support levels.

🔹 Mean Reversion Signals – Finds stocks likely to bounce back to their average price.

🔹 Momentum Signals – Detects strong upward/downward trends.

🔹 Swing Signals – Ideal for short-term traders capturing quick price swings.

🔹 Trend Following Signals – Best for long-term investors riding market trends.

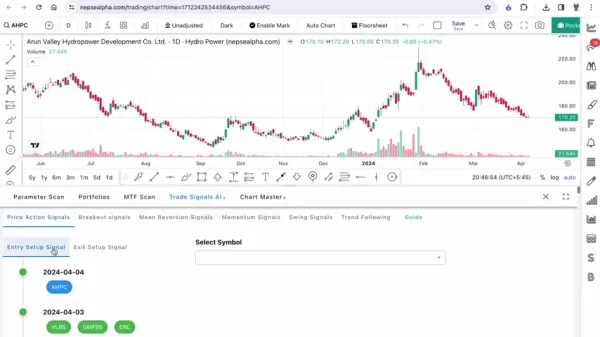

Understanding Entry & Exit Points

Every signal includes:

✔ Entry Price – When to buy.

✔ Exit Price – When to take profits.

✔ Stop-Loss Level – When to cut losses.

By following these setups, you can trade systematically instead of relying on emotions.

How to Use NepseAlpha Effectively

Step-by-Step Guide

1️⃣ Sign Up & Log In – Get a premium subscription for full access.

2️⃣ Set Your Preferences – Adjust risk tolerance and signal types.

3️⃣ Analyze Signals – Review AI-generated recommendations.

4️⃣ Verify with Technical Analysis – Cross-check with indicators like RSI, MACD.

5️⃣ Execute Trades – Follow entry/exit points with discipline.

6️⃣ Monitor Performance – Track results and refine strategies.

Customizing NepseAlpha for Your Style

- Day Traders → Focus on momentum & swing signals.

- Swing Traders → Use breakout & mean reversion signals.

- Long-Term Investors → Follow trend signals.

NepseAlpha Pricing & Subscription Plans

Premium Benefits

💰 Real-time AI signals

📊 Advanced risk management tools

📈 Detailed market analysis

⚙ Customizable trading strategies

🛠 Priority customer support

Subscription Tiers

Plan Features Best For Basic Limited signals, standard support Beginners Standard More signals, advanced tools Intermediate traders Premium Full access, real-time updates Professional traders

Pros & Cons of AI Trading with NepseAlpha

✅ Advantages

✔ Higher accuracy than manual trading.

✔ No emotional bias in decision-making.

✔ 24/7 market monitoring.

✔ Adapts to changing trends.

✔ Saves time on analysis.

❌ Limitations

✖ Dependent on data quality.

✖ May overfit past trends.

✖ Requires some technical knowledge.

✖ Premium plans can be costly.

FAQs About NepseAlpha

1. How accurate are NepseAlpha’s signals?

Accuracy varies based on market conditions, but historical data shows strong performance. Always verify with your own analysis.

2. Is NepseAlpha good for beginners?

Yes, but beginners should learn trading basics first before relying solely on AI signals.

3. Can I customize signals for my strategy?

Absolutely! Adjust risk levels, signal types, and alerts to fit your style.

Final Thoughts: Should You Use AI for NEPSE Trading?

AI-powered trading platforms like NepseAlpha offer a powerful edge—especially in a volatile market like NEPSE. By combining AI signals with your own analysis, you can trade smarter, reduce risks, and improve returns.

🚀 Ready to take your trading to the next level? Try NepseAlpha today and see the difference AI can make!

💬 Have questions? Join our Discord community for expert discussions and support!

Related article

AI-Powered Cover Letters: Expert Guide for Journal Submissions

In today's competitive academic publishing environment, crafting an effective cover letter can make the crucial difference in your manuscript's acceptance. Discover how AI-powered tools like ChatGPT can streamline this essential task, helping you cre

AI-Powered Cover Letters: Expert Guide for Journal Submissions

In today's competitive academic publishing environment, crafting an effective cover letter can make the crucial difference in your manuscript's acceptance. Discover how AI-powered tools like ChatGPT can streamline this essential task, helping you cre

US to Sanction Foreign Officials Over Social Media Regulations

US Takes Stand Against Global Digital Content Regulations

The State Department issued a sharp diplomatic rebuke this week targeting European digital governance policies, signaling escalating tensions over control of online platforms. Secretary Marco

US to Sanction Foreign Officials Over Social Media Regulations

US Takes Stand Against Global Digital Content Regulations

The State Department issued a sharp diplomatic rebuke this week targeting European digital governance policies, signaling escalating tensions over control of online platforms. Secretary Marco

Ultimate Guide to AI-Powered YouTube Video Summarizers

In our information-rich digital landscape, AI-powered YouTube video summarizers have become indispensable for efficient content consumption. This in-depth guide explores how to build a sophisticated summarization tool using cutting-edge NLP technolog

Comments (1)

0/200

Ultimate Guide to AI-Powered YouTube Video Summarizers

In our information-rich digital landscape, AI-powered YouTube video summarizers have become indispensable for efficient content consumption. This in-depth guide explores how to build a sophisticated summarization tool using cutting-edge NLP technolog

Comments (1)

0/200

![GregorySmith]() GregorySmith

GregorySmith

July 27, 2025 at 9:19:30 PM EDT

July 27, 2025 at 9:19:30 PM EDT

This AI trading stuff for NEPSE sounds wild! 🤯 I wonder how it actually predicts market moves—feels like having a crystal ball, but is it really that accurate?

0

0

AI-Powered Trading in NEPSE: A Complete Guide to NepseAlpha

The Nepalese stock market (NEPSE) is dynamic, fast-paced, and full of opportunities—but navigating it successfully requires more than just gut instinct. Artificial intelligence (AI) is transforming trading, offering data-driven insights that help investors make smarter, more strategic decisions.

If you're looking to enhance your trading strategies, minimize risks, and maximize returns, NepseAlpha—an AI-driven trading platform—could be your ultimate tool. Whether you're a beginner or a seasoned trader, this guide will show you how to leverage AI for better trading outcomes in NEPSE.

Why AI is a Game-Changer for NEPSE Trading

The Power of AI in Stock Markets

AI has revolutionized stock trading by:

✅ Processing vast amounts of data (market trends, news, economic indicators) in real-time.

✅ Identifying patterns that human traders might miss.

✅ Reducing emotional bias, leading to more disciplined trading.

✅ Adapting to market changes faster than traditional methods.

For NEPSE traders, AI tools like NepseAlpha provide automated buy/sell signals, risk management strategies, and deep market analysis—giving you an edge in a competitive market.

What is NepseAlpha?

NepseAlpha is an AI-powered trading platform designed specifically for the Nepalese stock market. It offers:

- AI-generated trading signals (buy/sell recommendations)

- Risk management tools (stop-loss, position sizing)

- Market sentiment analysis (sector performance, trends)

- Customizable strategies based on your trading style

How NepseAlpha’s AI Signals Work

Types of Trading Signals

NepseAlpha generates signals using multiple trading strategies:

🔹 Price Action Signals – Based on historical price movements.

🔹 Breakout Signals – Identifies stocks breaking key resistance/support levels.

🔹 Mean Reversion Signals – Finds stocks likely to bounce back to their average price.

🔹 Momentum Signals – Detects strong upward/downward trends.

🔹 Swing Signals – Ideal for short-term traders capturing quick price swings.

🔹 Trend Following Signals – Best for long-term investors riding market trends.

Understanding Entry & Exit Points

Every signal includes:

✔ Entry Price – When to buy.

✔ Exit Price – When to take profits.

✔ Stop-Loss Level – When to cut losses.

By following these setups, you can trade systematically instead of relying on emotions.

How to Use NepseAlpha Effectively

Step-by-Step Guide

1️⃣ Sign Up & Log In – Get a premium subscription for full access.

2️⃣ Set Your Preferences – Adjust risk tolerance and signal types.

3️⃣ Analyze Signals – Review AI-generated recommendations.

4️⃣ Verify with Technical Analysis – Cross-check with indicators like RSI, MACD.

5️⃣ Execute Trades – Follow entry/exit points with discipline.

6️⃣ Monitor Performance – Track results and refine strategies.

Customizing NepseAlpha for Your Style

- Day Traders → Focus on momentum & swing signals.

- Swing Traders → Use breakout & mean reversion signals.

- Long-Term Investors → Follow trend signals.

NepseAlpha Pricing & Subscription Plans

Premium Benefits

💰 Real-time AI signals

📊 Advanced risk management tools

📈 Detailed market analysis

⚙ Customizable trading strategies

🛠 Priority customer support

Subscription Tiers

| Plan | Features | Best For |

|---|---|---|

| Basic | Limited signals, standard support | Beginners |

| Standard | More signals, advanced tools | Intermediate traders |

| Premium | Full access, real-time updates | Professional traders |

Pros & Cons of AI Trading with NepseAlpha

✅ Advantages

✔ Higher accuracy than manual trading.

✔ No emotional bias in decision-making.

✔ 24/7 market monitoring.

✔ Adapts to changing trends.

✔ Saves time on analysis.

❌ Limitations

✖ Dependent on data quality.

✖ May overfit past trends.

✖ Requires some technical knowledge.

✖ Premium plans can be costly.

FAQs About NepseAlpha

1. How accurate are NepseAlpha’s signals?

Accuracy varies based on market conditions, but historical data shows strong performance. Always verify with your own analysis.

2. Is NepseAlpha good for beginners?

Yes, but beginners should learn trading basics first before relying solely on AI signals.

3. Can I customize signals for my strategy?

Absolutely! Adjust risk levels, signal types, and alerts to fit your style.

Final Thoughts: Should You Use AI for NEPSE Trading?

AI-powered trading platforms like NepseAlpha offer a powerful edge—especially in a volatile market like NEPSE. By combining AI signals with your own analysis, you can trade smarter, reduce risks, and improve returns.

🚀 Ready to take your trading to the next level? Try NepseAlpha today and see the difference AI can make!

💬 Have questions? Join our Discord community for expert discussions and support!

AI-Powered Cover Letters: Expert Guide for Journal Submissions

In today's competitive academic publishing environment, crafting an effective cover letter can make the crucial difference in your manuscript's acceptance. Discover how AI-powered tools like ChatGPT can streamline this essential task, helping you cre

AI-Powered Cover Letters: Expert Guide for Journal Submissions

In today's competitive academic publishing environment, crafting an effective cover letter can make the crucial difference in your manuscript's acceptance. Discover how AI-powered tools like ChatGPT can streamline this essential task, helping you cre

US to Sanction Foreign Officials Over Social Media Regulations

US Takes Stand Against Global Digital Content Regulations

The State Department issued a sharp diplomatic rebuke this week targeting European digital governance policies, signaling escalating tensions over control of online platforms. Secretary Marco

US to Sanction Foreign Officials Over Social Media Regulations

US Takes Stand Against Global Digital Content Regulations

The State Department issued a sharp diplomatic rebuke this week targeting European digital governance policies, signaling escalating tensions over control of online platforms. Secretary Marco

Ultimate Guide to AI-Powered YouTube Video Summarizers

In our information-rich digital landscape, AI-powered YouTube video summarizers have become indispensable for efficient content consumption. This in-depth guide explores how to build a sophisticated summarization tool using cutting-edge NLP technolog

Ultimate Guide to AI-Powered YouTube Video Summarizers

In our information-rich digital landscape, AI-powered YouTube video summarizers have become indispensable for efficient content consumption. This in-depth guide explores how to build a sophisticated summarization tool using cutting-edge NLP technolog

July 27, 2025 at 9:19:30 PM EDT

July 27, 2025 at 9:19:30 PM EDT

This AI trading stuff for NEPSE sounds wild! 🤯 I wonder how it actually predicts market moves—feels like having a crystal ball, but is it really that accurate?

0

0