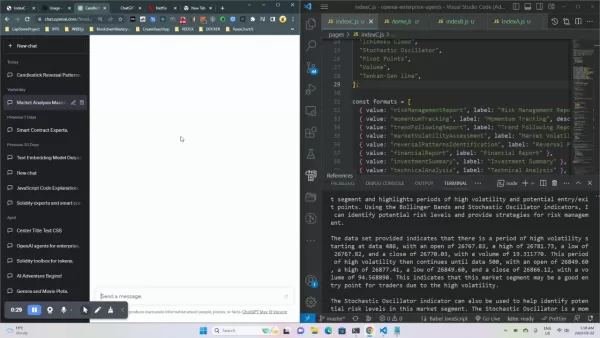

Master AI-Powered Market Analysis Agents for Smarter Trading Strategies

The Rise of AI in Financial Markets: How Smart Agents Are Changing Trading

The financial markets never sleep—prices fluctuate, trends emerge and vanish, and opportunities come and go in the blink of an eye. In this high-speed environment, traders and investors are always looking for an edge. Enter artificial intelligence (AI), the game-changing technology that’s revolutionizing market analysis. AI-powered agents can sift through mountains of data, spot hidden patterns, and generate actionable insights—all in real time.

But how exactly does AI fit into trading? Can it really outperform human intuition? And what should traders know before integrating AI into their strategies? Let’s break it down.

Why AI Is a Game-Changer for Traders

AI isn’t just another tool—it’s a paradigm shift in how we analyze markets. Unlike traditional methods, AI can:

- Process vast datasets in seconds – From price movements to news sentiment, AI digests information faster than any human.

- Detect subtle patterns – It spots trends and anomalies that might slip past even seasoned traders.

- Remove emotional bias – No fear, no greed—just cold, hard data-driven decisions.

- Generate tailored reports – Whether you're a day trader or a long-term investor, AI can adapt to your style.

But AI isn’t here to replace traders—it’s here to enhance them. Think of it as a supercharged assistant that does the heavy lifting, freeing you to focus on strategy.

How AI Market Analysis Agents Work

The Anatomy of an AI Trading Assistant

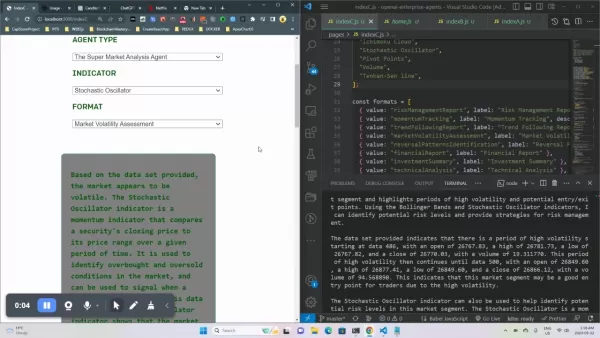

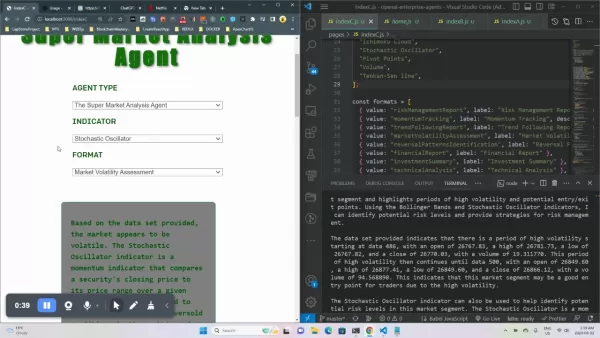

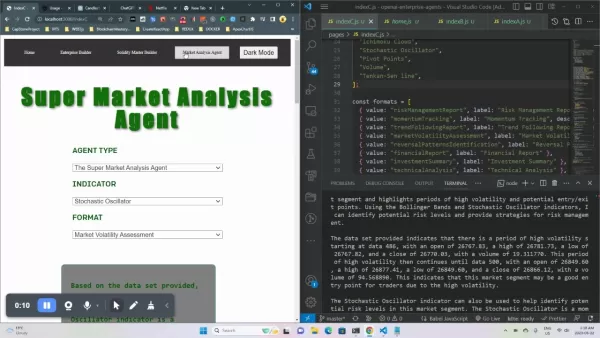

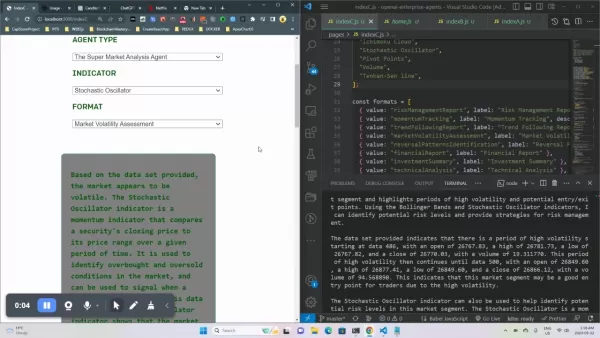

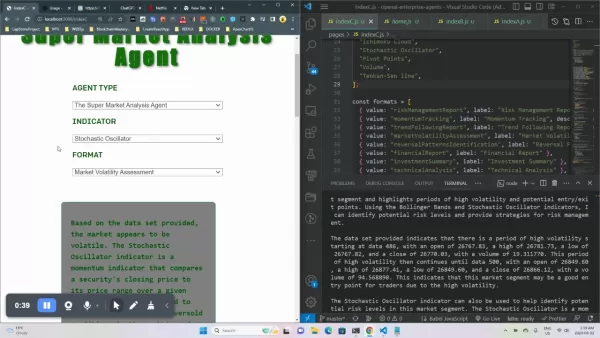

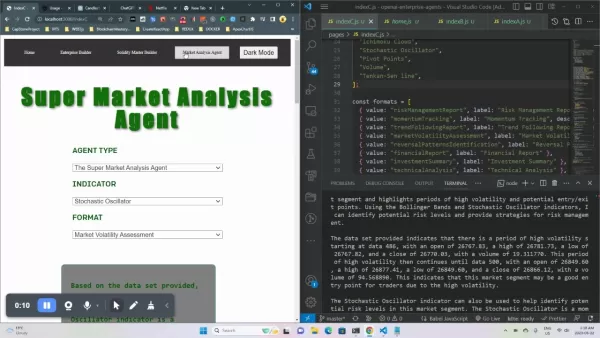

A Super Market Analysis Agent is an AI system designed to analyze financial data and generate insights. Here’s what powers it:

1. Data Input – The Fuel for AI

AI needs high-quality, real-time data to work effectively. This includes:

- Price and volume history

- Economic indicators

- News and social sentiment

2. Technical Indicators – The AI’s Toolkit

AI doesn’t just look at raw numbers—it applies advanced technical indicators like:

- Stochastic Oscillator – Measures momentum by comparing closing prices to recent highs and lows.

- Bollinger Bands – Tracks volatility and potential reversals.

- Moving Averages (SMA, EMA, MACD) – Smooths out noise to reveal trends.

- Relative Strength Index (RSI) – Identifies overbought or oversold conditions.

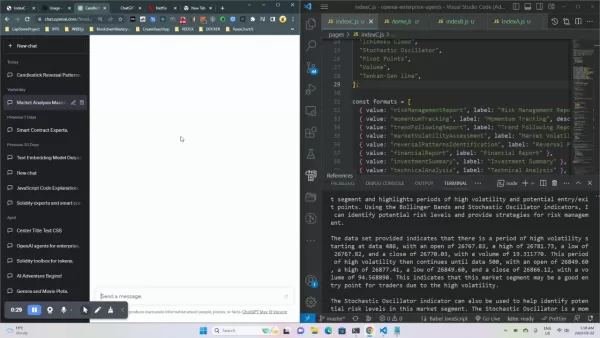

3. Natural Language Processing (NLP) – Making AI Speak Human

AI doesn’t just crunch numbers—it explains them. NLP allows traders to ask questions in plain English and get clear, actionable reports.

4. Prompt Engineering – The Secret Sauce

The quality of AI output depends on how you ask. A vague prompt like "Analyze the market" gets vague results. Instead, try:

"Generate a momentum report for Bitcoin using RSI, MACD, and volume data over the last 14 days."

5. Reporting & Strategy – Turning Data into Decisions

AI doesn’t just analyze—it recommends. Reports can include:

- Risk assessments

- Entry/exit points

- Volatility alerts

- Trend confirmations

Types of AI Market Reports

AI can generate different reports depending on your trading style:

✅ Risk Management Report – Identifies potential pitfalls before they happen.

✅ Momentum Tracking – Spots strong trends early.

✅ Reversal Patterns – Warns when a trend might flip.

✅ Volatility Assessment – Helps traders adjust strategies in choppy markets.

The Pros and Cons of AI Trading

👍 Advantages

✔ Speed & Efficiency – AI processes data in milliseconds.

✔ Pattern Recognition – Finds hidden correlations humans miss.

✔ Emotion-Free Trading – No panic selling or FOMO buying.

👎 Challenges

❌ Over-Reliance Risk – AI is a tool, not a crystal ball.

❌ Data Dependency – Garbage in, garbage out.

❌ Algorithmic Errors – Bugs or biases can lead to bad calls.

FAQ: Your AI Trading Questions Answered

❓ What indicators do AI agents use?

AI can use any technical indicator—SMA, EMA, MACD, Bollinger Bands—but the best results come from combining multiple signals.

❓ Can AI replace human traders?

No. AI excels at analysis, but humans still make the final call. The best traders use AI as a decision-support tool.

❓ How do I get started with AI trading?

- Choose a reliable AI platform (many brokers now offer AI tools).

- Learn prompt engineering—better questions = better answers.

- Start small—test AI insights before going all-in.

Final Thoughts

AI is transforming trading, but it’s not a magic bullet. The best traders will be those who combine AI’s analytical power with their own market intuition.

Want to stay ahead? Start experimenting with AI tools today—but always keep your critical thinking hat on.

🚀 Ready to supercharge your trading? Dive into AI and see how it can sharpen your edge!

Related article

Adobe's AI Strategy: Winners and Losers in the Tech Race

In the fast-changing world of artificial intelligence (AI), investors are closely watching which companies will thrive in this tech transformation. This article examines Adobe's AI approach, recent fi

Adobe's AI Strategy: Winners and Losers in the Tech Race

In the fast-changing world of artificial intelligence (AI), investors are closely watching which companies will thrive in this tech transformation. This article examines Adobe's AI approach, recent fi

BigBear.ai (BBAI) Stock Outlook: Can Its AI Growth Momentum Persist?

In the fast-paced world of artificial intelligence (AI) and cybersecurity, BigBear.ai (BBAI) is capturing investor interest. This article offers an in-depth analysis of BigBear.ai’s stock, exploring i

BigBear.ai (BBAI) Stock Outlook: Can Its AI Growth Momentum Persist?

In the fast-paced world of artificial intelligence (AI) and cybersecurity, BigBear.ai (BBAI) is capturing investor interest. This article offers an in-depth analysis of BigBear.ai’s stock, exploring i

Akamai Slashes Cloud Costs by 70% with AI-Driven Kubernetes Automation

In the era of generative AI, cloud expenses are soaring. Enterprises are projected to waste $44.5 billion on unnecessary cloud spending this year due to inefficient resource use.Akamai Technologies, w

Comments (8)

0/200

Akamai Slashes Cloud Costs by 70% with AI-Driven Kubernetes Automation

In the era of generative AI, cloud expenses are soaring. Enterprises are projected to waste $44.5 billion on unnecessary cloud spending this year due to inefficient resource use.Akamai Technologies, w

Comments (8)

0/200

![CharlesJohnson]() CharlesJohnson

CharlesJohnson

September 10, 2025 at 6:30:37 PM EDT

September 10, 2025 at 6:30:37 PM EDT

¡Qué interesante! Los agentes de IA para análisis de mercado podrían ser un game-changer en trading. Aunque me pregunto... ¿realmente pueden predecir crisis inesperadas como la de 2008? 🤔 La tecnología avanza, pero el mercado siempre encuentra formas de sorprendernos.

0

0

![KevinJohnson]() KevinJohnson

KevinJohnson

July 29, 2025 at 8:25:16 AM EDT

July 29, 2025 at 8:25:16 AM EDT

This AI trading stuff sounds like a game-changer! 🤯 Curious how these smart agents handle market crashes—do they panic like humans or stay cool?

0

0

![JustinKing]() JustinKing

JustinKing

July 27, 2025 at 9:19:30 PM EDT

July 27, 2025 at 9:19:30 PM EDT

This AI trading stuff is wild! 😮 It's like having a super-smart robot buddy who never sleeps, catching market trends I’d totally miss. But, gotta wonder, are we just handing over the keys to the market to these bots? Feels a bit risky!

0

0

![JoseDavis]() JoseDavis

JoseDavis

July 6, 2025 at 8:26:49 AM EDT

July 6, 2025 at 8:26:49 AM EDT

Incroyable, l’IA dans le trading ! 😲 Ça peut vraiment booster les stratégies, mais j’ai peur que ça rende tout trop automatisé.

0

0

The Rise of AI in Financial Markets: How Smart Agents Are Changing Trading

The financial markets never sleep—prices fluctuate, trends emerge and vanish, and opportunities come and go in the blink of an eye. In this high-speed environment, traders and investors are always looking for an edge. Enter artificial intelligence (AI), the game-changing technology that’s revolutionizing market analysis. AI-powered agents can sift through mountains of data, spot hidden patterns, and generate actionable insights—all in real time.

But how exactly does AI fit into trading? Can it really outperform human intuition? And what should traders know before integrating AI into their strategies? Let’s break it down.

Why AI Is a Game-Changer for Traders

AI isn’t just another tool—it’s a paradigm shift in how we analyze markets. Unlike traditional methods, AI can:

- Process vast datasets in seconds – From price movements to news sentiment, AI digests information faster than any human.

- Detect subtle patterns – It spots trends and anomalies that might slip past even seasoned traders.

- Remove emotional bias – No fear, no greed—just cold, hard data-driven decisions.

- Generate tailored reports – Whether you're a day trader or a long-term investor, AI can adapt to your style.

But AI isn’t here to replace traders—it’s here to enhance them. Think of it as a supercharged assistant that does the heavy lifting, freeing you to focus on strategy.

How AI Market Analysis Agents Work

The Anatomy of an AI Trading Assistant

A Super Market Analysis Agent is an AI system designed to analyze financial data and generate insights. Here’s what powers it:

1. Data Input – The Fuel for AI

AI needs high-quality, real-time data to work effectively. This includes:

- Price and volume history

- Economic indicators

- News and social sentiment

2. Technical Indicators – The AI’s Toolkit

AI doesn’t just look at raw numbers—it applies advanced technical indicators like:

- Stochastic Oscillator – Measures momentum by comparing closing prices to recent highs and lows.

- Bollinger Bands – Tracks volatility and potential reversals.

- Moving Averages (SMA, EMA, MACD) – Smooths out noise to reveal trends.

- Relative Strength Index (RSI) – Identifies overbought or oversold conditions.

3. Natural Language Processing (NLP) – Making AI Speak Human

AI doesn’t just crunch numbers—it explains them. NLP allows traders to ask questions in plain English and get clear, actionable reports.

4. Prompt Engineering – The Secret Sauce

The quality of AI output depends on how you ask. A vague prompt like "Analyze the market" gets vague results. Instead, try:

"Generate a momentum report for Bitcoin using RSI, MACD, and volume data over the last 14 days."

5. Reporting & Strategy – Turning Data into Decisions

AI doesn’t just analyze—it recommends. Reports can include:

- Risk assessments

- Entry/exit points

- Volatility alerts

- Trend confirmations

Types of AI Market Reports

AI can generate different reports depending on your trading style:

✅ Risk Management Report – Identifies potential pitfalls before they happen.

✅ Momentum Tracking – Spots strong trends early.

✅ Reversal Patterns – Warns when a trend might flip.

✅ Volatility Assessment – Helps traders adjust strategies in choppy markets.

The Pros and Cons of AI Trading

👍 Advantages

✔ Speed & Efficiency – AI processes data in milliseconds.

✔ Pattern Recognition – Finds hidden correlations humans miss.

✔ Emotion-Free Trading – No panic selling or FOMO buying.

👎 Challenges

❌ Over-Reliance Risk – AI is a tool, not a crystal ball.

❌ Data Dependency – Garbage in, garbage out.

❌ Algorithmic Errors – Bugs or biases can lead to bad calls.

FAQ: Your AI Trading Questions Answered

❓ What indicators do AI agents use?

AI can use any technical indicator—SMA, EMA, MACD, Bollinger Bands—but the best results come from combining multiple signals.

❓ Can AI replace human traders?

No. AI excels at analysis, but humans still make the final call. The best traders use AI as a decision-support tool.

❓ How do I get started with AI trading?

- Choose a reliable AI platform (many brokers now offer AI tools).

- Learn prompt engineering—better questions = better answers.

- Start small—test AI insights before going all-in.

Final Thoughts

AI is transforming trading, but it’s not a magic bullet. The best traders will be those who combine AI’s analytical power with their own market intuition.

Want to stay ahead? Start experimenting with AI tools today—but always keep your critical thinking hat on.

🚀 Ready to supercharge your trading? Dive into AI and see how it can sharpen your edge!

Adobe's AI Strategy: Winners and Losers in the Tech Race

In the fast-changing world of artificial intelligence (AI), investors are closely watching which companies will thrive in this tech transformation. This article examines Adobe's AI approach, recent fi

Adobe's AI Strategy: Winners and Losers in the Tech Race

In the fast-changing world of artificial intelligence (AI), investors are closely watching which companies will thrive in this tech transformation. This article examines Adobe's AI approach, recent fi

BigBear.ai (BBAI) Stock Outlook: Can Its AI Growth Momentum Persist?

In the fast-paced world of artificial intelligence (AI) and cybersecurity, BigBear.ai (BBAI) is capturing investor interest. This article offers an in-depth analysis of BigBear.ai’s stock, exploring i

BigBear.ai (BBAI) Stock Outlook: Can Its AI Growth Momentum Persist?

In the fast-paced world of artificial intelligence (AI) and cybersecurity, BigBear.ai (BBAI) is capturing investor interest. This article offers an in-depth analysis of BigBear.ai’s stock, exploring i

Akamai Slashes Cloud Costs by 70% with AI-Driven Kubernetes Automation

In the era of generative AI, cloud expenses are soaring. Enterprises are projected to waste $44.5 billion on unnecessary cloud spending this year due to inefficient resource use.Akamai Technologies, w

Akamai Slashes Cloud Costs by 70% with AI-Driven Kubernetes Automation

In the era of generative AI, cloud expenses are soaring. Enterprises are projected to waste $44.5 billion on unnecessary cloud spending this year due to inefficient resource use.Akamai Technologies, w

September 10, 2025 at 6:30:37 PM EDT

September 10, 2025 at 6:30:37 PM EDT

¡Qué interesante! Los agentes de IA para análisis de mercado podrían ser un game-changer en trading. Aunque me pregunto... ¿realmente pueden predecir crisis inesperadas como la de 2008? 🤔 La tecnología avanza, pero el mercado siempre encuentra formas de sorprendernos.

0

0

July 29, 2025 at 8:25:16 AM EDT

July 29, 2025 at 8:25:16 AM EDT

This AI trading stuff sounds like a game-changer! 🤯 Curious how these smart agents handle market crashes—do they panic like humans or stay cool?

0

0

July 27, 2025 at 9:19:30 PM EDT

July 27, 2025 at 9:19:30 PM EDT

This AI trading stuff is wild! 😮 It's like having a super-smart robot buddy who never sleeps, catching market trends I’d totally miss. But, gotta wonder, are we just handing over the keys to the market to these bots? Feels a bit risky!

0

0

July 6, 2025 at 8:26:49 AM EDT

July 6, 2025 at 8:26:49 AM EDT

Incroyable, l’IA dans le trading ! 😲 Ça peut vraiment booster les stratégies, mais j’ai peur que ça rende tout trop automatisé.

0

0