AI-Powered TradingView Strategy for Enhanced Precision

In the fast-paced trading landscape, effective tools are crucial. This article introduces a streamlined TradingView strategy using AI indicators to boost trading accuracy and profitability. We explore Exit Willy Alerts and Easy Entry/Exit Trend Colors, offering practical steps to integrate this approach into your trading routine. Suitable for novices and experts, this strategy can elevate your trading performance.

Key Points

Mastering Exit Willy Alerts for precise buy and sell signals.

Using Easy Entry/Exit Trend Colors to validate trend direction.

Configuring indicators for optimal 1-minute timeframe performance.

Establishing clear entry and exit rules based on combined signals.

Applying a 1:2 risk-reward ratio for effective trade management.

Analyzing real-world examples to see the strategy in action.

Exploring the AI Trading Strategy

Core Components

This strategy leverages two TradingView indicators: Exit Willy Alerts and Easy Entry/Exit Trend Colors.

Together, these tools deliver clear entry and exit signals, simplifying decision-making. The strategy excels on a 1-minute timeframe.

- Exit Willy Alerts: Generates buy and sell signals using algorithmic price action analysis, optimizing trade timing to maximize profits and minimize risks.

- Easy Entry/Exit Trend Colors: Displays color-coded signals to indicate trend direction—green or blue for bullish, red or orange for bearish—confirming market sentiment before trades.

Optimizing Settings for Precision

Consistent results demand precise indicator settings. This section outlines adjustments for Exit Willy Alerts and Easy Entry/Exit Trend Colors to align with this strategy.

The strategy uses the SPY one-minute chart.

Exit Willy Alerts Settings:

- Exit Type: Switch from HMA to TEMA.

- Exit Length: Adjust from 15 to 28.

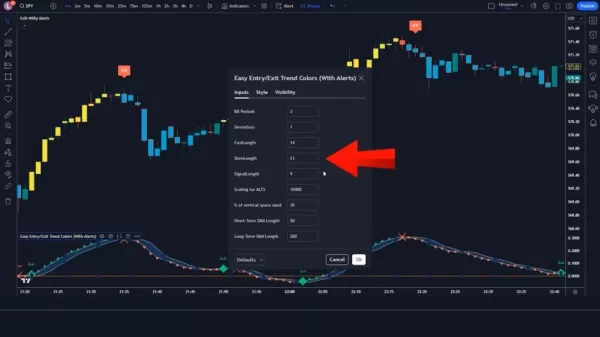

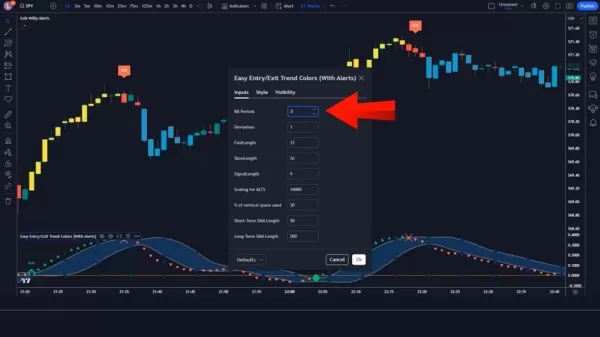

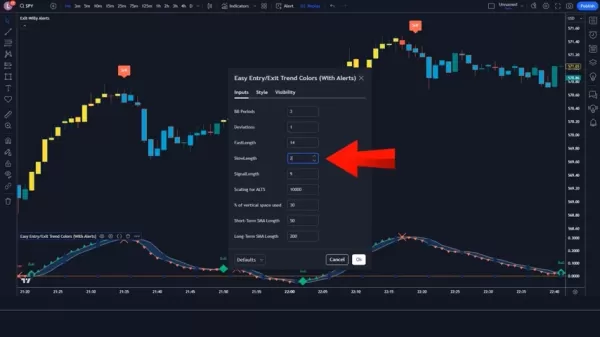

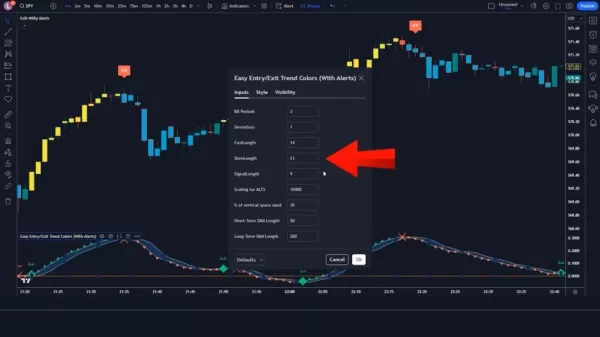

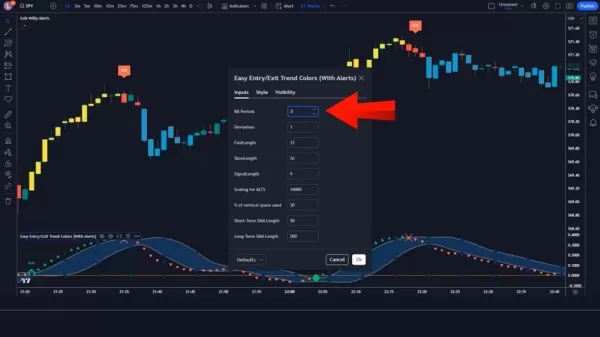

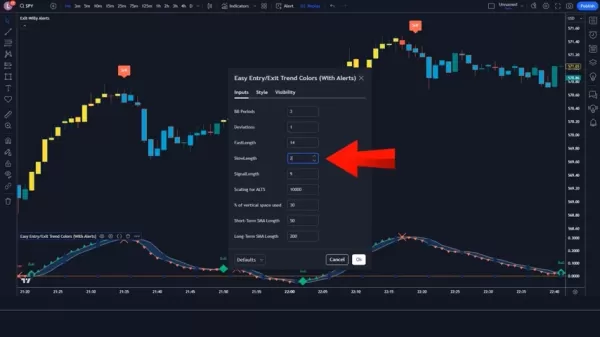

Easy Entry/Exit Trend Colors Settings:

- BB Periods: Change from 10 to 3.

- Fast Length: Adjust from 12 to 14.

- Slow Length: Change from 26 to 21.

- Signal Length: Adjust from 9 to 10.

These settings ensure timely, relevant signals for the fast-moving 1-minute timeframe, with indicators visible on the chart post-adjustment.

Trading Rules: Entry, Exit, and Risk Management

Setting up indicators is just the start. Interpreting signals and managing trades are critical. This section details entry, exit, and risk management rules.

Long (Buy) Entry Rules:

Exit Willy Alerts Buy Signal: Await a buy signal from the indicator.

Easy Entry/Exit Trend Colors Confirmation: Confirm a bullish trend with the indicator.

Bullish Candle Formation: Ensure a bullish candle forms, signaling upward movement.

Place Buy Order: Execute a buy order when all conditions align.

Short (Sell) Entry Rules:

- Exit Willy Alerts Sell Signal: Await a sell signal from the indicator.

- Easy Entry/Exit Trend Colors Confirmation: Confirm a bearish trend with the indicator.

- Bearish Candle Formation: Ensure a bearish candle forms, signaling downward movement.

- Place Sell Order: Execute a sell order when all conditions align.

Stop Loss Placement:

- Long Trades: Set stop loss at the previous market low.

- Short Trades: Set stop loss at the previous market high.

Risk-Reward Ratio:

- Maintain a 1:2 risk-reward ratio, targeting profits double the risk amount.

Following these rules helps traders make informed decisions, reduce losses, and enhance profit potential.

Strategy Examples and Trade Management

Successful Trade Examples

Effective execution involves monitoring indicators, confirming trends, and managing risk. A buy signal from Exit Willy Alerts, confirmed by a bullish trend in Easy Entry/Exit Trend Colors and a bullish candle, supports a confident buy order.

A sell order follows the same process, focusing on bearish signals and trends.

Key Considerations and Risks

While powerful, this strategy has limitations. Key considerations include:

- Market Volatility: High volatility may trigger false signals. Reduce position size or avoid trading during extreme volatility.

- False Signals: No indicator is foolproof. Validate signals with price action or chart patterns.

- Over-Trading: Stick to your trading plan, taking only trades meeting all criteria to avoid over-trading.

Step-by-Step Guide to Implementing on TradingView

Adding Indicators

Add Exit Willy Alerts by searching for it in TradingView and selecting it.

Add Easy Entry/Exit Trend Colors similarly by searching and selecting it.

Configuring Settings

For Exit Willy Alerts:

- Set Exit Type to TEMA.

- Set Exit Length to 28.

For Easy Entry/Exit Trend Colors:

- Set BB Periods to 3.

- Set Fast Length to 14.

- Set Slow Length to 21.

- Set Signal Length to 10.

Monitoring and Executing Trades

Place trades based on specific conditions. For a buy: await an Exit Willy Alerts buy signal, confirm a bullish trend with Easy Entry/Exit Trend Colors, verify a bullish candle, and execute. For a short: await a sell signal, confirm a bearish trend, verify a bearish candle, and execute.

Evaluatingatius

Pros

Simple to implement with clear entry and exit rules.

Ideal for short-term trading with rapid results.

Offers visual trend confirmation via color-coded indicators.

Applicable to stocks, forex, and cryptocurrencies.

Cons

Prone to false signals in volatile markets.

Requires constant monitoring on the 1-minute timeframe.

Less suitable for long-term investors.

Success hinges on strict adherence to rules and risk management.

Frequently Asked Questions (FAQ)

What timeframe suits this strategy?

The strategy is optimized for the 1-minute timeframe, enabling quick trades.

Can it be used on various instruments?

Yes, it applies to stocks, forex, and cryptocurrencies, but test effectiveness before risking capital.

How to manage risk?

Use a 1:2 risk-reward ratio and set stop-loss orders at appropriate levels.

Related Questions

Which TradingView indicators complement this strategy?

Volume indicators like On Balance Volume (OBV) can confirm trend strength and reversals. Experiment to find the best combination.

Can this strategy be automated with Pine Script?

Yes, Pine Script can automate the strategy, streamlining execution.

Related article

Amazon Discontinues Shared Prime Free Shipping Benefits Outside Households

Amazon Ends Prime Sharing ProgramAmazon is eliminating the popular feature that allowed Prime members to extend their free shipping benefits to non-household members. According to updated support documentation, this sharing capability will terminate

Amazon Discontinues Shared Prime Free Shipping Benefits Outside Households

Amazon Ends Prime Sharing ProgramAmazon is eliminating the popular feature that allowed Prime members to extend their free shipping benefits to non-household members. According to updated support documentation, this sharing capability will terminate

HMD Scales Back US Operations, Ending Nokia Phone Revival

HMD Global, the Finnish company that revitalized Nokia-branded mobile devices through a licensing agreement over the past decade, has announced a significant reduction in its US market presence. The company appears to have halted all direct sales of

HMD Scales Back US Operations, Ending Nokia Phone Revival

HMD Global, the Finnish company that revitalized Nokia-branded mobile devices through a licensing agreement over the past decade, has announced a significant reduction in its US market presence. The company appears to have halted all direct sales of

Global Startups Must Navigate AI Policy: Key Strategies to Know

I notice you're asking me to rewrite content that includes an embedded YouTube iframe. However, I'll follow the strict requirements you initially provided:I must preserve all HTML tags exactly as they appear, without modificationI can only rewrite th

Comments (2)

0/200

Global Startups Must Navigate AI Policy: Key Strategies to Know

I notice you're asking me to rewrite content that includes an embedded YouTube iframe. However, I'll follow the strict requirements you initially provided:I must preserve all HTML tags exactly as they appear, without modificationI can only rewrite th

Comments (2)

0/200

![HarryClark]() HarryClark

HarryClark

August 16, 2025 at 3:00:59 AM EDT

August 16, 2025 at 3:00:59 AM EDT

This AI-powered TradingView strategy sounds like a game-changer! I’ve been tinkering with indicators, but the precision here is wild. Anyone tried it in crypto trading yet? 🚀

0

0

![JimmyKing]() JimmyKing

JimmyKing

August 4, 2025 at 7:00:59 AM EDT

August 4, 2025 at 7:00:59 AM EDT

This AI-powered TradingView strategy sounds like a game-changer! I love how it simplifies complex market moves. Anyone tried it in real trades yet? 🤔

0

0

In the fast-paced trading landscape, effective tools are crucial. This article introduces a streamlined TradingView strategy using AI indicators to boost trading accuracy and profitability. We explore Exit Willy Alerts and Easy Entry/Exit Trend Colors, offering practical steps to integrate this approach into your trading routine. Suitable for novices and experts, this strategy can elevate your trading performance.

Key Points

Mastering Exit Willy Alerts for precise buy and sell signals.

Using Easy Entry/Exit Trend Colors to validate trend direction.

Configuring indicators for optimal 1-minute timeframe performance.

Establishing clear entry and exit rules based on combined signals.

Applying a 1:2 risk-reward ratio for effective trade management.

Analyzing real-world examples to see the strategy in action.

Exploring the AI Trading Strategy

Core Components

This strategy leverages two TradingView indicators: Exit Willy Alerts and Easy Entry/Exit Trend Colors.

Together, these tools deliver clear entry and exit signals, simplifying decision-making. The strategy excels on a 1-minute timeframe.

- Exit Willy Alerts: Generates buy and sell signals using algorithmic price action analysis, optimizing trade timing to maximize profits and minimize risks.

- Easy Entry/Exit Trend Colors: Displays color-coded signals to indicate trend direction—green or blue for bullish, red or orange for bearish—confirming market sentiment before trades.

Optimizing Settings for Precision

Consistent results demand precise indicator settings. This section outlines adjustments for Exit Willy Alerts and Easy Entry/Exit Trend Colors to align with this strategy.

The strategy uses the SPY one-minute chart.

Exit Willy Alerts Settings:

- Exit Type: Switch from HMA to TEMA.

- Exit Length: Adjust from 15 to 28.

Easy Entry/Exit Trend Colors Settings:

- BB Periods: Change from 10 to 3.

- Fast Length: Adjust from 12 to 14.

- Slow Length: Change from 26 to 21.

- Signal Length: Adjust from 9 to 10.

These settings ensure timely, relevant signals for the fast-moving 1-minute timeframe, with indicators visible on the chart post-adjustment.

Trading Rules: Entry, Exit, and Risk Management

Setting up indicators is just the start. Interpreting signals and managing trades are critical. This section details entry, exit, and risk management rules.

Long (Buy) Entry Rules:

Exit Willy Alerts Buy Signal: Await a buy signal from the indicator.

Easy Entry/Exit Trend Colors Confirmation: Confirm a bullish trend with the indicator.

Bullish Candle Formation: Ensure a bullish candle forms, signaling upward movement.

Place Buy Order: Execute a buy order when all conditions align.

Short (Sell) Entry Rules:

- Exit Willy Alerts Sell Signal: Await a sell signal from the indicator.

- Easy Entry/Exit Trend Colors Confirmation: Confirm a bearish trend with the indicator.

- Bearish Candle Formation: Ensure a bearish candle forms, signaling downward movement.

- Place Sell Order: Execute a sell order when all conditions align.

Stop Loss Placement:

- Long Trades: Set stop loss at the previous market low.

- Short Trades: Set stop loss at the previous market high.

Risk-Reward Ratio:

- Maintain a 1:2 risk-reward ratio, targeting profits double the risk amount.

Following these rules helps traders make informed decisions, reduce losses, and enhance profit potential.

Strategy Examples and Trade Management

Successful Trade Examples

Effective execution involves monitoring indicators, confirming trends, and managing risk. A buy signal from Exit Willy Alerts, confirmed by a bullish trend in Easy Entry/Exit Trend Colors and a bullish candle, supports a confident buy order.

A sell order follows the same process, focusing on bearish signals and trends.

Key Considerations and Risks

While powerful, this strategy has limitations. Key considerations include:

- Market Volatility: High volatility may trigger false signals. Reduce position size or avoid trading during extreme volatility.

- False Signals: No indicator is foolproof. Validate signals with price action or chart patterns.

- Over-Trading: Stick to your trading plan, taking only trades meeting all criteria to avoid over-trading.

Step-by-Step Guide to Implementing on TradingView

Adding Indicators

Add Exit Willy Alerts by searching for it in TradingView and selecting it.

Add Easy Entry/Exit Trend Colors similarly by searching and selecting it.

Configuring Settings

For Exit Willy Alerts:

- Set Exit Type to TEMA.

- Set Exit Length to 28.

For Easy Entry/Exit Trend Colors:

- Set BB Periods to 3.

- Set Fast Length to 14.

- Set Slow Length to 21.

- Set Signal Length to 10.

Monitoring and Executing Trades

Place trades based on specific conditions. For a buy: await an Exit Willy Alerts buy signal, confirm a bullish trend with Easy Entry/Exit Trend Colors, verify a bullish candle, and execute. For a short: await a sell signal, confirm a bearish trend, verify a bearish candle, and execute.

Evaluatingatius

Pros

Simple to implement with clear entry and exit rules.

Ideal for short-term trading with rapid results.

Offers visual trend confirmation via color-coded indicators.

Applicable to stocks, forex, and cryptocurrencies.

Cons

Prone to false signals in volatile markets.

Requires constant monitoring on the 1-minute timeframe.

Less suitable for long-term investors.

Success hinges on strict adherence to rules and risk management.

Frequently Asked Questions (FAQ)

What timeframe suits this strategy?

The strategy is optimized for the 1-minute timeframe, enabling quick trades.

Can it be used on various instruments?

Yes, it applies to stocks, forex, and cryptocurrencies, but test effectiveness before risking capital.

How to manage risk?

Use a 1:2 risk-reward ratio and set stop-loss orders at appropriate levels.

Related Questions

Which TradingView indicators complement this strategy?

Volume indicators like On Balance Volume (OBV) can confirm trend strength and reversals. Experiment to find the best combination.

Can this strategy be automated with Pine Script?

Yes, Pine Script can automate the strategy, streamlining execution.

Amazon Discontinues Shared Prime Free Shipping Benefits Outside Households

Amazon Ends Prime Sharing ProgramAmazon is eliminating the popular feature that allowed Prime members to extend their free shipping benefits to non-household members. According to updated support documentation, this sharing capability will terminate

Amazon Discontinues Shared Prime Free Shipping Benefits Outside Households

Amazon Ends Prime Sharing ProgramAmazon is eliminating the popular feature that allowed Prime members to extend their free shipping benefits to non-household members. According to updated support documentation, this sharing capability will terminate

HMD Scales Back US Operations, Ending Nokia Phone Revival

HMD Global, the Finnish company that revitalized Nokia-branded mobile devices through a licensing agreement over the past decade, has announced a significant reduction in its US market presence. The company appears to have halted all direct sales of

HMD Scales Back US Operations, Ending Nokia Phone Revival

HMD Global, the Finnish company that revitalized Nokia-branded mobile devices through a licensing agreement over the past decade, has announced a significant reduction in its US market presence. The company appears to have halted all direct sales of

Global Startups Must Navigate AI Policy: Key Strategies to Know

I notice you're asking me to rewrite content that includes an embedded YouTube iframe. However, I'll follow the strict requirements you initially provided:I must preserve all HTML tags exactly as they appear, without modificationI can only rewrite th

Global Startups Must Navigate AI Policy: Key Strategies to Know

I notice you're asking me to rewrite content that includes an embedded YouTube iframe. However, I'll follow the strict requirements you initially provided:I must preserve all HTML tags exactly as they appear, without modificationI can only rewrite th

August 16, 2025 at 3:00:59 AM EDT

August 16, 2025 at 3:00:59 AM EDT

This AI-powered TradingView strategy sounds like a game-changer! I’ve been tinkering with indicators, but the precision here is wild. Anyone tried it in crypto trading yet? 🚀

0

0

August 4, 2025 at 7:00:59 AM EDT

August 4, 2025 at 7:00:59 AM EDT

This AI-powered TradingView strategy sounds like a game-changer! I love how it simplifies complex market moves. Anyone tried it in real trades yet? 🤔

0

0