AI Trading Bots: Boost Earnings with Strategic Automation

The financial trading landscape is transforming swiftly, with artificial intelligence (AI) at the forefront. AI trading bots empower users to automate strategies, analyze extensive market data, and execute trades with precision. Navigating this space demands informed choices. This article explores critical factors for selecting an AI trading bot, shares practical examples, and provides insights to optimize profits while reducing risks.

Key Highlights

AI trading bots enable automated trading with strong potential for success.

Selecting the right bot requires evaluating user feedback, developer credibility, trading history, and support quality.

Real-world cases and user experiences demonstrate the profitability of AI trading bots.

Understanding the bot’s algorithms and indicators is vital for effective trading decisions.

Effective risk management and ongoing learning are crucial for sustained success.

The Surge of AI in Trading

AI’s Financial Transformation

AI’s accessibility has revolutionized industries, with financial trading leading the charge. Powered by advanced algorithms, AI trading bots excel at processing vast datasets, spotting patterns, and executing trades with unmatched efficiency compared to human traders.

Generative AI has sparked excitement in tech and investment circles, with many curious about its capabilities. While claims of AI fully replacing humans may be overstated, its integration across industries is undeniable.

These bots avoid emotional biases that often skew human decisions, fostering more consistent and profitable outcomes. Staying ahead in a dynamic market requires embracing AI’s advancements.

Debunking AI Replacement Myths

AI’s impact on jobs sparks heated discussion. While some fear it could displace workers, others view AI as a tool to enhance human potential, allowing traders to focus on strategy and high-level decisions. AI unlocks opportunities previously out of reach, reshaping the trading landscape.

A McKinsey report suggests AI could automate up to 30% of financial sector tasks, underscoring its transformative potential for the workforce.

Choosing the Right AI Trading Bot

User Feedback & Testimonials

When evaluating an AI trading bot, begin with user reviews and testimonials. These offer critical insights into performance, reliability, and usability.

Seek detailed reviews covering both successes and challenges.

Prioritize feedback highlighting specific metrics like profit margins, win rates, and consistency. Avoid vague or generic reviews, which may lack credibility.

Authentic user reviews with photos or videos carry more weight, showcasing real-world performance. Key factors to consider include:

- Steady profitability

- Responsive support

- Intuitive interface

- Overall user satisfaction

Developer Credibility

The developer’s expertise and reliability are pivotal. Investigate their trading experience, industry reputation, and track record. A developer with deep market knowledge is more likely to deliver a robust bot.

Explore their website for bios, past projects, or industry accolades. Questions to ask include:

- Do they have trading expertise?

- What are their credentials?

- How experienced is their team?

Trading History & Performance Metrics

Transparency is essential when assessing a bot. Reputable developers provide access to trade history and performance metrics, including win rates, profit margins, drawdowns, and trade types. Scrutinize this data to evaluate consistency and risk management.

Beware of developers lacking transparent data, as this raises red flags. Watch for:

- Consistent gains

- Minimal drawdowns

- Verified data

Developer Support Quality

Reliable support is critical, especially for beginners. A responsive team can assist with setup, troubleshooting, and feature navigation. Assess support channels (email, chat, phone) and response times. Look for developers offering detailed documentation, tutorials, and FAQs.

Inquire about setup processes and common user challenges. Is there a community for guidance? Key considerations include:

- Support responsiveness

- Available channels

- Comprehensive tutorials

Setting Up Your AI Trading Bot

Initial Configuration

Start by accessing the bot via the provided link and follow the setup instructions.

- Click the provided link

- Connect to the bot via Telegram

- Receive trade notifications

- Pre-set transaction times in your broker to save time

Mastering the Interface

After setup, explore the bot’s interface. Most bots feature a user-friendly dashboard displaying key metrics, strategies, and performance data. Learn to adjust settings to align with your risk tolerance and goals.

Focus on:

Predicted trading pairs

Trade durations

The “Take Part” button

Activating Notifications

Enable Telegram and in-bot notifications to stay updated on trading opportunities. Most bots send alerts 10 minutes before a session begins, giving you time to prepare.

These updates cover trade signals, market conditions, and critical information. Customize notifications to your needs, but keep them active.

Cost of AI Trading Bots

Pricing

A standout feature of this bot is its free access, offering full functionality at no cost.

Pros & Cons of AI Trading Bots

Advantages

Streamlined automation reduces manual effort

Rapid analysis of vast market data

Emotion-free trading for rational decisions

High success rates and consistent profits

Enhanced risk management

Drawbacks

Potential losses without proper risk management

Reliance on developer quality and support

Need for ongoing monitoring and adjustments

Risk of scams or subpar bots

Learning curve for understanding algorithms

Core Features

Trading Indicators

Bollinger Bands and ADX provide clear market insights.

These tools reveal market volatility and trend strength.

Bollinger Bands highlight price deviations from the average, signaling potential reversals.

ADX measures trend strength, indicating market momentum.

Sample Trades

AUD/USD Trade

This trade involves the Australian and U.S. dollar pair.

The bot predicted a downward trend, supported by Bollinger Bands and ADX indicators.

EUR/JPY Trade

This trade tracks the Euro against the Japanese Yen, showing an upward trend as predicted by the bot, with a $92.16 deposit.

Another signal yielded $175.10.

FAQ

What ensures an AI trading bot’s reliability?

Reliability depends on authentic user reviews with visuals, a transparent developer with proven expertise, accessible trade history showing consistent performance, and responsive support. Evaluate these to ensure the bot’s quality.

How frequently does the bot send trading signals?

The bot delivers daily signals, 10 minutes before trades begin, identifying profitable entry points in seconds.

Related Questions

Are AI trading bots profitable, and what are realistic expectations?

AI trading bots offer strong profit potential, but expectations must be grounded. A 91.3% success rate indicates high accuracy, but not every trade guarantees profit.

Related article

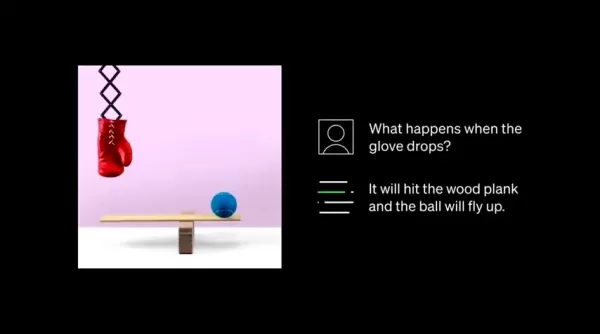

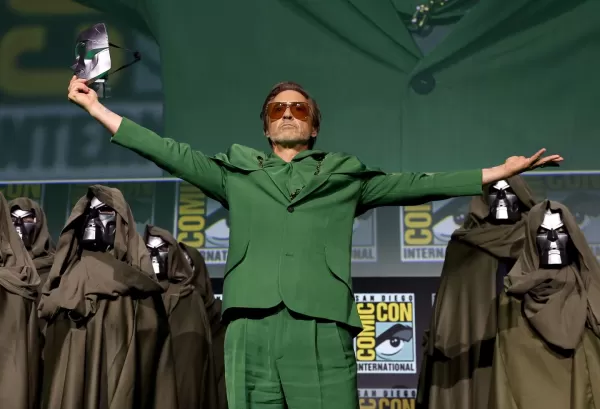

Marvel Delays Next Two Avengers Films, Adjusts Phase 6 Release Schedule

Marvel Studios has announced significant schedule changes for its upcoming Avengers franchise installments. Industry publication The Hollywood Reporter reveals that Avengers: Doomsday will now debut on December 18th, 2026 instead of its originally pl

Marvel Delays Next Two Avengers Films, Adjusts Phase 6 Release Schedule

Marvel Studios has announced significant schedule changes for its upcoming Avengers franchise installments. Industry publication The Hollywood Reporter reveals that Avengers: Doomsday will now debut on December 18th, 2026 instead of its originally pl

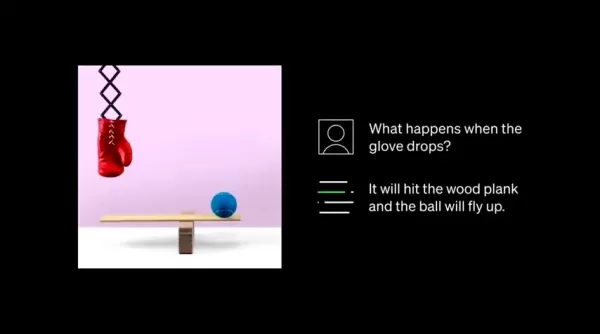

AI Evaluation Requires Real-World Performance Review Beyond Benchmarks

If you've been tracking AI advancements, you've undoubtedly encountered headlines announcing record-breaking benchmark performances. From computer vision tasks to medical diagnostics, these standardized tests have long served as the definitive measur

AI Evaluation Requires Real-World Performance Review Beyond Benchmarks

If you've been tracking AI advancements, you've undoubtedly encountered headlines announcing record-breaking benchmark performances. From computer vision tasks to medical diagnostics, these standardized tests have long served as the definitive measur

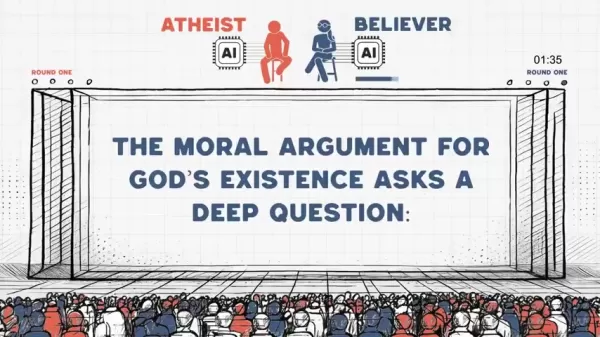

Atheist and Believer AI Clash Over Moral Argument in Heated Debate

When artificial intelligence systems with diametrically opposed philosophical frameworks engage in ethical debate, what insights emerge? This groundbreaking experiment staged an intellectual confrontation between an Atheist AI and Believer AI, focusi

Comments (1)

0/200

Atheist and Believer AI Clash Over Moral Argument in Heated Debate

When artificial intelligence systems with diametrically opposed philosophical frameworks engage in ethical debate, what insights emerge? This groundbreaking experiment staged an intellectual confrontation between an Atheist AI and Believer AI, focusi

Comments (1)

0/200

![HarryAllen]() HarryAllen

HarryAllen

August 21, 2025 at 3:01:25 PM EDT

August 21, 2025 at 3:01:25 PM EDT

This AI trading bot stuff sounds like a game-changer! 🚀 I'm curious how it handles wild market swings—any risk of it going rogue?

0

0

The financial trading landscape is transforming swiftly, with artificial intelligence (AI) at the forefront. AI trading bots empower users to automate strategies, analyze extensive market data, and execute trades with precision. Navigating this space demands informed choices. This article explores critical factors for selecting an AI trading bot, shares practical examples, and provides insights to optimize profits while reducing risks.

Key Highlights

AI trading bots enable automated trading with strong potential for success.

Selecting the right bot requires evaluating user feedback, developer credibility, trading history, and support quality.

Real-world cases and user experiences demonstrate the profitability of AI trading bots.

Understanding the bot’s algorithms and indicators is vital for effective trading decisions.

Effective risk management and ongoing learning are crucial for sustained success.

The Surge of AI in Trading

AI’s Financial Transformation

AI’s accessibility has revolutionized industries, with financial trading leading the charge. Powered by advanced algorithms, AI trading bots excel at processing vast datasets, spotting patterns, and executing trades with unmatched efficiency compared to human traders.

Generative AI has sparked excitement in tech and investment circles, with many curious about its capabilities. While claims of AI fully replacing humans may be overstated, its integration across industries is undeniable.

These bots avoid emotional biases that often skew human decisions, fostering more consistent and profitable outcomes. Staying ahead in a dynamic market requires embracing AI’s advancements.

Debunking AI Replacement Myths

AI’s impact on jobs sparks heated discussion. While some fear it could displace workers, others view AI as a tool to enhance human potential, allowing traders to focus on strategy and high-level decisions. AI unlocks opportunities previously out of reach, reshaping the trading landscape.

A McKinsey report suggests AI could automate up to 30% of financial sector tasks, underscoring its transformative potential for the workforce.

Choosing the Right AI Trading Bot

User Feedback & Testimonials

When evaluating an AI trading bot, begin with user reviews and testimonials. These offer critical insights into performance, reliability, and usability.

Seek detailed reviews covering both successes and challenges.

Prioritize feedback highlighting specific metrics like profit margins, win rates, and consistency. Avoid vague or generic reviews, which may lack credibility.

Authentic user reviews with photos or videos carry more weight, showcasing real-world performance. Key factors to consider include:

- Steady profitability

- Responsive support

- Intuitive interface

- Overall user satisfaction

Developer Credibility

The developer’s expertise and reliability are pivotal. Investigate their trading experience, industry reputation, and track record. A developer with deep market knowledge is more likely to deliver a robust bot.

Explore their website for bios, past projects, or industry accolades. Questions to ask include:

- Do they have trading expertise?

- What are their credentials?

- How experienced is their team?

Trading History & Performance Metrics

Transparency is essential when assessing a bot. Reputable developers provide access to trade history and performance metrics, including win rates, profit margins, drawdowns, and trade types. Scrutinize this data to evaluate consistency and risk management.

Beware of developers lacking transparent data, as this raises red flags. Watch for:

- Consistent gains

- Minimal drawdowns

- Verified data

Developer Support Quality

Reliable support is critical, especially for beginners. A responsive team can assist with setup, troubleshooting, and feature navigation. Assess support channels (email, chat, phone) and response times. Look for developers offering detailed documentation, tutorials, and FAQs.

Inquire about setup processes and common user challenges. Is there a community for guidance? Key considerations include:

- Support responsiveness

- Available channels

- Comprehensive tutorials

Setting Up Your AI Trading Bot

Initial Configuration

Start by accessing the bot via the provided link and follow the setup instructions.

- Click the provided link

- Connect to the bot via Telegram

- Receive trade notifications

- Pre-set transaction times in your broker to save time

Mastering the Interface

After setup, explore the bot’s interface. Most bots feature a user-friendly dashboard displaying key metrics, strategies, and performance data. Learn to adjust settings to align with your risk tolerance and goals.

Focus on:

Predicted trading pairs

Trade durations

The “Take Part” button

Activating Notifications

Enable Telegram and in-bot notifications to stay updated on trading opportunities. Most bots send alerts 10 minutes before a session begins, giving you time to prepare.

These updates cover trade signals, market conditions, and critical information. Customize notifications to your needs, but keep them active.

Cost of AI Trading Bots

Pricing

A standout feature of this bot is its free access, offering full functionality at no cost.

Pros & Cons of AI Trading Bots

Advantages

Streamlined automation reduces manual effort

Rapid analysis of vast market data

Emotion-free trading for rational decisions

High success rates and consistent profits

Enhanced risk management

Drawbacks

Potential losses without proper risk management

Reliance on developer quality and support

Need for ongoing monitoring and adjustments

Risk of scams or subpar bots

Learning curve for understanding algorithms

Core Features

Trading Indicators

Bollinger Bands and ADX provide clear market insights.

These tools reveal market volatility and trend strength.

Bollinger Bands highlight price deviations from the average, signaling potential reversals.

ADX measures trend strength, indicating market momentum.

Sample Trades

AUD/USD Trade

This trade involves the Australian and U.S. dollar pair.

The bot predicted a downward trend, supported by Bollinger Bands and ADX indicators.

EUR/JPY Trade

This trade tracks the Euro against the Japanese Yen, showing an upward trend as predicted by the bot, with a $92.16 deposit.

Another signal yielded $175.10.

FAQ

What ensures an AI trading bot’s reliability?

Reliability depends on authentic user reviews with visuals, a transparent developer with proven expertise, accessible trade history showing consistent performance, and responsive support. Evaluate these to ensure the bot’s quality.

How frequently does the bot send trading signals?

The bot delivers daily signals, 10 minutes before trades begin, identifying profitable entry points in seconds.

Related Questions

Are AI trading bots profitable, and what are realistic expectations?

AI trading bots offer strong profit potential, but expectations must be grounded. A 91.3% success rate indicates high accuracy, but not every trade guarantees profit.

Marvel Delays Next Two Avengers Films, Adjusts Phase 6 Release Schedule

Marvel Studios has announced significant schedule changes for its upcoming Avengers franchise installments. Industry publication The Hollywood Reporter reveals that Avengers: Doomsday will now debut on December 18th, 2026 instead of its originally pl

Marvel Delays Next Two Avengers Films, Adjusts Phase 6 Release Schedule

Marvel Studios has announced significant schedule changes for its upcoming Avengers franchise installments. Industry publication The Hollywood Reporter reveals that Avengers: Doomsday will now debut on December 18th, 2026 instead of its originally pl

Atheist and Believer AI Clash Over Moral Argument in Heated Debate

When artificial intelligence systems with diametrically opposed philosophical frameworks engage in ethical debate, what insights emerge? This groundbreaking experiment staged an intellectual confrontation between an Atheist AI and Believer AI, focusi

Atheist and Believer AI Clash Over Moral Argument in Heated Debate

When artificial intelligence systems with diametrically opposed philosophical frameworks engage in ethical debate, what insights emerge? This groundbreaking experiment staged an intellectual confrontation between an Atheist AI and Believer AI, focusi

August 21, 2025 at 3:01:25 PM EDT

August 21, 2025 at 3:01:25 PM EDT

This AI trading bot stuff sounds like a game-changer! 🚀 I'm curious how it handles wild market swings—any risk of it going rogue?

0

0