AI-Powered Trading: Maximize Profits with Automated Bots

In today's dynamic financial markets, traders are always searching for cutting-edge tools to stay ahead. AI-powered trading bots are revolutionizing the industry, using advanced algorithms and technical analysis to automate strategies. These bots process market data, spot opportunities, and execute trades, empowering both beginners and seasoned traders to boost efficiency and profitability. Discover how AI-driven trading can transform your market approach.

Key Highlights

AI trading bots leverage algorithms for smarter decision-making.

Automation enhances efficiency and minimizes emotional trading errors.

Telegram channels deliver instant trading signals from AI systems.

PocketOption offers a seamless platform for bot-driven trades.

Success depends on acting on bot signals and adapting to market shifts.

Exploring AI Trading Bots

What Are AI Trading Bots?

An AI trading bot is a software tool powered by artificial intelligence and machine learning to automate trading in financial markets.

These bots analyze market data, detect trading opportunities, and execute trades for users. Their primary aim is to streamline trading, reduce emotional decisions, and potentially increase returns.

AI trading bots continuously track market indicators like price trends and trading volume. Using complex algorithms, they identify patterns signaling potential trades and execute them based on predefined settings.

Core features of AI trading bots include:

- Data Processing: Bots collect and analyze extensive market data from multiple sources.

- Pattern Detection: AI identifies trends and patterns in market data.

- Trade Signals: Bots generate buy or sell signals based on data analysis.

- Automated Trading: Trades are executed automatically, eliminating manual input.

By automating these tasks, AI trading bots enable smarter decisions, reduce time spent monitoring markets, and can enhance trading outcomes. Choosing a reliable bot aligned with your goals and risk profile is critical.

AI’s Role in Technical Analysis

Technical analysis evaluates securities using market data like historical prices and volume. AI enhances this by processing vast datasets and uncovering complex patterns beyond human capability, leading to more precise predictions and better trading choices.

AI algorithms learn from past data and adapt to market changes, outperforming traditional methods. They incorporate diverse indicators for a holistic market view.

AI’s impact on technical analysis includes:

- Enhanced Pattern Detection: AI spots subtle trends and correlations humans might overlook.

- Predictive Insights: AI forecasts price movements using historical data with higher accuracy.

- Risk Control: AI evaluates market volatility to manage potential losses.

- Real-Time Strategy Adjustment: AI optimizes trading strategies based on live market conditions.

By integrating AI into technical analysis, traders gain a competitive edge, making informed decisions that can boost profitability.

Using Trading Platforms and Telegram for AI Trading

Integrating with Platforms: PocketOption

Effective AI trading requires integration with a robust trading platform.

PocketOption stands out as an accessible platform, simplifying bot-driven trading with its intuitive design, suitable for both new and experienced traders.

Benefits of using PocketOption with AI bots include:

- Seamless Integration: PocketOption supports easy setup for AI trading bots.

- Intuitive Design: The platform’s interface is user-friendly for all skill levels.

- Live Data Access: Real-time market data enables timely bot decisions.

- Automated Trading: The platform supports hands-free trade execution.

- Risk Management Features: Tools help traders safeguard their investments.

Pairing PocketOption with an AI bot streamlines trading and enhances the overall experience.

Real-Time Signals via Telegram

Telegram channels are a fast-growing medium for AI trading bots to share real-time signals. These channels deliver instant alerts on trading opportunities, enabling swift action to capitalize on market movements.

Advantages of Telegram for trading signals:

- Instant Alerts: Receive signals in real time for quick responses.

- Accessibility: Access signals anywhere with an internet connection.

- Community Engagement: Many channels foster trader discussions and support.

- Varied Signals: Access diverse signals from multiple AI bots and strategies.

However, verify the credibility of Telegram channels before relying on their signals. Choose channels with proven track records and positive trader feedback. Always note that trading carries risks, and past results don’t guarantee future success.

Join a Telegram channel linked in the video description for free AI trading sessions.

These sessions demonstrate the AI bot in action and guide you in applying its signals to your strategy.

Guide to AI-Driven Trading

Setting Up Your Platform and AI Bot

To start AI-powered trading, set up a trading platform and connect it to an AI bot. Steps include:

- Select a Platform: Choose a reliable platform like PocketOption that supports automated trading.

- Create an Account: Sign up on the chosen platform.

- Fund Your Account: Deposit funds to begin trading.

- Pick an AI Bot: Select a bot matching your goals and risk tolerance after researching options.

- Connect the Bot: Use API keys or credentials to link the bot to the platform.

- Configure Settings: Adjust the bot’s parameters, such as risk levels and trading strategies.

Once set up, your platform and bot are ready for automated trading.

Using Signals and Executing Trades

With your AI bot configured, follow its signals to trade effectively:

- Monitor Signals: Track buy or sell signals generated by the bot.

- Verify Signals (Optional): Cross-check signals with your analysis to reduce risks.

- Execute Trades: Act on signals manually or automatically, depending on your setup.

- Manage Trades: Use stop-loss and take-profit orders to control risks and secure gains.

- Review Performance: Regularly assess the bot’s results to refine strategies.

The video shows setting a one-minute timeframe and awaiting Telegram signals for PocketOption trades.

AI Trading Bots: Pros and Cons

Pros

Automation removes emotional bias from trading decisions.

AI processes massive datasets faster than humans.

Bots operate 24/7, seizing opportunities anytime.

Optimized strategies can boost profitability.

Telegram delivers instant trading signals.

Cons

Technical glitches can disrupt trading.

Rapid market changes may reduce bot effectiveness.

Over-optimized bots may underperform in real conditions.

Unreliable bots and scams pose risks.

Setup and ongoing adjustments are required.

Frequently Asked Questions

Can AI Trading Bots Guarantee Profits?

Profitability varies based on bot quality, market conditions, and risk management. While some bots show strong results, trading carries inherent risks, and past performance doesn’t ensure future gains. Research and careful selection are key.

Are AI Trading Bots Legal?

AI trading bots are legal in most regions if they comply with securities laws. Always check local regulations to ensure compliance.

Which Platform Is Best for AI Bots?

The ideal platform depends on your needs. PocketOption is praised for its ease of use and bot integration. Research platforms to find the best fit for your trading style.

Related Questions

What Are the Risks of AI Trading Bots?

Risks include technical issues disrupting trades, market volatility impacting performance, over-optimization, unreliable bots, and regulatory changes. Mitigate risks by choosing trusted bots, monitoring performance, and using robust risk management.

How Do I Choose a Reliable AI Trading Bot?

To find a trustworthy bot, read user reviews, check historical performance, verify the developer’s reputation, test the bot with a demo account, and seek recommendations from experienced traders.

Do AI Trading Bots Ensure Profits?

No bot can guarantee profits. Success depends on market conditions, algorithm quality, and risk management. Trading always involves risks, and past results don’t predict future outcomes.

Related article

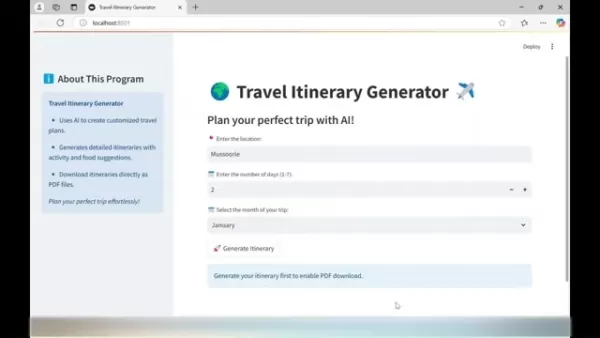

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

Comments (2)

0/200

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

Comments (2)

0/200

![RaymondBaker]() RaymondBaker

RaymondBaker

August 24, 2025 at 11:01:18 AM EDT

August 24, 2025 at 11:01:18 AM EDT

AI trading bots sound like a game-changer! But I wonder if they’re just fancy toys for the rich or actually level the playing field for small traders? 🤔

0

0

![WillieRoberts]() WillieRoberts

WillieRoberts

August 10, 2025 at 11:00:59 AM EDT

August 10, 2025 at 11:00:59 AM EDT

AI trading bots sound like a game-changer! But I wonder if they’re really smarter than a seasoned trader or just overhyped tech. Anyone tried one yet? 🤔

0

0

In today's dynamic financial markets, traders are always searching for cutting-edge tools to stay ahead. AI-powered trading bots are revolutionizing the industry, using advanced algorithms and technical analysis to automate strategies. These bots process market data, spot opportunities, and execute trades, empowering both beginners and seasoned traders to boost efficiency and profitability. Discover how AI-driven trading can transform your market approach.

Key Highlights

AI trading bots leverage algorithms for smarter decision-making.

Automation enhances efficiency and minimizes emotional trading errors.

Telegram channels deliver instant trading signals from AI systems.

PocketOption offers a seamless platform for bot-driven trades.

Success depends on acting on bot signals and adapting to market shifts.

Exploring AI Trading Bots

What Are AI Trading Bots?

An AI trading bot is a software tool powered by artificial intelligence and machine learning to automate trading in financial markets.

These bots analyze market data, detect trading opportunities, and execute trades for users. Their primary aim is to streamline trading, reduce emotional decisions, and potentially increase returns.

AI trading bots continuously track market indicators like price trends and trading volume. Using complex algorithms, they identify patterns signaling potential trades and execute them based on predefined settings.

Core features of AI trading bots include:

- Data Processing: Bots collect and analyze extensive market data from multiple sources.

- Pattern Detection: AI identifies trends and patterns in market data.

- Trade Signals: Bots generate buy or sell signals based on data analysis.

- Automated Trading: Trades are executed automatically, eliminating manual input.

By automating these tasks, AI trading bots enable smarter decisions, reduce time spent monitoring markets, and can enhance trading outcomes. Choosing a reliable bot aligned with your goals and risk profile is critical.

AI’s Role in Technical Analysis

Technical analysis evaluates securities using market data like historical prices and volume. AI enhances this by processing vast datasets and uncovering complex patterns beyond human capability, leading to more precise predictions and better trading choices.

AI algorithms learn from past data and adapt to market changes, outperforming traditional methods. They incorporate diverse indicators for a holistic market view.

AI’s impact on technical analysis includes:

- Enhanced Pattern Detection: AI spots subtle trends and correlations humans might overlook.

- Predictive Insights: AI forecasts price movements using historical data with higher accuracy.

- Risk Control: AI evaluates market volatility to manage potential losses.

- Real-Time Strategy Adjustment: AI optimizes trading strategies based on live market conditions.

By integrating AI into technical analysis, traders gain a competitive edge, making informed decisions that can boost profitability.

Using Trading Platforms and Telegram for AI Trading

Integrating with Platforms: PocketOption

Effective AI trading requires integration with a robust trading platform.

PocketOption stands out as an accessible platform, simplifying bot-driven trading with its intuitive design, suitable for both new and experienced traders.

Benefits of using PocketOption with AI bots include:

- Seamless Integration: PocketOption supports easy setup for AI trading bots.

- Intuitive Design: The platform’s interface is user-friendly for all skill levels.

- Live Data Access: Real-time market data enables timely bot decisions.

- Automated Trading: The platform supports hands-free trade execution.

- Risk Management Features: Tools help traders safeguard their investments.

Pairing PocketOption with an AI bot streamlines trading and enhances the overall experience.

Real-Time Signals via Telegram

Telegram channels are a fast-growing medium for AI trading bots to share real-time signals. These channels deliver instant alerts on trading opportunities, enabling swift action to capitalize on market movements.

Advantages of Telegram for trading signals:

- Instant Alerts: Receive signals in real time for quick responses.

- Accessibility: Access signals anywhere with an internet connection.

- Community Engagement: Many channels foster trader discussions and support.

- Varied Signals: Access diverse signals from multiple AI bots and strategies.

However, verify the credibility of Telegram channels before relying on their signals. Choose channels with proven track records and positive trader feedback. Always note that trading carries risks, and past results don’t guarantee future success.

Join a Telegram channel linked in the video description for free AI trading sessions.

These sessions demonstrate the AI bot in action and guide you in applying its signals to your strategy.

Guide to AI-Driven Trading

Setting Up Your Platform and AI Bot

To start AI-powered trading, set up a trading platform and connect it to an AI bot. Steps include:

- Select a Platform: Choose a reliable platform like PocketOption that supports automated trading.

- Create an Account: Sign up on the chosen platform.

- Fund Your Account: Deposit funds to begin trading.

- Pick an AI Bot: Select a bot matching your goals and risk tolerance after researching options.

- Connect the Bot: Use API keys or credentials to link the bot to the platform.

- Configure Settings: Adjust the bot’s parameters, such as risk levels and trading strategies.

Once set up, your platform and bot are ready for automated trading.

Using Signals and Executing Trades

With your AI bot configured, follow its signals to trade effectively:

- Monitor Signals: Track buy or sell signals generated by the bot.

- Verify Signals (Optional): Cross-check signals with your analysis to reduce risks.

- Execute Trades: Act on signals manually or automatically, depending on your setup.

- Manage Trades: Use stop-loss and take-profit orders to control risks and secure gains.

- Review Performance: Regularly assess the bot’s results to refine strategies.

The video shows setting a one-minute timeframe and awaiting Telegram signals for PocketOption trades.

AI Trading Bots: Pros and Cons

Pros

Automation removes emotional bias from trading decisions.

AI processes massive datasets faster than humans.

Bots operate 24/7, seizing opportunities anytime.

Optimized strategies can boost profitability.

Telegram delivers instant trading signals.

Cons

Technical glitches can disrupt trading.

Rapid market changes may reduce bot effectiveness.

Over-optimized bots may underperform in real conditions.

Unreliable bots and scams pose risks.

Setup and ongoing adjustments are required.

Frequently Asked Questions

Can AI Trading Bots Guarantee Profits?

Profitability varies based on bot quality, market conditions, and risk management. While some bots show strong results, trading carries inherent risks, and past performance doesn’t ensure future gains. Research and careful selection are key.

Are AI Trading Bots Legal?

AI trading bots are legal in most regions if they comply with securities laws. Always check local regulations to ensure compliance.

Which Platform Is Best for AI Bots?

The ideal platform depends on your needs. PocketOption is praised for its ease of use and bot integration. Research platforms to find the best fit for your trading style.

Related Questions

What Are the Risks of AI Trading Bots?

Risks include technical issues disrupting trades, market volatility impacting performance, over-optimization, unreliable bots, and regulatory changes. Mitigate risks by choosing trusted bots, monitoring performance, and using robust risk management.

How Do I Choose a Reliable AI Trading Bot?

To find a trustworthy bot, read user reviews, check historical performance, verify the developer’s reputation, test the bot with a demo account, and seek recommendations from experienced traders.

Do AI Trading Bots Ensure Profits?

No bot can guarantee profits. Success depends on market conditions, algorithm quality, and risk management. Trading always involves risks, and past results don’t predict future outcomes.

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

August 24, 2025 at 11:01:18 AM EDT

August 24, 2025 at 11:01:18 AM EDT

AI trading bots sound like a game-changer! But I wonder if they’re just fancy toys for the rich or actually level the playing field for small traders? 🤔

0

0

August 10, 2025 at 11:00:59 AM EDT

August 10, 2025 at 11:00:59 AM EDT

AI trading bots sound like a game-changer! But I wonder if they’re really smarter than a seasoned trader or just overhyped tech. Anyone tried one yet? 🤔

0

0