AI Trading Bots: Your Guide to Automated Financial Success

Curious about automating your trading strategies to enhance profits? AI trading bots are gaining traction in financial markets, leveraging algorithms and machine learning to analyze data and execute trades seamlessly. This beginner’s guide dives into automated trading, explaining how AI trading bots work, their benefits, and potential risks. Discover if AI-driven trading suits your financial goals.

Key Points

AI trading bots automate trading decisions using advanced algorithms.

They enhance efficiency and minimize emotional trading errors.

Understanding risks and limitations is essential before adoption.

Effective use requires ongoing monitoring and strategy tweaks.

Opt for a high-performing AI bot to maximize profitability.

Understanding AI Trading Bots

What is an AI Trading Bot?

An AI trading bot is a program that automates buying and selling financial assets like stocks, cryptocurrencies, or forex.

These bots utilize advanced algorithms and machine learning to scan market data, spot opportunities, and execute trades for users. They simplify technical analysis, helping traders profit from market movements.

Unlike manual trading, AI bots operate autonomously around the clock, following predefined strategies and risk settings without constant oversight.

Key features of AI trading bots include:

- Algorithmic Trading: Bots rely on algorithms to detect patterns, trends, or anomalies in market data, signaling potential trades.

- Automation: They handle the entire trading process, from analysis to execution, freeing users from constant market monitoring.

- Data Analysis: Bots process real-time data like price shifts, trading volumes, and technical indicators to make informed decisions.

- Customization: Many bots allow users to adjust strategies and risk parameters to align with personal goals and risk tolerance.

- Backtesting: Testing bots with historical data evaluates performance, revealing strengths and areas for improvement before live trading.

How AI Trading Bots Work: Decoding the Algorithm

AI trading bots follow a cyclical process, continuously analyzing data and refining strategies for efficient market navigation. Here’s how they operate:

- Data Collection: Bots access real-time market feeds, gathering data on prices, volumes, order books, and other indicators for analysis.

Market Analysis:

The bot employs algorithms and machine learning to analyze data, identify patterns, and forecast price movements. This involves:

- Technical Indicators: Using tools like Moving Averages, RSI, or MACD to evaluate market conditions and trade timing.

- Pattern Recognition: Spotting candlestick patterns or chart formations that signal future price trends.

- Sentiment Analysis: Assessing market mood through news, social media, and other textual data.

- Volume Analysis: Evaluating trade strength via volume to confirm price movements.

- Signal Generation: The bot produces buy or sell signals based on its AI-driven analysis.

- Risk Management: Pre-set rules determine trade size and stop-loss levels to manage risk.

- Trade Execution: When signals align with risk parameters, the bot executes trades via a linked brokerage account.

- Monitoring and Adaptation: Bots track trade performance, adapting strategies using machine learning and parameter optimization for evolving markets.

Benefits of Using AI Trading Bots

Increased Efficiency and Speed

AI trading bots execute trades at unmatched speeds, monitoring multiple markets simultaneously to seize opportunities human traders might miss.

This efficiency can boost profitability and lower transaction costs through rapid, data-driven decisions.

Reduced Emotional Bias

Emotions like fear or greed can skew trading decisions. AI bots rely on logic and data, eliminating emotional bias to enhance performance and reduce impulsive errors.

24/7 Trading

Operating continuously, AI bots capitalize on opportunities anytime, offering a key advantage in fast-moving global markets.

Improved Strategy Development

Bots enable efficient strategy testing through backtesting with historical data, helping users refine approaches and uncover new trading opportunities.

How to Use AI Trading Bots

Opening the Platform

Start by accessing your chosen trading platform, noted for its user-friendly interface.

Once open, you can activate the AI bot.

Open the AI Bot

Navigate to the AI bot within the platform, often via a Telegram channel, ensuring you understand its operation before launching.

Set Trade Duration

Configure the trade duration, such as one-minute trades, to align with the bot’s strategy for optimal performance.

Start Trading

With settings in place, begin trading. For example, the bot may analyze a currency pair like dirham-yuan, recommend a long position, and prompt you to select the ‘Higher’ option.

Utilizing The AI Bot for Free

Leveraging the AI Bot

You can use the AI bot at no cost, observing its performance in live trading sessions and integrating its recommendations to generate profits.

Pros and Cons of AI Trading Bots

Pros

Enhanced efficiency and speed

Elimination of emotional bias

Continuous 24/7 trading

Streamlined strategy testing and optimization

Cons

Risk of technical issues or errors

Need for ongoing monitoring and adjustments

Over-optimization may harm live trading performance

Limited adaptability to unexpected market events

Primary Analysis of AI Trading Bot

What can the AI bot analyze?

AI bots excel at analyzing market trends, helping traders identify chart directions and optimal entry points for maximum gains.

They assess market movements to provide trend-based recommendations.

The Many Use Cases of AI Trading Bots

How can the AI bot be used?

AI trading bots are versatile, ideal for beginners, enhancing trading accuracy, and streamlining processes across various financial markets.

Frequently Asked Questions

Are AI trading bots suitable for beginners?

Yes, AI bots simplify trading by automating processes, making them accessible for those with limited market knowledge.

Can AI trading bots guarantee profits?

No, no trading system, including AI bots, can ensure profits due to market unpredictability. Always assess risks carefully.

How can I choose the right AI trading bot?

Consider these factors: - Performance Track Record: Evaluate historical backtesting results for profitability and consistency. - Customization Options: Select a bot allowing strategy and risk adjustments. - Security Features: Prioritize bots with strong security to safeguard your account and data.

Related Questions

What is PocketOption Trading?

Pocket Option is an online broker offering trading in forex, stocks, indices, and commodities. Known for its intuitive platform, it appeals to both novice and seasoned traders with features like social trading for copying successful strategies.

Related article

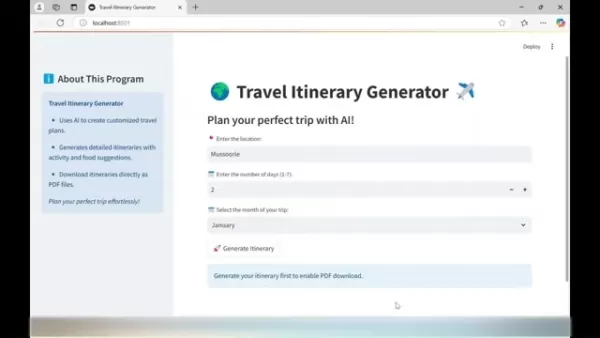

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

Comments (0)

0/200

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

Comments (0)

0/200

Curious about automating your trading strategies to enhance profits? AI trading bots are gaining traction in financial markets, leveraging algorithms and machine learning to analyze data and execute trades seamlessly. This beginner’s guide dives into automated trading, explaining how AI trading bots work, their benefits, and potential risks. Discover if AI-driven trading suits your financial goals.

Key Points

AI trading bots automate trading decisions using advanced algorithms.

They enhance efficiency and minimize emotional trading errors.

Understanding risks and limitations is essential before adoption.

Effective use requires ongoing monitoring and strategy tweaks.

Opt for a high-performing AI bot to maximize profitability.

Understanding AI Trading Bots

What is an AI Trading Bot?

An AI trading bot is a program that automates buying and selling financial assets like stocks, cryptocurrencies, or forex.

These bots utilize advanced algorithms and machine learning to scan market data, spot opportunities, and execute trades for users. They simplify technical analysis, helping traders profit from market movements.

Unlike manual trading, AI bots operate autonomously around the clock, following predefined strategies and risk settings without constant oversight.

Key features of AI trading bots include:

- Algorithmic Trading: Bots rely on algorithms to detect patterns, trends, or anomalies in market data, signaling potential trades.

- Automation: They handle the entire trading process, from analysis to execution, freeing users from constant market monitoring.

- Data Analysis: Bots process real-time data like price shifts, trading volumes, and technical indicators to make informed decisions.

- Customization: Many bots allow users to adjust strategies and risk parameters to align with personal goals and risk tolerance.

- Backtesting: Testing bots with historical data evaluates performance, revealing strengths and areas for improvement before live trading.

How AI Trading Bots Work: Decoding the Algorithm

AI trading bots follow a cyclical process, continuously analyzing data and refining strategies for efficient market navigation. Here’s how they operate:

- Data Collection: Bots access real-time market feeds, gathering data on prices, volumes, order books, and other indicators for analysis.

Market Analysis:

The bot employs algorithms and machine learning to analyze data, identify patterns, and forecast price movements. This involves:

- Technical Indicators: Using tools like Moving Averages, RSI, or MACD to evaluate market conditions and trade timing.

- Pattern Recognition: Spotting candlestick patterns or chart formations that signal future price trends.

- Sentiment Analysis: Assessing market mood through news, social media, and other textual data.

- Volume Analysis: Evaluating trade strength via volume to confirm price movements.

- Signal Generation: The bot produces buy or sell signals based on its AI-driven analysis.

- Risk Management: Pre-set rules determine trade size and stop-loss levels to manage risk.

- Trade Execution: When signals align with risk parameters, the bot executes trades via a linked brokerage account.

- Monitoring and Adaptation: Bots track trade performance, adapting strategies using machine learning and parameter optimization for evolving markets.

Benefits of Using AI Trading Bots

Increased Efficiency and Speed

AI trading bots execute trades at unmatched speeds, monitoring multiple markets simultaneously to seize opportunities human traders might miss.

This efficiency can boost profitability and lower transaction costs through rapid, data-driven decisions.

Reduced Emotional Bias

Emotions like fear or greed can skew trading decisions. AI bots rely on logic and data, eliminating emotional bias to enhance performance and reduce impulsive errors.

24/7 Trading

Operating continuously, AI bots capitalize on opportunities anytime, offering a key advantage in fast-moving global markets.

Improved Strategy Development

Bots enable efficient strategy testing through backtesting with historical data, helping users refine approaches and uncover new trading opportunities.

How to Use AI Trading Bots

Opening the Platform

Start by accessing your chosen trading platform, noted for its user-friendly interface.

Once open, you can activate the AI bot.

Open the AI Bot

Navigate to the AI bot within the platform, often via a Telegram channel, ensuring you understand its operation before launching.

Set Trade Duration

Configure the trade duration, such as one-minute trades, to align with the bot’s strategy for optimal performance.

Start Trading

With settings in place, begin trading. For example, the bot may analyze a currency pair like dirham-yuan, recommend a long position, and prompt you to select the ‘Higher’ option.

Utilizing The AI Bot for Free

Leveraging the AI Bot

You can use the AI bot at no cost, observing its performance in live trading sessions and integrating its recommendations to generate profits.

Pros and Cons of AI Trading Bots

Pros

Enhanced efficiency and speed

Elimination of emotional bias

Continuous 24/7 trading

Streamlined strategy testing and optimization

Cons

Risk of technical issues or errors

Need for ongoing monitoring and adjustments

Over-optimization may harm live trading performance

Limited adaptability to unexpected market events

Primary Analysis of AI Trading Bot

What can the AI bot analyze?

AI bots excel at analyzing market trends, helping traders identify chart directions and optimal entry points for maximum gains.

They assess market movements to provide trend-based recommendations.

The Many Use Cases of AI Trading Bots

How can the AI bot be used?

AI trading bots are versatile, ideal for beginners, enhancing trading accuracy, and streamlining processes across various financial markets.

Frequently Asked Questions

Are AI trading bots suitable for beginners?

Yes, AI bots simplify trading by automating processes, making them accessible for those with limited market knowledge.

Can AI trading bots guarantee profits?

No, no trading system, including AI bots, can ensure profits due to market unpredictability. Always assess risks carefully.

How can I choose the right AI trading bot?

Consider these factors: - Performance Track Record: Evaluate historical backtesting results for profitability and consistency. - Customization Options: Select a bot allowing strategy and risk adjustments. - Security Features: Prioritize bots with strong security to safeguard your account and data.

Related Questions

What is PocketOption Trading?

Pocket Option is an online broker offering trading in forex, stocks, indices, and commodities. Known for its intuitive platform, it appeals to both novice and seasoned traders with features like social trading for copying successful strategies.

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

AI-Powered Travel Itinerary Generator Helps You Plan the Perfect Trip

Planning unforgettable journeys just got simpler with cutting-edge AI technology. The Travel Itinerary Generator revolutionizes vacation planning by crafting customized travel guides packed with attractions, dining suggestions, and daily schedules -

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Apple Vision Pro Debuts as a Game-Changer in Augmented Reality

Apple makes a bold leap into spatial computing with its groundbreaking Vision Pro headset - redefining what's possible in augmented and virtual reality experiences through cutting-edge engineering and thoughtful design.Introduction to Vision ProRedef

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe

Perplexity AI Shopping Assistant Transforms Online Shopping Experience

Perplexity AI is making waves in e-commerce with its revolutionary AI shopping assistant, poised to transform how consumers discover and purchase products online. This innovative platform merges conversational AI with e-commerce functionality, challe