Agentic AI Revolutionizes Investing to Outperform Wall Street in 2025

For years, Wall Street firms have dominated the stock market, leveraging superior resources to shape profits. Now, cutting-edge technology, especially Artificial Intelligence, is balancing the scales. Agentic AI empowers individual investors to make sharper, data-driven choices, potentially surpassing Wall Street in 2025. This article dives into how Agentic AI is transforming investing, offering practical tips to boost returns.

Key Points

Agentic AI is reshaping stock market investing.

Individual investors can use AI for a competitive advantage.

Mastering AI-driven strategies is vital for 2025 success.

BestofUSInvestors.com provides tools and insights for AI-powered investing.

The Evolving Investment Landscape

Wall Street's Historical Edge

Wall Street has long ruled the stock market, armed with vast resources, advanced tools, and insider knowledge. These firms influenced trends and outcomes, often sidelining individual investors. Yet, technology is sparking a shift, opening doors for everyone to compete and succeed.

Why Wall Street dominated for so long:

- Advanced Tech: Proprietary algorithms and high-speed trading systems.

- Data Access: Real-time market insights and exclusive reports.

- Expert Teams: Skilled analysts and traders.

- Regulatory Power: Influence over financial regulations.

For years, individual investors struggled to keep up as Wall Street left them behind. Now, technology is closing the gap.

The rise of Agentic AI is making sophisticated tools accessible, enabling individual investors to challenge Wall Street and achieve financial success.

Agentic AI's Rise in Investing

Agentic AI marks a bold step forward in investment strategies. Unlike traditional AI, which focuses on data analysis, Agentic AI acts autonomously, making independent decisions.

It creates intelligent agents that trade and adapt to market shifts in real-time, revolutionizing investing.

Agentic AI transforms investing by:

- Analyzing vast datasets to uncover opportunities.

- Automating precise, rapid trading strategies.

- Adapting to market changes for optimal returns.

- Offering tailored investment advice based on risk profiles.

Combining machine learning, natural language processing, and advanced algorithms, Agentic AI outperforms traditional methods, spotting opportunities human analysts might overlook.

Core Technologies Behind Agentic AI for Investing

Navigating the AI Landscape

Several technologies power Agentic AI’s investment capabilities:

- Machine Learning (ML): Identifies patterns in market data to guide decisions.

- Natural Language Processing (NLP): Interprets financial news and social media for strategy context.

- Reinforcement Learning (RL): Optimizes strategies through market feedback.

- Predictive Analytics: Forecasts trends using historical data and models.

These technologies enable AI agents to handle complex tasks like portfolio optimization, risk management, and algorithmic trading, boosting investment outcomes.

Using Agentic AI for Investment Success

Steps to Adopt AI in Your Strategy

To leverage Agentic AI effectively, follow these steps:

- Learn the Basics: Study AI’s role in finance using resources like BestofUSInvestors.com.

- Set Goals: Define your objectives, risk tolerance, and timeline.

- Choose Tools: Select AI platforms aligned with your goals, considering data quality and interface.

- Test Small: Start with a small portfolio portion to test AI strategies.

- Monitor and Adjust: Regularly review performance and tweak strategies.

- Stay Current: Keep up with evolving tech to maintain your edge.

These steps help investors use Agentic AI to improve strategies and outcomes.

Costs and Access to AI Tools

Investment in AI-Driven Tools

Costs for Agentic AI vary by platform and services:

- Basic Accounts: Free, with limited features.

- Subscription Plans: $50-$500 monthly for advanced tools and support.

- Custom Solutions: Thousands monthly for tailored strategies.

Resources like BestofUSInvestors.com offer insights and support for AI-driven investing.

Pros and Cons of Agentic AI Investing

Advantages

Better Decisions: AI uncovers opportunities humans might miss.

Efficiency: Automates trading and portfolio management.

Reduced Bias: Makes rational choices, free from emotions.

Risk Management: Identifies and mitigates risks effectively.

Personalization: Tailors strategies to individual needs.

Disadvantages

Opaque Algorithms: Complex systems can be hard to trust.

Potential Bias: Algorithms may reflect biased training data.

Data Dependence: May struggle with unexpected market shifts.

Cybersecurity Risks: Vulnerable to attacks on investment data.

Ethical Issues: Raises concerns about fairness and job displacement.

Key Features of Agentic AI Platforms

What to Seek in AI Tools

When choosing AI investment platforms, prioritize:

- Data Analysis: Identifies trends in large datasets.

- Algorithmic Trading: Executes precise, fast trades.

- Risk Management: Protects portfolios from losses.

- Personalized Advice: Tailors recommendations to your goals.

- Real-Time Monitoring: Tracks markets and performance.

- Analytics: Offers detailed performance reports.

These features help investors optimize portfolios and achieve better results.

Real-World Agentic AI Success

AI-Driven Investment Examples

Agentic AI is already delivering results:

- Algorithmic Trading: Executes high-frequency trades for short-term gains.

- Portfolio Optimization: Balances assets for maximum returns, minimal risk.

- Sentiment Analysis: Predicts market moves using news and social media.

- Fraud Detection: Protects investors from fraudulent activities.

These examples show Agentic AI’s power to transform investing.

Frequently Asked Questions

What is Agentic AI?

Agentic AI refers to autonomous systems that analyze data, make decisions, and execute trades to optimize investments.

Is Agentic AI safe for investing?

Agentic AI offers benefits but carries risks. Understand the system, monitor performance, diversify investments, and choose secure platforms.

How do I start with Agentic AI investing?

Learn about AI in finance, research platforms, start small, and consult experts as needed.

Related Questions

What are the ethical considerations of AI in investing?

AI raises concerns about algorithmic bias, transparency, and job displacement. Investors must ensure fairness, comply with regulations, and protect data security to maintain ethical standards.

Related article

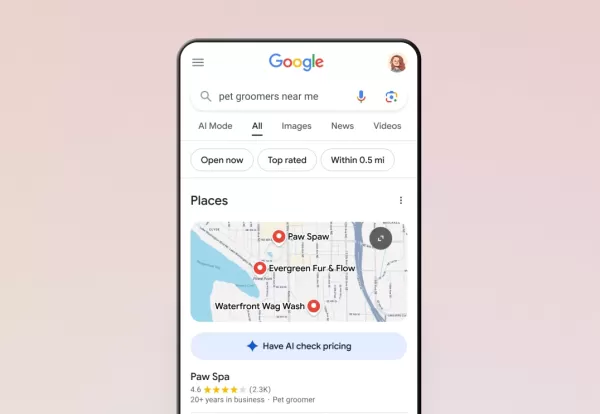

Google's AI Now Handles Phone Calls for You

Google has expanded its AI calling feature to all US users through Search, enabling customers to inquire about pricing and availability with local businesses without phone conversations. Initially tested in January, this capability currently supports

Google's AI Now Handles Phone Calls for You

Google has expanded its AI calling feature to all US users through Search, enabling customers to inquire about pricing and availability with local businesses without phone conversations. Initially tested in January, this capability currently supports

Trump Exempts Smartphones, Computers, and Chips from Tariff Hikes

The Trump administration has granted exclusions for smartphones, computers, and various electronic devices from recent tariff increases, even when imported from China, according to Bloomberg reporting. However, these products remain subject to earlie

Trump Exempts Smartphones, Computers, and Chips from Tariff Hikes

The Trump administration has granted exclusions for smartphones, computers, and various electronic devices from recent tariff increases, even when imported from China, according to Bloomberg reporting. However, these products remain subject to earlie

AI Reimagines Michael Jackson in the Metaverse with Stunning Digital Transformations

Artificial intelligence is fundamentally reshaping our understanding of creativity, entertainment, and cultural legacy. This exploration into AI-generated interpretations of Michael Jackson reveals how cutting-edge technology can breathe new life int

Comments (0)

0/200

AI Reimagines Michael Jackson in the Metaverse with Stunning Digital Transformations

Artificial intelligence is fundamentally reshaping our understanding of creativity, entertainment, and cultural legacy. This exploration into AI-generated interpretations of Michael Jackson reveals how cutting-edge technology can breathe new life int

Comments (0)

0/200

For years, Wall Street firms have dominated the stock market, leveraging superior resources to shape profits. Now, cutting-edge technology, especially Artificial Intelligence, is balancing the scales. Agentic AI empowers individual investors to make sharper, data-driven choices, potentially surpassing Wall Street in 2025. This article dives into how Agentic AI is transforming investing, offering practical tips to boost returns.

Key Points

Agentic AI is reshaping stock market investing.

Individual investors can use AI for a competitive advantage.

Mastering AI-driven strategies is vital for 2025 success.

BestofUSInvestors.com provides tools and insights for AI-powered investing.

The Evolving Investment Landscape

Wall Street's Historical Edge

Wall Street has long ruled the stock market, armed with vast resources, advanced tools, and insider knowledge. These firms influenced trends and outcomes, often sidelining individual investors. Yet, technology is sparking a shift, opening doors for everyone to compete and succeed.

Why Wall Street dominated for so long:

- Advanced Tech: Proprietary algorithms and high-speed trading systems.

- Data Access: Real-time market insights and exclusive reports.

- Expert Teams: Skilled analysts and traders.

- Regulatory Power: Influence over financial regulations.

For years, individual investors struggled to keep up as Wall Street left them behind. Now, technology is closing the gap.

The rise of Agentic AI is making sophisticated tools accessible, enabling individual investors to challenge Wall Street and achieve financial success.

Agentic AI's Rise in Investing

Agentic AI marks a bold step forward in investment strategies. Unlike traditional AI, which focuses on data analysis, Agentic AI acts autonomously, making independent decisions.

It creates intelligent agents that trade and adapt to market shifts in real-time, revolutionizing investing.

Agentic AI transforms investing by:

- Analyzing vast datasets to uncover opportunities.

- Automating precise, rapid trading strategies.

- Adapting to market changes for optimal returns.

- Offering tailored investment advice based on risk profiles.

Combining machine learning, natural language processing, and advanced algorithms, Agentic AI outperforms traditional methods, spotting opportunities human analysts might overlook.

Core Technologies Behind Agentic AI for Investing

Navigating the AI Landscape

Several technologies power Agentic AI’s investment capabilities:

- Machine Learning (ML): Identifies patterns in market data to guide decisions.

- Natural Language Processing (NLP): Interprets financial news and social media for strategy context.

- Reinforcement Learning (RL): Optimizes strategies through market feedback.

- Predictive Analytics: Forecasts trends using historical data and models.

These technologies enable AI agents to handle complex tasks like portfolio optimization, risk management, and algorithmic trading, boosting investment outcomes.

Using Agentic AI for Investment Success

Steps to Adopt AI in Your Strategy

To leverage Agentic AI effectively, follow these steps:

- Learn the Basics: Study AI’s role in finance using resources like BestofUSInvestors.com.

- Set Goals: Define your objectives, risk tolerance, and timeline.

- Choose Tools: Select AI platforms aligned with your goals, considering data quality and interface.

- Test Small: Start with a small portfolio portion to test AI strategies.

- Monitor and Adjust: Regularly review performance and tweak strategies.

- Stay Current: Keep up with evolving tech to maintain your edge.

These steps help investors use Agentic AI to improve strategies and outcomes.

Costs and Access to AI Tools

Investment in AI-Driven Tools

Costs for Agentic AI vary by platform and services:

- Basic Accounts: Free, with limited features.

- Subscription Plans: $50-$500 monthly for advanced tools and support.

- Custom Solutions: Thousands monthly for tailored strategies.

Resources like BestofUSInvestors.com offer insights and support for AI-driven investing.

Pros and Cons of Agentic AI Investing

Advantages

Better Decisions: AI uncovers opportunities humans might miss.

Efficiency: Automates trading and portfolio management.

Reduced Bias: Makes rational choices, free from emotions.

Risk Management: Identifies and mitigates risks effectively.

Personalization: Tailors strategies to individual needs.

Disadvantages

Opaque Algorithms: Complex systems can be hard to trust.

Potential Bias: Algorithms may reflect biased training data.

Data Dependence: May struggle with unexpected market shifts.

Cybersecurity Risks: Vulnerable to attacks on investment data.

Ethical Issues: Raises concerns about fairness and job displacement.

Key Features of Agentic AI Platforms

What to Seek in AI Tools

When choosing AI investment platforms, prioritize:

- Data Analysis: Identifies trends in large datasets.

- Algorithmic Trading: Executes precise, fast trades.

- Risk Management: Protects portfolios from losses.

- Personalized Advice: Tailors recommendations to your goals.

- Real-Time Monitoring: Tracks markets and performance.

- Analytics: Offers detailed performance reports.

These features help investors optimize portfolios and achieve better results.

Real-World Agentic AI Success

AI-Driven Investment Examples

Agentic AI is already delivering results:

- Algorithmic Trading: Executes high-frequency trades for short-term gains.

- Portfolio Optimization: Balances assets for maximum returns, minimal risk.

- Sentiment Analysis: Predicts market moves using news and social media.

- Fraud Detection: Protects investors from fraudulent activities.

These examples show Agentic AI’s power to transform investing.

Frequently Asked Questions

What is Agentic AI?

Agentic AI refers to autonomous systems that analyze data, make decisions, and execute trades to optimize investments.

Is Agentic AI safe for investing?

Agentic AI offers benefits but carries risks. Understand the system, monitor performance, diversify investments, and choose secure platforms.

How do I start with Agentic AI investing?

Learn about AI in finance, research platforms, start small, and consult experts as needed.

Related Questions

What are the ethical considerations of AI in investing?

AI raises concerns about algorithmic bias, transparency, and job displacement. Investors must ensure fairness, comply with regulations, and protect data security to maintain ethical standards.

Google's AI Now Handles Phone Calls for You

Google has expanded its AI calling feature to all US users through Search, enabling customers to inquire about pricing and availability with local businesses without phone conversations. Initially tested in January, this capability currently supports

Google's AI Now Handles Phone Calls for You

Google has expanded its AI calling feature to all US users through Search, enabling customers to inquire about pricing and availability with local businesses without phone conversations. Initially tested in January, this capability currently supports

Trump Exempts Smartphones, Computers, and Chips from Tariff Hikes

The Trump administration has granted exclusions for smartphones, computers, and various electronic devices from recent tariff increases, even when imported from China, according to Bloomberg reporting. However, these products remain subject to earlie

Trump Exempts Smartphones, Computers, and Chips from Tariff Hikes

The Trump administration has granted exclusions for smartphones, computers, and various electronic devices from recent tariff increases, even when imported from China, according to Bloomberg reporting. However, these products remain subject to earlie

AI Reimagines Michael Jackson in the Metaverse with Stunning Digital Transformations

Artificial intelligence is fundamentally reshaping our understanding of creativity, entertainment, and cultural legacy. This exploration into AI-generated interpretations of Michael Jackson reveals how cutting-edge technology can breathe new life int

AI Reimagines Michael Jackson in the Metaverse with Stunning Digital Transformations

Artificial intelligence is fundamentally reshaping our understanding of creativity, entertainment, and cultural legacy. This exploration into AI-generated interpretations of Michael Jackson reveals how cutting-edge technology can breathe new life int