TaxGenius

TaxGenius AI: Simplify Tax Season

TaxGenius Product Information

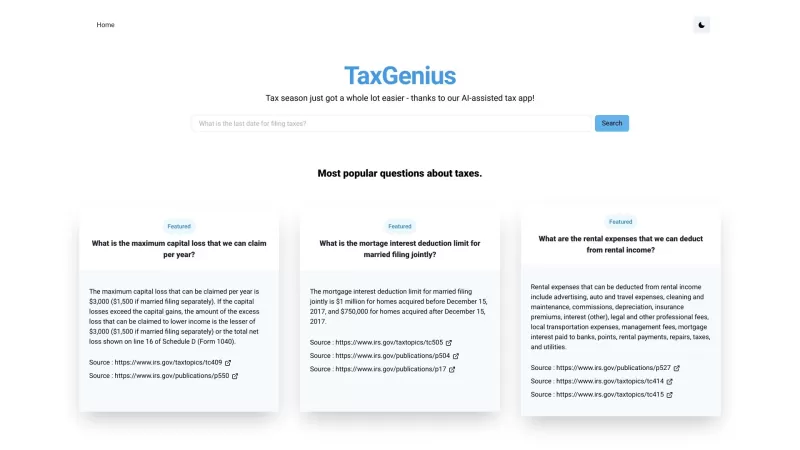

Ever found yourself knee-deep in tax forms, scratching your head over deductions and credits? Enter TaxGenius—an AI-powered tax app that's here to save the day and make tax season a whole lot less daunting. It's like having a tax expert in your pocket, ready to answer your burning tax questions with the latest and most accurate information.

How to Use TaxGenius?

Using TaxGenius is a breeze. Just fire up the app, type in your tax question, and let the AI magic work its wonders. Not sure what to ask? No problem! You can browse through the most popular tax questions or dive into different tax topics to get the detailed info you need. It's like having a personal tax tutor, but without the hefty fees.

TaxGenius's Core Features

TaxGenius isn't just another app; it's a powerhouse of features designed to make your tax life easier. Here's what you get:

- AI-Assisted Tax Help: Get instant, AI-driven answers to your tax queries.

- Up-to-Date Info: Stay on top of the latest tax laws and regulations.

- Popular Questions: Easily find answers to common tax questions.

- Explore Topics: Delve into various tax subjects for a deeper understanding.

- Instant Answers: No more waiting on hold for tax advice—just ask and get an answer.

TaxGenius's Use Cases

TaxGenius isn't just for tax season; it's your year-round tax buddy. Here's how it can help:

- Quick Answers: Got a tax question? Get an instant answer.

- Complex Topics: Navigate through those tricky tax subjects with ease.

- Deductions and Credits: Understand what you can claim to maximize your savings.

- Maximizing Savings: Learn how to keep more of your hard-earned money.

- Confidence in Filing: File your taxes with confidence, knowing you've got all the info you need.

FAQ from TaxGenius

- ### What is the maximum capital loss that can be claimed per year?

- TaxGenius can tell you that the IRS allows you to claim up to $3,000 in net capital losses per year if you're single, or $1,500 if you're married filing separately. Any excess can be carried over to future years.

- ### What is the mortgage interest deduction limit for married filing jointly?

- According to TaxGenius, for married couples filing jointly, the mortgage interest deduction limit is on mortgage debt up to $750,000 for homes purchased after December 15, 2017. For homes purchased before this date, the limit is $1 million.

- ### What are the rental expenses that can be deducted from rental income?

- TaxGenius lists several deductible rental expenses, including mortgage interest, property taxes, operating expenses, depreciation, repairs, and travel related to rental property management. Keep good records to make the most of these deductions!

TaxGenius Screenshot

TaxGenius Reviews

Would you recommend TaxGenius? Post your comment

¡TaxGenius es un salvavidas! Hizo que mi declaración de impuestos fuera mucho más fácil, como tener un profesional en mi bolsillo. La única queja es que a veces se pierde algunas deducciones de nicho, pero aún así es mucho mejor que hacerlo todo yo mismo. ¡Definitivamente lo recomiendo! 😊

タックスジーニアスは本当に便利です!税金の申告が簡単になりました。ただ、特殊な控除を見逃すことがあるのが少し残念です。でも、自分でやるよりはるかに良いので、おすすめです!😊

TaxGenius is a lifesaver! It made my tax filing so much easier, like having a pro in my pocket. Only gripe is it sometimes misses out on some niche deductions, but hey, it's still way better than doing it all myself. Definitely recommend! 😊

O TaxGenius é um salva-vidas! Tornou minha declaração de impostos muito mais fácil, como se eu tivesse um profissional no bolso. A única reclamação é que às vezes perde algumas deduções de nicho, mas ainda assim é muito melhor do que fazer tudo sozinho. Super recomendo! 😊