Backtesting Power

Evaluate trading decisions with historical data.

Backtesting Power Product Information

Ever wondered if your trading strategy could stand the test of time? That's where Backtesting Power comes into play. It's like a time machine for traders, allowing you to run your strategies through the wringer of historical market data. This isn't just about seeing if your approach would have worked in the past; it's about fine-tuning your game to be sharper and more profitable in the future.

How to Harness Backtesting Power?

Ready to dive in? Using Backtesting Power is like playing chess with history. You take your trading strategy and pit it against the moves of the market from yesteryear. Here's how you do it: First, you apply your strategy to the historical data. Then, you sit back and watch how it would have performed. Did it make money? Did it flop? This is your chance to see where you went right or wrong. After analyzing the results, you tweak your strategy. Maybe you adjust your entry points or your stop-loss levels. It's all about refining your approach until it's as sharp as a tack.

Core Features of Backtesting Power

Simulation of Trading Strategies

Imagine testing your trading strategy in a safe environment where the only thing at stake is your time. That's what Backtesting Power offers with its simulation feature. You can see how your strategy would have fared in different market scenarios without risking a dime.

Analysis of Historical Market Data

Ever wished you could peek into the past and see how the market moved? With Backtesting Power, you can. It's like having a crystal ball that shows you the market's past performance, helping you understand the patterns and trends that could affect your trading decisions.

Optimization of Trading Performance

The real magic happens when you use Backtesting Power to optimize your trading performance. It's not just about seeing what worked; it's about making it work better. You tweak, you adjust, and you watch your strategy evolve into something that's not just good, but great.

Use Cases for Backtesting Power

Testing the Profitability of a New Trading Strategy

Got a new strategy you're dying to try? Before you risk your hard-earned cash, run it through Backtesting Power. See if it's the golden ticket to profitability or just another dud.

Evaluating the Impact of Specific Market Conditions on Trading Performance

Markets can be wild and unpredictable, but with Backtesting Power, you can see how your strategy holds up in different conditions. Was it a bull market? A bear market? A sideways slog? You'll know how your strategy performs in all of them.

Identifying Patterns and Trends in Historical Market Data

The market is full of patterns and trends, but spotting them can be like finding a needle in a haystack. Backtesting Power helps you sift through the data and uncover those hidden gems that could give you an edge in your trading.

FAQ from Backtesting Power

- ### What is backtesting?

- Backtesting is like a rehearsal for your trading strategy, using historical market data to see how it would have performed in the past.

- ### How can backtesting improve trading performance?

- By running your strategy through historical data, you can identify its strengths and weaknesses, allowing you to make adjustments that can lead to better performance in real trading scenarios.

- ### What are the core features of backtesting?

- The core features include simulating trading strategies, analyzing historical market data, and optimizing trading performance to refine and improve your approach.

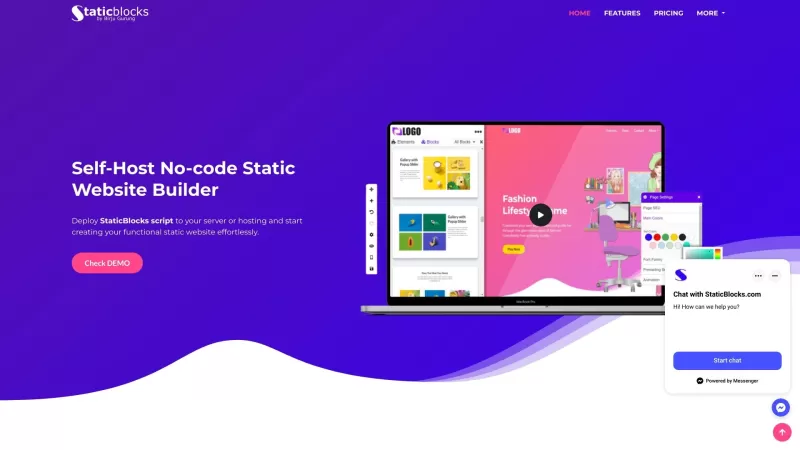

Backtesting Power Screenshot

Backtesting Power Reviews

Would you recommend Backtesting Power? Post your comment