Receipt Cat

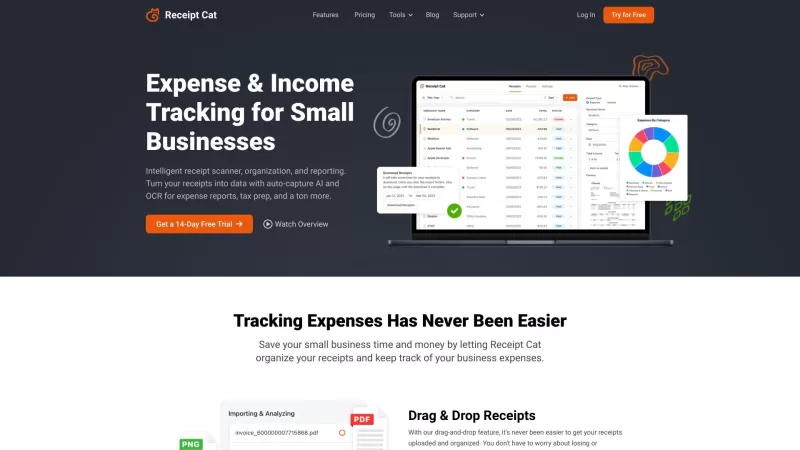

Receipt Cat: Scanner for Business Expense Tracking

Receipt Cat Product Information

Ever find yourself drowning in a sea of paper receipts, struggling to keep your business expenses in check? Well, let me introduce you to Receipt Cat—a game-changer for anyone juggling a side hustle, freelancing, or running a small business. This nifty app isn't just another receipt scanner; it's your personal expense tracking wizard, designed to make life easier for indie developers, freelancers, and sole proprietors like you.

How to Use Receipt Cat?

Getting started with Receipt Cat is a breeze. Just log into your account, and you're ready to go. Got a pile of receipts? No problem! Simply drag-and-drop them into the app. Receipt Cat's smart technology, powered by OCR and AI, works its magic to pull out all the important details like the merchant's name, tax amounts, and totals. And if you're always on the move, the mobile app lets you snap a quick photo of your receipts and upload them instantly. Before you know it, your receipts are neatly organized into searchable categories, and you've got a handy reporting dashboard to keep an eye on your expenses and income over time.

Receipt Cat's Core Features

What makes Receipt Cat stand out? Let me count the ways. First off, it effortlessly tracks your income and expenses, making it a snap to upload receipts with a simple drag-and-drop. The auto-capture AI is like having a personal assistant that extracts all the key data from your receipts. Plus, your receipts are organized and searchable, so you'll never lose track of them again. The reporting dashboard? It's your go-to for analyzing your expenses. And when tax season rolls around, Receipt Cat makes preparation and audit readiness a walk in the park. You can even set up custom categories to itemize your expenses, digitize those pesky paper receipts, and meet all your legal record-keeping needs. With custom rules for automatic categorization, data and receipt export options, and the ability to scan receipts on the go, Receipt Cat is truly a one-stop shop for all your expense tracking needs.

Receipt Cat's Use Cases

Who can benefit from Receipt Cat? If you're juggling a side hustle, freelancing, or running a small business, this app is your new best friend. It's perfect for those who want a straightforward way to track expenses and income without getting bogged down in complex accounting systems. With Receipt Cat, you'll be ready for tax time, and you'll have the peace of mind that comes with having digital copies of all your receipts. It's like having a personal accountant in your pocket!

FAQ from Receipt Cat

- ### Why do I need an expense tracker?

- An expense tracker like Receipt Cat helps you stay organized, save time during tax season, and ensure you never miss a deductible expense.

- ### Who is Receipt Cat best suited for?

- Receipt Cat is ideal for freelancers, indie developers, sole proprietors, and small businesses looking for a simple yet effective way to manage their expenses.

- ### Are scanner apps safe to use?

- Yes, reputable scanner apps like Receipt Cat use secure methods to protect your data and ensure your privacy.

- ### What does the receipt scanner do?

- The receipt scanner uses OCR and AI technology to extract key data from your receipts, making it easy to track and categorize your expenses.

- ### What kind of files can I upload?

- You can upload various file types, including images of receipts, invoices, and other financial documents.

- ### Does Receipt Cat keep a digital copy of my receipts?

- Yes, Receipt Cat stores digital copies of all your uploaded receipts, ensuring you never lose them.

- ### Can I add custom categories?

- Absolutely! You can create custom categories to better organize and itemize your expenses.

- ### Can I try Receipt Cat for free?

- Yes, Receipt Cat offers a free trial so you can test out the app before committing.

- ### Can I cancel at any time?

- Yes, you can cancel your subscription at any time, no questions asked.