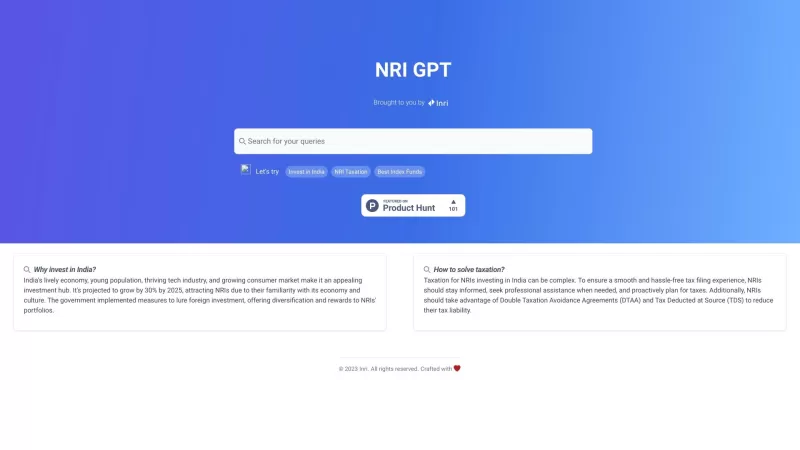

NRI GPT

NRI GPT: India Investing and Tax Assistance

NRI GPT Product Information

Ever wondered what NRI GPT is all about? Well, it's your go-to chatbot, powered by the brains behind Open AI's ChatGPT, specifically designed to tackle those tricky questions Non-Resident Indians (NRIs) have about investing in India and managing their taxes. It's like having a personal financial advisor who's always ready to help you navigate the maze of Indian investments and taxation rules.

So, how do you get the most out of NRI GPT? It's simple—fire away any question you have about investing in India or the tax implications that come with it. Whether you're curious about the best index funds for NRIs, the perks of putting your money into the Indian market, or the nitty-gritty of taxation like Double Taxation Avoidance Agreements (DTAA) and Tax Deducted at Source (TDS), NRI GPT has got you covered. Just type in your query, and watch as it dishes out the info you need to make smarter financial moves.

NRI GPT's Core Features

1. **India Investing**: Curious about the best ways to grow your wealth in India? NRI GPT can point you towards the best index funds, highlight promising investment opportunities, and explain why investing in India could be your golden ticket.

2. **NRI Taxation**: Tangled up in tax troubles? NRI GPT breaks down the complexities of taxation for NRIs, offering tips and tricks to keep your tax liabilities in check.

3. **Double Taxation Avoidance Agreements (DTAA)**: Ever heard of DTAA? It's a game-changer for NRIs looking to reduce their tax burden. NRI GPT explains how you can leverage these agreements to your advantage.

4. **Tax Deducted at Source (TDS)**: Managing taxes can be a headache, but understanding TDS can make it a lot easier. NRI GPT sheds light on how TDS can help you manage your tax payments smoothly.

NRI GPT's Use Cases

1. **Planning Your Investments**: If you're an NRI eyeing the Indian market, NRI GPT is your secret weapon. It helps you dive deep into the Indian economy, the tech scene, and what consumers are buzzing about, so you can make investment choices that are both informed and profitable.

2. **Navigating Taxation**: Filing taxes in India can feel like solving a puzzle. But with NRI GPT, you'll get the guidance you need to understand the complexities, find ways to minimize your tax liability, and make the most of DTAA and TDS provisions.

3. **A Resource for Financial Advisors**: If you're in the business of giving financial advice to NRIs, NRI GPT is a treasure trove of information. Use it to stay on top of the latest in India investing and taxation, and provide your clients with the best advice possible.

FAQ from NRI GPT

- ### Why should NRIs invest in India?

- India's booming economy, coupled with its growing tech and consumer markets, offers NRIs a golden opportunity to grow their wealth. Plus, the potential for high returns makes it an attractive investment destination.

- ### How can NRIs manage taxation while investing in India?

- Navigating Indian taxation as an NRI can be tricky, but with the right strategies like understanding DTAA and managing TDS, you can minimize your tax burden and keep more of your earnings.

- ### What are the benefits of Double Taxation Avoidance Agreements (DTAA)?

- DTAA is a lifesaver for NRIs, helping you avoid being taxed twice on the same income. It's a way to keep your tax liabilities down and your profits up.

- ### How does Tax Deducted at Source (TDS) help NRIs?

- TDS helps NRIs manage their tax payments by automatically deducting taxes at the source of income. It's a streamlined way to ensure you're meeting your tax obligations without the hassle.

And who's behind this nifty tool? That would be Inri, the company that's making financial navigation a breeze for NRIs.

NRI GPT Screenshot

NRI GPT Reviews

Would you recommend NRI GPT? Post your comment